Software spending fell 51% in the second quarter compared with the same period in 2022, analysis by tech procurement form Vendr showed.

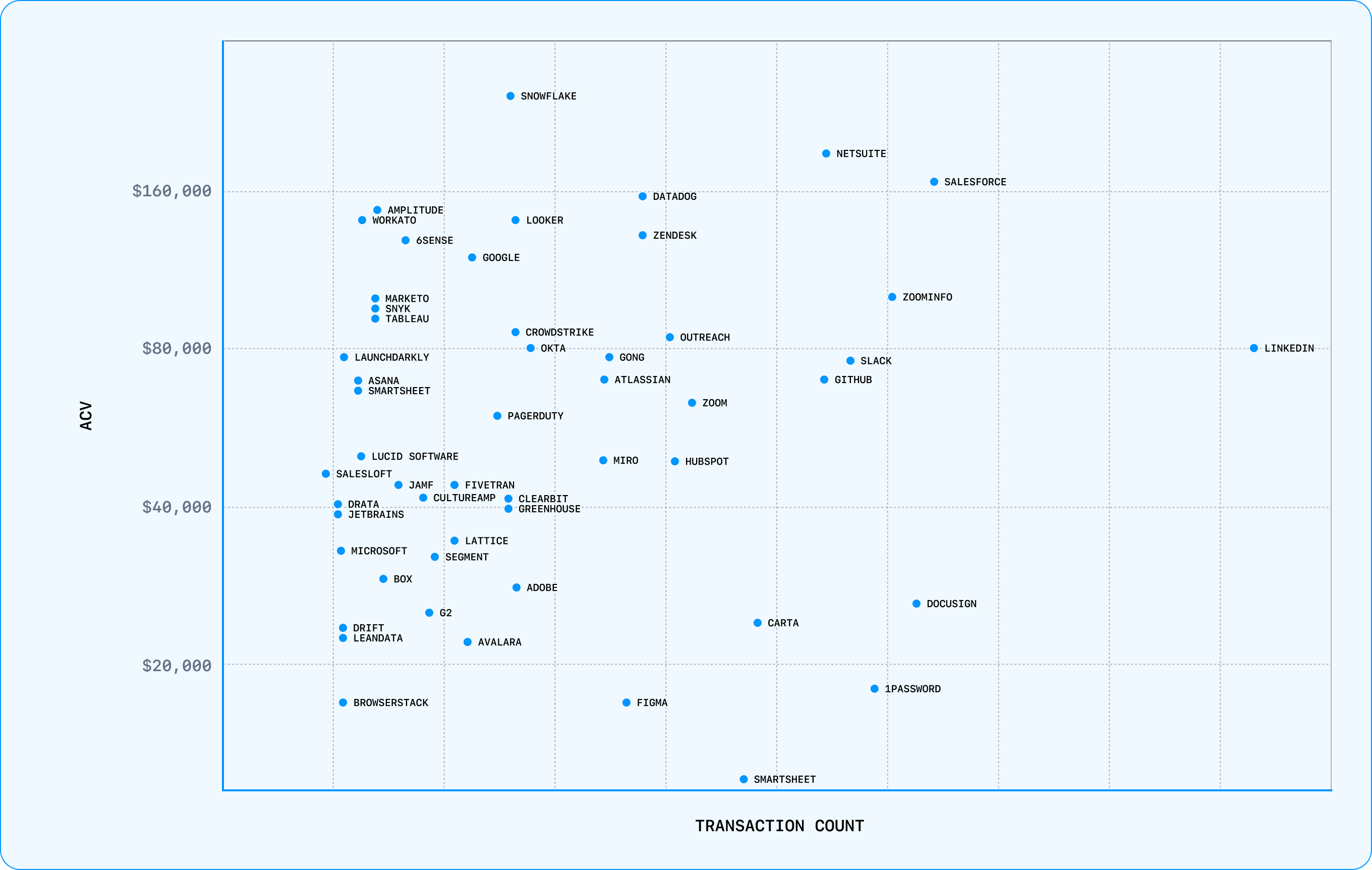

Analysis by Vendr of 3,000 transactions from over 500 buyers showed that the average annualized value of software deals in Q2 fell to $62,000.

(The Boston-based company, founded in 2019, provides a platform for SaaS buying and management. It includes public, internal, and user-submitted data on pricing across over 19,000 technology products.)

Annual Contract Value (ACV) analysis by Vendr suggested that Snowflake, Netsuite and Salesforce were earning some of the biggest deals still, with Zoominfo, Datadog and LinkedIn all also performing well (see below.)

See also: UK corporate insolvencies spike to the highest levels since 2008

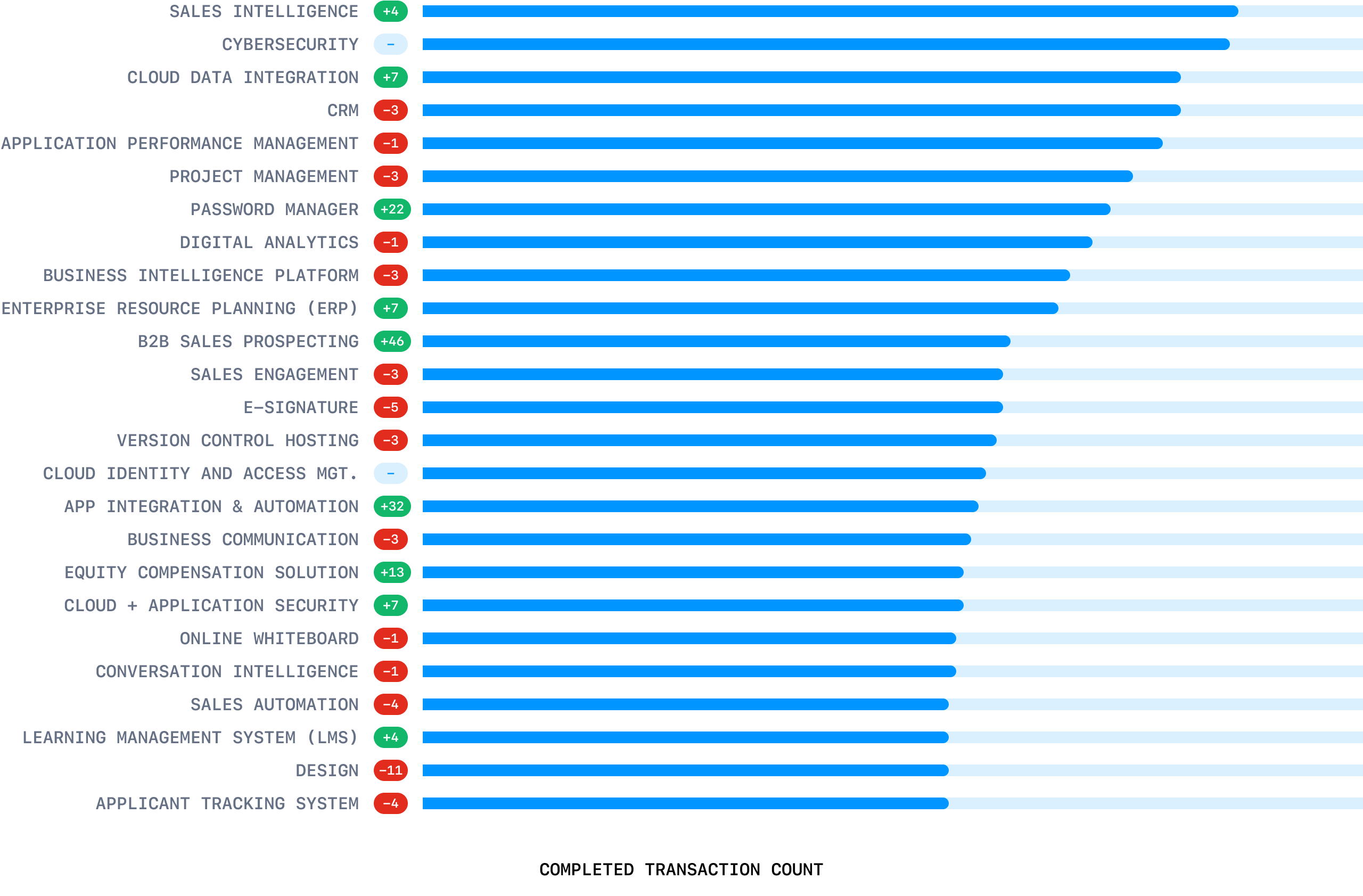

The top newly purchased products were 1Password, ZoomInfo, LinkedIn, Gong, KnowBe4, 6Sense, Workato, Netsuite, CrowdStrike, Avalara.

But “CFOs are scrutinizing net-new spending more aggressively than ever" while "new product purchases emphasize 2023’s mission-critical priorities: growth, sustainability, and security” its annual SaaS Trends Report found.

Looking ahead, CIOs should be ready for price hikes – many are already landing – “as SaaS suppliers manage challenges like declining ACV, reduced seat counts, and need to hit growth targets” the company said.

As Bloomberg notes, prices are already climbing: Salesforce just announced its first price increase (an average of 9%) in seven years, effective August 2023, and Microsoft this week said its new AI products will cost $30/seat per month; higher than many analysts expected.