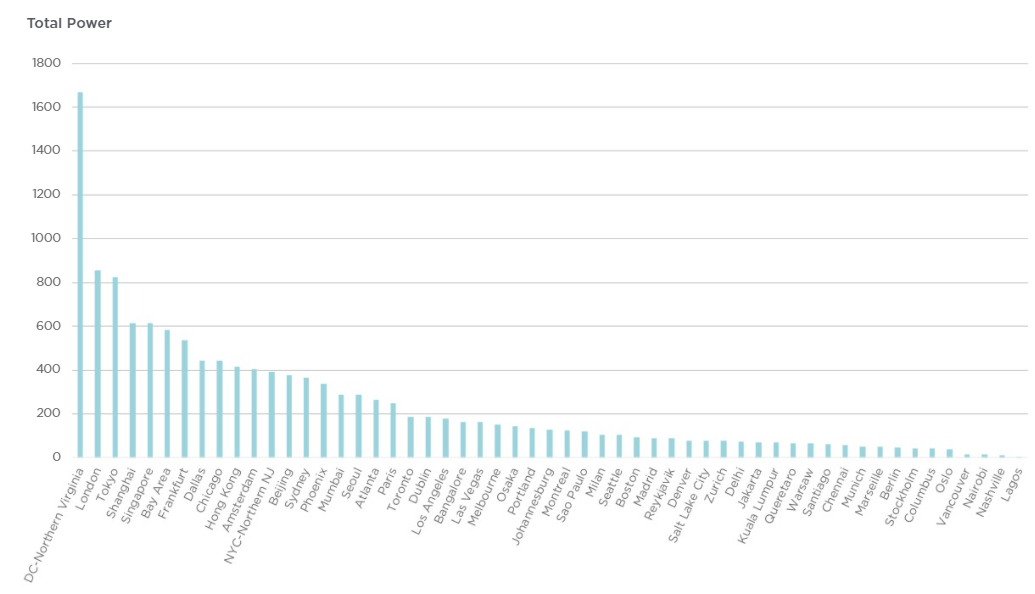

Data centres in 18 markets are now operating at over 90% capacity, led by Singapore and Northern Virginia which are both under 2% vacant, according to a new report from Cushman and Wakefield – which highlights the world’s top 10 data centre locations in 2022, as scored across 13 different weighted categories.

Dublin, Silicon Valley, Milan, Columbus, Paris, and Frankfurt are all below 5% vacant “thanks to moves by major cloud services into these markets and... smaller services following suit” the commercial services firm said.

(The tight capacity came despite what CBRE described as a “tremendous” supply growth late in 2021 despite increased materials, shipping, fuel, labour, land and equipment costs in the wake of Covid-driven supply chain constraints and amid rising power costs that are increasingly being passed on to customers.

Expect further construction starts in the tightest markets with power available, as operators work to loosen constricted areas, the company added in its January 2022 report; noting that of the 55 markets it profiled, 28 now offer all three major cloud services, with “considerable further expansion planned and land already acquired in several locations.”

The world’s top 10 data centre locations in 2022

Assessing them by fibre connectivity, market size, cloud availability, incentives, taxes, political stability, vacancy, development pipeline, sustainability, “smart cities”, power cost, land price and environmental risk, Cushman and Wakefield scoring of the world’s top 10 data centre locations in 2022 saw Hong Kong hit the top 10 for its “robust development pipeline, excellent networks and all major cloud services are available.”

See also: Making sense of Data Centre sustainability

"One prominent change is how markets are developing" the report notes meanwhile.

"Historically, data center markets emerged when telecom companies -- and later, colocation operators -- built the first facilities and established footholds. But today, many of the hyperscalers that dominate cloud, network and internet services can enter a new or relatively immature market and simply begin a major build. This shift has led to rapid increases in market size, particularly in cities across Southeast Asia, South America, and soon, Sub-Saharan Africa. We anticipate secondary markets will continue to benefit as certain primary markets restrict power usage and as sustainability demands put pressure on the industry" it noted.

Outside of the top 10 data centre locations, Madrid was the largest gainer, moving up to 19th from 34th place in the 2021 rankings. Cushman and Wakefield said: “It’s a low-risk location with respect to natural disasters, has all major cloud services present, and is quickly tightening as take-up continues faster than development occurs.”

The top 10 data centre locations in 2022 (the list saw some ties…)

1: Northern Virginia

Northern Virginia again finished on top of the overall standings for the third consecutive year.

"It’s the largest data center market in the world, featuring a strong construction pipeline. It offers excellent connectivity, attractive incentives and low-cost power" the Cushman and Wakefield 2022 global data centre market comparison report said, adding that "vacancy is exceptionally low and demand is high—operators and tenants alike are interested in expansion. Given those conditions, the area will likely become the world’s first two-gigawatt market over the next two years."

2: Silicon Valley/Singapore

Right behind Northern Virginia, tying for second, were Silicon Valley and Singapore.

"Both rank high despite a lack of available developable land, and in Singapore’s case, despite a moratorium on data center construction. Both have strong ecosystems, excellent connectivity, consistent demand, and all major cloud services available and expanding where possible," the report said.

3: Singapore/Silicon Valley

(As it selects just 10 locations and with Singapore and Silicon Valley tied for second place, the report skips straight to fourth. Singapore actually appears to have lifted its moratorium on new DC construction in January 2022, although the Minister of Trade and Industry told law makers that "we [will] seek to anchor data centers that are best in class in terms of resource efficiency, which can contribute towards Singapore’s economic and strategic objective".

4: Atlanta/Chicago

Tied for fourth place were the US's Atlanta and Chicago.

Both offer "sizable incentives, low cost of land, plenty of development in the pipeline and lower power

costs than most large data center markets" the report notes. (Georgia is home to at least 50 DCs. Its advocates cite excellent fiber and "infrastructure as a former railroad town, connectivity to the Southeast and low costs of land and electricity." Georgia has at least 50 major data centers.)

5: Chicago/Atlanta

As with the second place tie, the list of the top 10 data centre locations skips fifth place for six owing to the tie for fourth place. Looking at Chicago, however, The Stack notes that Illinois’ data center tax incentives have proven a lure. The city had 303.5MW in H1 2021, with competitive kW/month rental rates starting at $95.

6: Hong Kong

Hong Kong makes the list of the top 10 data centre locations for the first time.

The 2022 report cites it for a "robust development pipeline, excellent networks" and the availability of "all major cloud services." Despite its recent turmoil and the inclusion of political stability as a factor, the report notes that it is a "global financial and business capital, with a long history of pro-business policies and an accordingly robust data center sector."

7: Phoenix

Phoenix, Arizona came in at seventh place.

Phoenix data center users leased more space and power in Q2 of 2021 than any other quarter on record as the city's proximity to other major West Coast centres, affordable land and "abundant" power availability attracted users, CBRE earlier noted, with Amazon among those boosting its presence there in January 2022, opening a local zone (edge location) there this month.

8: Sydney

Data centre growth in Sydney continues to soar

Cushman and Wakefield ranked it highly for political stability, cloud connectivity and renewable energy. There are currently some 42 DCs in the Sydney area. Equinix dominates with six sites; its owntown campus of SY1, SY2, SY3, and SY4 are network dense and have become the primary Peering Exchange Point in Sydney, Baxtel notes.

9: Portland/Seattle

Portland and Seattle tied for ninth/tenth place in the report.

Portland has become an increasingly popular location, helped on its way by a climate that’s conducive to keeping servers cool and ample supplies of renewable energy. Like many others on this list, it has also benefited heavily from business friendly tax environment/tax incentives.

The report cites its "dense fiber and sites available in the local market cluster".

10: Seattle/Portland

Seattle, tied with Portland for ninth/tenth place, ranks highly for sustainability.

As Equinix noted in 2021 report, Seattle is also a fantastic interconnection hub when it comes to North American and Asia-Pacific (AP) digital corridors: "From Seattle, you can take high-speed, low-latency terrestrial fiber routes to Canada and the rest of the U.S., and subsea cable routes to China, New Zealand, Australia and Hawaii via the Hawaiki Cable, and the Japanese market via the FASTER subsea cable system. New providers are bringing increased connectivity to the state of Washington, such as China Mobile, China Telecom, Global Transit, Google, KDDI and SingTel" Equinix's Jeff Bender noted last year.