New Atos CEO Nourdine Bihmane has his work cut out. There is no way to sugar coat it: Atos has had a dismal few years. Bihmane is its fourth CEO since 2019 and third in 12 months, after internecine strife spilled over at the French multinational. Its share price has seen a precipitous decline from $75 to $9 in just 24 months. As market pressure mounted over the summer, Atos secured a €2.7 billion bank debt package “to ensure group liquidity”; a reprieve, but observers could be forgiven for asking tartly that if that is the good news, what is the bad?

There has been no shortage and it has been visible. Atos in June 2022 decided the gloves were off and threw some body shots in its own direction. The company – which employs over 112,000, handling tasks as eclectic as running 111 data centres in 43 countries, operating disability benefits assessments, and building hardware for the French military – told its investors and the world bluntly that it had a “fragmented portfolio”, “high use of subcontractors”, a “significant number of red contracts”, and “low productivity and inadequate skill-set of commercial resources”, as it announced a proposed transformation that would see it split into two.

Follow The Stack on LinkedIn

Six months on, those hoping for a narrative arc of rise, fall, and redemption see glimmers of light on the horizon however. There was the welcome return to revenue growth in the Americas and Northern Europe in its Q3 results, reported on October 26; an eight-year deal on December 8 to become UEFA’s football team partner and optimise its IT operations; a sweeping new partnership with AWS; the appointment of five new directors: four of them independent, four of them women. Then there’s Bihmane himself. Among the homogenous masonry of France's corporate society, Bihmane is something of an anachronism: A Morocco-born, Madrid-resident, self-confessed “citizen of the world” and softly spoken software engineer, he has been appointed to lead the turnaround of what is still a formidable business, with a backlog of work worth over €21 billion.

He joined The Stack in London to discuss where the company went wrong and his plans to put it right.

Perhaps, he suggests, it is good to start with the cloud and why Atos had to stop fighting it.

Time to stop shouting at clouds

Fluffy memoranda of understanding about wide-ranging corporate partnerships proliferate. Atos and AWS’s is more substantial. And there are a number of reasons that this partnership is also a little unusual, not least because in a sovereignty-centric European IT powerhouse (and Atos is still a force to be reckoned with) American cloud hyperscalers have long been seen as the bête noire: an enemy intent on eating its extensive managed services lunch.

The new Atos CEO tells The Stack that his company has been trying to hold back the tide: “We have been totally disrupted by the public cloud over the past ten years. It started with cheap storage, moved to compute, then additional services like firewall services, network services, databases services… We have been really resisting that. But we saw our market share reduce and then the hyperscalers have taken more and more of our infrastructure, also on the application side. One of the first paradigms I wanted to change was [the one in which we are a] victim of the hyperscalers; trying to resist them. Instead of doing that, let's look at it differently.”

What does that mean, really? “Atos is managing more than half a billion workloads across the world. We look[ed] at them by different criteria: Complexity, distribution of the application, network security, compliance, and tried to identify how many of those are potentially going to move to public cloud in the next three to four years and sized that part of our business. Our approach was to go in front of the hyperscalers and say 'here's a potential book of business that may come to you. If it does, we end up with big issues on our side'. Those are less revenue, less margin, people put on the bench, under-utilised capacity, under-utilised infrastructure in my data centres.”

What does each partner get from the deal?

Bihmane tells The Stack that there has been a healthy amount of horse-trading: AWS gets to be the preferred partner for Atos customers who opt for cloud migrations. They will get discounts from AWS and value-added services from Atos; whether that’s migration support, external encryption key management etc. Atos, in short, will be bringing AWS business it would likely be getting anyway, eventually -- and being in a strategic position to do value-added work around it with security or sovereignty-minded clients. He names French online medical portal provider Doctolib, which handles sensitive medical data; exactly the kind of company Atos's traditionalists would have assumed would not go near the public cloud: "They put that on AWS" he says: "But we encrypt that entire data with external keys which are protected in a third-party bank. They get the benefit of the innovation of the hyperscaler and also to leverage the European No. 1 player on digital to protect sensitive data."

AWS meanwhile in turn is investing in Atos’s network of increasingly underutilised data centres, which the company is also rationalising. This will include leasing racks and installing high-speed cloud interconnects. AWS will also provide extensive AWS training for an initial cohort of 2,000 Atos staff, which will expand up to 20,000.

This training will be done on billable Atos time, Bihmane emphasises, saying previous training efforts at the “overly centralised” company have faced resistance from managers and left staff working on up-skilling in their personal time; something that came up persistently town hall meetings that he has held with local staff.

New Atos CEO: “Everything needed to go through 17 workflows”

Where else did Atos go wrong? “I think the company has been suffering [from] putting targets out that were unachievable [and saying that] we're going to invest [but] at the end of the day, it was just words and not the money behind it to make it happen" Bihmane says: "We came from a culture of huge centralization that disempowers people on the ground. If you shift that a little bit, you're able to get a lot of energy,” he adds.

What kind of shifts? “Just basic processes of empowering a country to hire what we need: Yesterday, everything needed to go through 17 workflow steps; by the time you agree to hire a person they were already tired."

"How do you empower a person?" he muses: "You let them fail."

Among those who have been allowed to fail, of course, is a conveyor belt of CEOs: His predecessor Rodolphe Belmer told those who would listen that Atos has the "necessary assets and all the talents to operate a swift turnaround" but found himself doing a swift turnaround rather faster, exiting after six months. What makes Bihmane think he can succeed after three previous Atos CEOs failed to drive necessary changes?

“[Of] the three CEOs that you mentioned, I'm the only one with 20+ years within the company,” he says: “I understand our business. I've been dealing with our customers. I don't want to resist transformation. And I'm going to stop running after growth at any cost. I think that has been impacting us: Atos comes from a strong culture of inorganic growth – we had 5,000 people when I joined, now it’s 112,000 – but we never took time to pause, integrate, rationalise the portfolio and bring everybody together.”

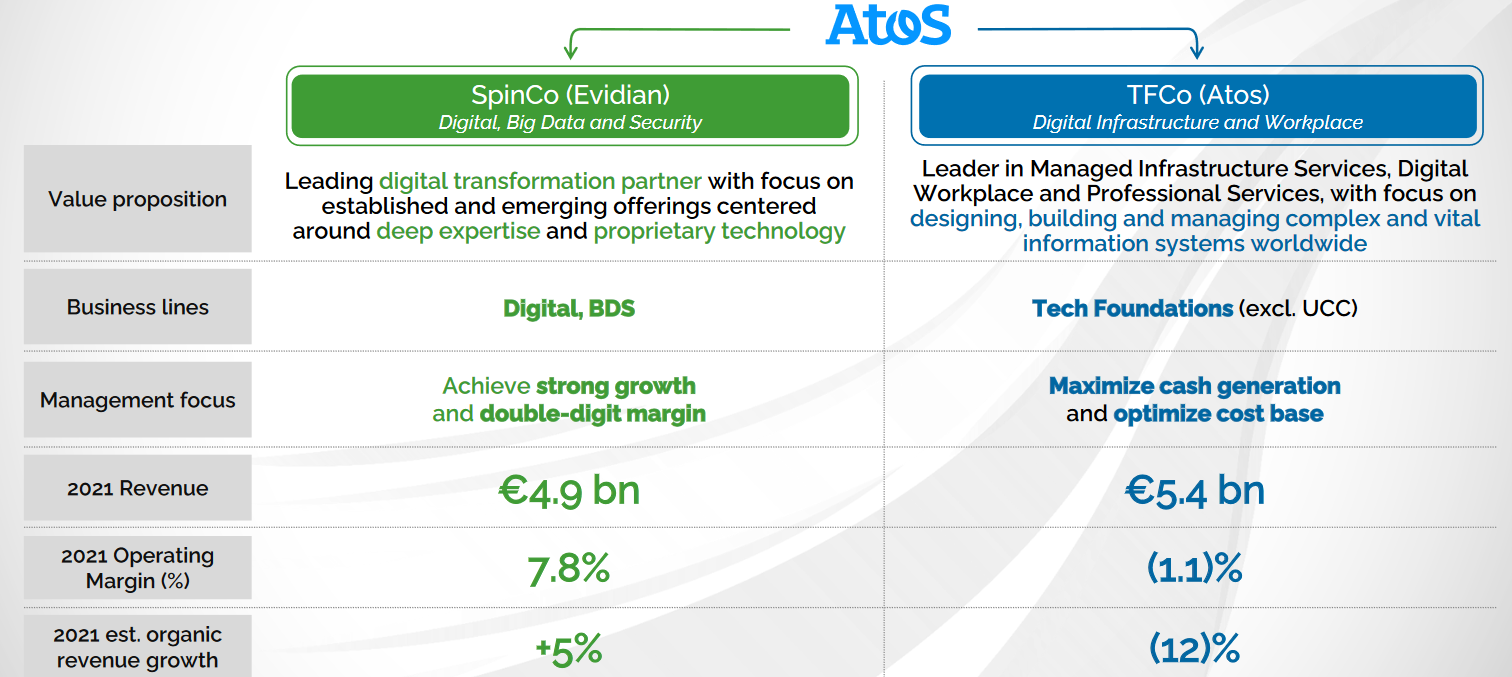

Is bringing people together while breaking up a company not triggering cognitive dissonance in some quarters? “The portfolio of Atos is pretty vast. It has been struggling managing both worlds under the same umbrella. The board has decided to split the company" he says calmly. (The proposed restructuring, which is subject to various works councils giving their approval, will see the creation of “SpinCo”, to include cybersecurity, application building, "digital transformation" and other workloads associated heavily with its $3.4 billion buyout of Syntel in 2019. "SpinCo" has 59,000 staff and expected revenues of €5.3 billion in 2022. Then there’s “TFCo”, spanning managed infrastructure services, with 48,000 employees and expected revenues of €5 billion in 2022.)

BDS will be “bringing cybersecurity around all the cloud migration activity, to put a strong wrapper around what seems to be the most important need around public cloud migration… and will in reality be mostly gravitating around the large acquisition we did in 2019 of Syntel, plus all the smaller bolt-on acquisitions we did more recently. We want it to be a European champion cyber tech company," Bihmane tells The Stack.

The idea is that both two firms will remain publicly listed. Atos has already rejected an unsolicited €4.2 billion offer for this part of the company from Onepoint and private equity firm ICG. As it noted in October it has also “been approached by several players" interested in the managed services business.

Meanwhile there's a lot of work today. One thing he is proud of already is Atos’s work on sustainability. For two years Bihmane was head of Atos’s decarbonisation business line and it remains a passion. Atos recently won an upgrade to a AAA rating from MSCI ESG and launched its “MyC02 compass” tool to help CIOs measure their carbon footprint. (This pulls in diverse data sets to display energy consumption and emissions predictions from IT, travel, waste and more.) He adds: “We are committed in all our large contracts to reduce carbon footprint from beginning to end of the contract; all measured by third parties, with the customer committing to it.”

Positive news. But investors remain to be convinced by what they see of the reforms. (Atos plans to separate the two companies in mid-2023 at the earliest.) As one wrote earlier in December: "Atos isn't exactly an investment for the weak-stomached investors among us. Nor should it be called anything but a 'mistake', if invested in some of the earlier high valuations that I covered it at. But any investment and any company have an inflection point. Atos doesn't hold the most solid or convincing of upsides here, but there is an eventual upside to cover."

As enthusiasm goes, it is tepid. Atos's putting-together from disparate pieces of Siemens, Bull, Xerox, Syntel and the many others it has subsumed over the years resulted in a Frankenstein company that was not, until now, able to evolve with the times and which generates huge revenues but with the most slender of margins ("the lower end of the 3% to 5% range" in 2022.) Whether its taking-apart results in something more effective remains an open question. Bihmane wants to "stabilise" the TFco segment and return it to profitability by 2025 and the company's board finally seems aligned on the strategy, which will also include some disposals as Atos bids to streamline itself. Meanwhile its staff will need to continue executing on some critical IT projects around the world, including at the heart of the British government, where customers include HMRC and the Ministry of Defence.

Many will be watching closely: In the new Atos CEO they will see a collegiate soul who retains something of an outsider's view, is keen to forge new partnerships, upskill staff, reflect on Atos's mistakes and who appears to have the trust of the board. While large outsourcers are increasingly looked on with some caution by CIOs keen to disaggregate large IT contracts and boost their own internal capabilities, signs of flexibility and some forward-thinking at Atos will no doubt be seen as a small but welcome step in the right direction for a company now intent on unwinding acquisitive excesses and proving that the parts are greater than the sum of the whole.