Atos this morning flagged critical “risks associated with its refinancing” and warned that it will need to “implement a major asset disposal program” if it cannot raise money from banks or the markets.

A second Atos CEO quit the embattled French technology company in just nine weeks ahead of the news in earnings today – with veteran Nourdine Bihmane abandoning ship after 23 years at the company

Bihmane cited a “strategy misalignment” for his decision, adding in a LinkedIn post that “as you can imagine, this was a hard decision to make.”

Bihmane, who was CEO of Atos Tech Foundations, follows group CEO Yves Bernaert out the door. Bernaert lasted just four months before quitting in January, citing a “difference of opinion on governance” for his reason.

Atos is in a desperate spiral downwards, with restructuring and spin-off efforts all woefully complicated by French government interference amid concern that many of its tech assets are highly sensitive; for example Atos runs secure communications for the French military and secret services.

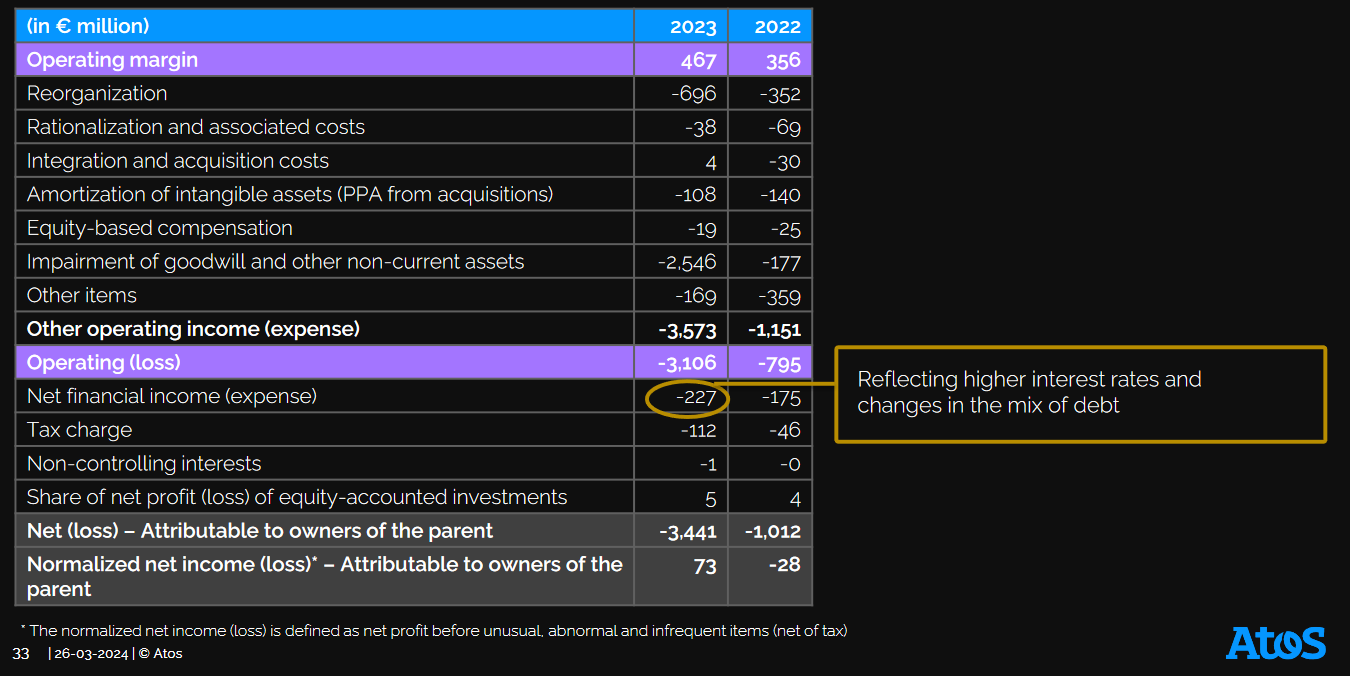

Atos's net losses tripled to over €3 billion in 2023, an earnings presentation showed – with €223 million in restructuring costs; €382 million in "one-off separation and transformation costs" after it split the company into two units, and €47 million of "rationalization cost resulting from the closure and consolidation of data centers" further hitting the company.

See also: Feds to CIOs: Actively ask your vendors if they’ve done a SQLi audit...

Last week (March 19, 2024) European defence multinational Airbus walked away from politically fraught negotiations over a potential buyout of Atos’s cybersecurity and “Big Data” division, whilst Czech billionaire Daniel Kretinsky, who was eyeing Bihmane’s Tech Foundations unit, has faced last-minute hurdles to proposed investment that has now also been abandoned, Atos confirmed in its FY2023 earnings report on March 26.

In the wake of Airbus’s decision, Atos said it was “analysing the resulting situation and actively evaluating strategic alternatives that will take into consideration the sovereign imperatives of the French state…”

Interviewing Bihmane in 2022, The Stack started its article with the comment that the new CEO “has his work cut out…Atos has had a dismal few years. Bihmane is its fourth CEO since 2019 and third in 12 months, after internecine strife spilled over at the French multinational. Its share price has seen a precipitous decline from $75 to $9 in just 24 months.”

Just 15 months later Bihmane is also gone and that share price is $1.60.

“Precipitous” didn’t do it justice and direct state intervention looks increasingly likely if “sovereign imperatives” are such a complication.

Speaking to The Stack in late 2022, Bihmane said Atos had been “totally disrupted by the public cloud over the past ten years… the hyperscalers have taken more and more of our infrastructure, also [applications].”

He also emphasised that “we came from a culture of huge centralization that disempowers people on the ground” adding that many of Atos’s troubles had been born of “a strong culture of inorganic growth – we had 5,000 people when I joined, now it’s 112,000 – but we never took time to pause, integrate, rationalise the portfolio and bring everybody together.”

New Atos CEO Paul Saleh, who replaced Yves Bernaert, said today: "We are... in discussions with our financial creditors with a view to reaching a refinancing plan by July within the framework of an amicable conciliation procedure that is part of the mandat ad hoc procedure initiated last February.

Our colleagues around the world work with dedication and passion to serve our clients with the highest quality. I thank them deeply for their daily commitment and energy in this evolving environment."