The technology team at Deutsche Börse Group – which runs the Frankfurt Stock Exchange along with other global trading infrastructure – has successfully migrated an ageing SAP ERP system from its own data centres and onto S/4 HANA on Google Cloud in a move that it says has slashed recovery point objective (RPO) to “nearly zero” and boosted innovation.

The move is a landmark one for the exchange operator, which aims to get 70% of its workloads onto the cloud by 2026 (from 40% currently) as part of a strategic partnership with Google Cloud announced in February 2023.

Achieving the move meant winning over “hesitant stakeholders and cautious regulators” with transparency and a focus on security, including the encryption of data “at the infrastructure level, database level, and application level,” taking a bring-your-own-key (BYOK) approach.

See also: US Army CIO applauds cloud migration of “3 most complex ERPs”

That’s according to Lars Bolanca, MD, Corporate IT at Deutsche Börse, in a blog on February 1. In it, he spelled out how badly the group’s ageing SAP software (he did not name the specific version it was on) was crippling the organisation: “From adding new legal entities following mergers and acquisitions, through launching products such as swap types or securities, to simple requests to improve our workflows, the system couldn’t keep up. Just a simple launch request would take as much as nine months.”

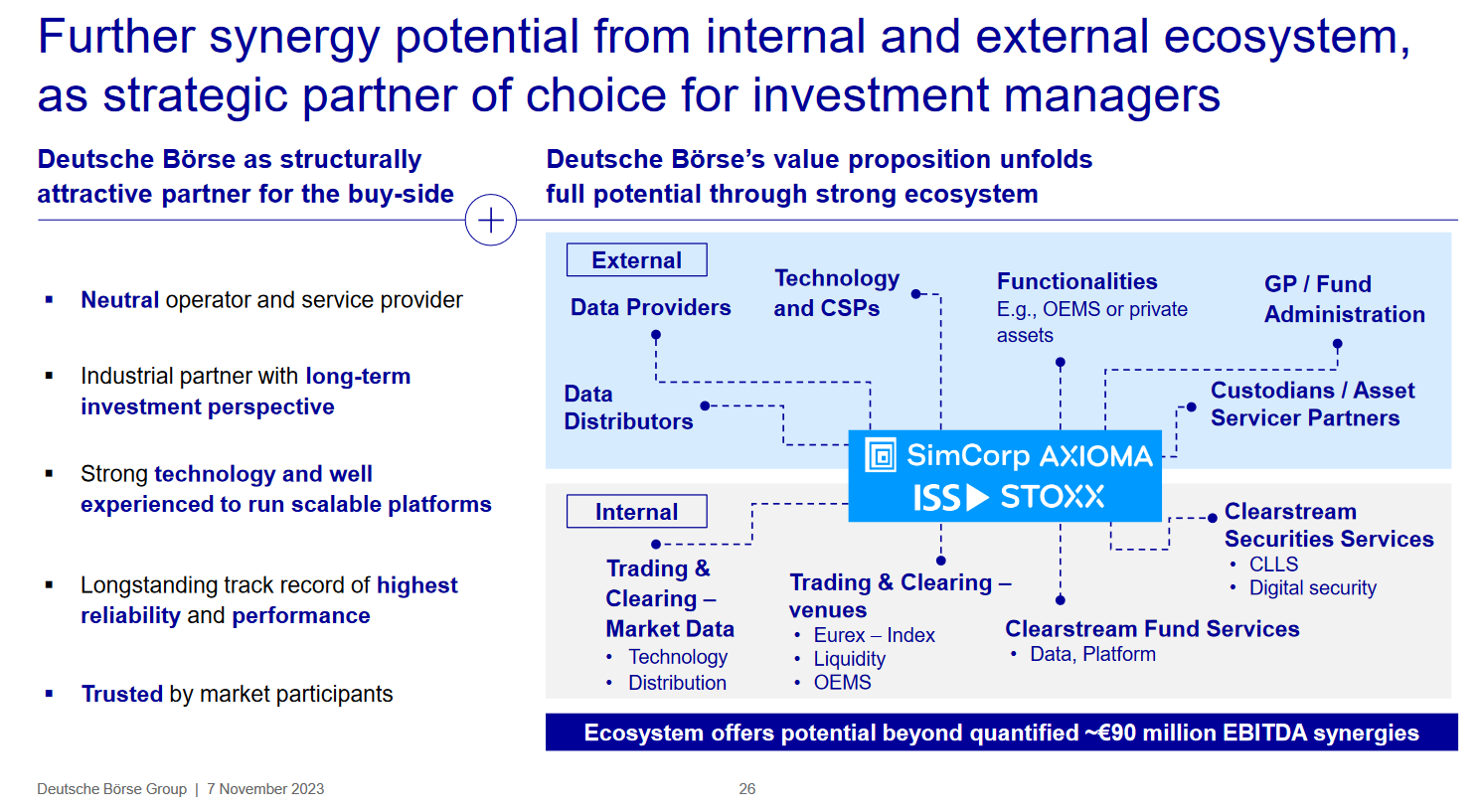

In November 2023 Deutsche Börse Group detailed its “Horizon 2026” strategy with a focus on “further expansion of cloud usage” and the “establishment of a trading platform for digital asset classes” among other priorities. In a classic PowerPoint pyramid, the group put “digital leadership” right at the pinnacle, yet like many continental European companies, has had to contend with regulators still deeply leery of perceived security and resilience risk from putting workloads in the cloud.

“Technology and accelerated digitalisation are transforming the way the financial sector operates” Deutsche Börse Group said on its investor day, adding that it sees “unbroken strong growing demand for high-quality, reliable data supporting multifaceted decision intelligence…”

Bolanca added: “With SAP S4/HANA now running on Google Cloud, our ability to react quickly to a changing market has improved dramatically.

“If we need to rapidly scale up our processing power, in response to a sudden increase in trading volumes, we are now able to do so in a matter of a few clicks. Our development cycle has shortened considerably, too.

“Previously, we had just one development environment, accommodating 10 to 15 developers, leading to development cycles of nine to twelve months. Now we have 60-70 developers working in multiple development environments in parallel, significantly reducing development time.

In a blog that does sound rather like it was written by Google Cloud’s communications team, he added: “We also no longer need to worry about lengthy delays to add new hardware to our systems. With Google Cloud, we can simply add new software services at the click of a button, meaning we can onboard new services in days, rather than spending months adding new hardware. Disaster recovery times have improved, too, with automated failover, meaning our recovery time objective (RTO) is now down from two hours to less than 20 minutes, while our recovery point objective (RPO) has been cut from two hours to nearly zero.”