Profits at Goldman Sachs tumbled 33% from one year ago, to $2.05 billion this quarter with revenues at the bank’s new technology-centric “Platform Solutions” segment falling 12% to $578 million – as CEO David Solomon warned that “I don't think it's the right run rate….”

Part of the pain came from a writedown on Goldman’s sale of fintech GreenSky last week (it only closed its acquisition of the company for $1.7 billion in early 2022(, as it dials back consumer banking ambitions.

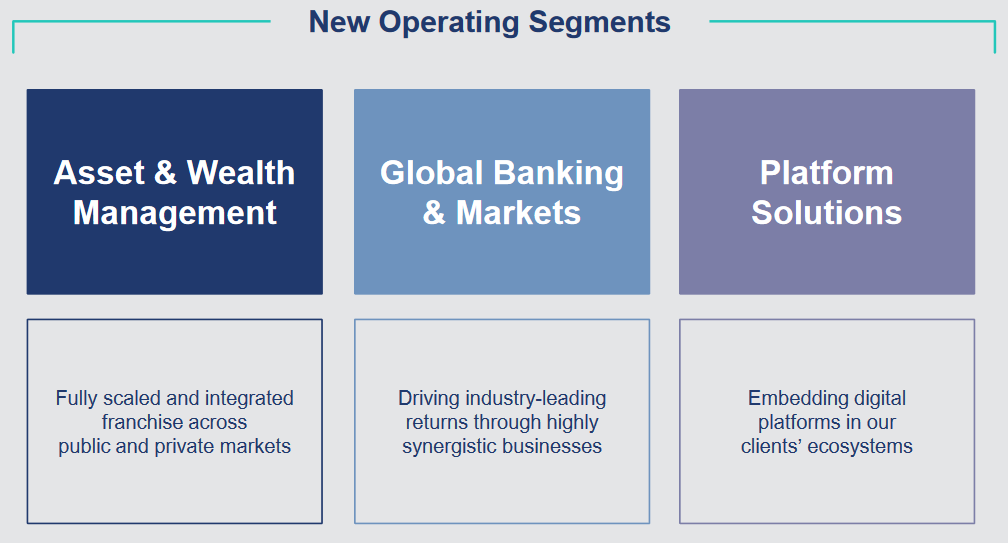

Goldman launched Platform Solutions in October 2022, as an “end-to-end primarily cloud-based technology platform business that embeds our best-in-class financial products and services into our clients' ecosystems” and a way to “enhance our focus on building platforms that deliver digital financial services capabilities to… clients.”

It was no lodestar for the bank as it reported its eighth consecutive quarter of falling earnings however, and Solomon said of the segment that “I think there's a combination of things that we expect over the next 12 months in terms of growth in revenue, composition of the clients as well as ongoing efficiency with respect to expenses.”

The bank has hired Citi veteran Bill Johnson as CEO of Enterprise Partnerships for Platform Solutions; a role that will include overseeing credit card partnerships with Apple, General Motors and other partners. (The segment spans consumer, transaction banking and financial technology.)

Commercial Rest Estate pain mounts

Goldman was badly stung more broadly by commercial real estate, as the wholesale shift to remote working during the pandemic continues to have powerful repercussions, beyond debates among executives about how to optimise hybrid work environments for their businesses.

Goldman Sachs admitted to analysts on its Q3 earnings call that it had marked down or dumped commercial real estate (CRE) investments at a huge scale, with Solomon saying “we've either marked or impaired that down by about approximately 50% this year. That's quite significant…

“Three-quarters of that was either through paydowns or dispositions, the balance through marks and impairments,” he told analysts.

See also: Back to HQ? Thanks, I’d rather walk, says Lyft’s CISO

(Some flagship buildings in San Francisco and New York have traded down 75% of their pre-Covid levels, the FT has earlier noted, although McKinsey has pointed out that better quality buildings have performed better as organisations turn to high quality premises as a real asset in ensuring staff retention as people resist being pulled back to offices...)

Despite some of these numbers, total assets under supervision ended the quarter at $2.7 trillion, with $7 billion of long-term net inflows; Goldman’s 23rd consecutive quarter of long-term fee-based inflows.