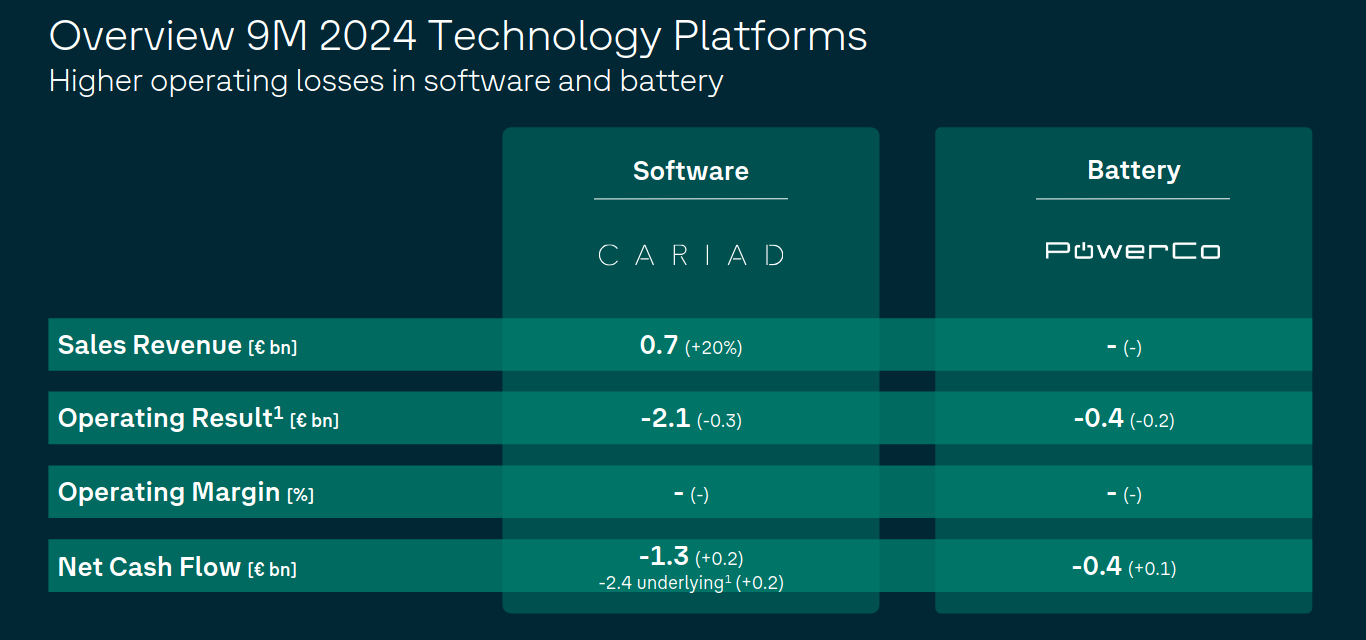

VW’s software arm Cariad lost over €2 billion in the first nine months of 2024 – the automaker blamed “upfront development expenditure” of persistently problematic software for the €7.4 million daily cash burn.

The numbers were revealed in Q3 earnings posted October 30 – two days after VW rocked markets by posting a shock profit warning.

VW software losses mount

“Development of what?” critics would be forgiven for asking of Cariad.

VW this summer finally turned to Rivian for a software platform for its EVs – even as its own ambitious platform efforts haemorrhage cash. (The $5 billion JV will “enable Volkswagen Group to utilize Rivian’s existing electrical architecture and software platform” Rivian said in June.)

Volkswagen: DAS AUTO ✨️ pic.twitter.com/De0LmZrRjk

— P4mui (@P4mui) October 30, 2024

Did a VW dev use a slider instead of a progress indicator

Persistent software flaws from Cariad’s efforts have reportedly caused the delay of numerous vehicle model releases and led in large part to multiple executives losing their jobs. One group member, Porsche, has turned to the “Google Built-In” platform amid growing frustration at the failure.

Cariad’s software losses effectively wiped out the earnings from sales of Audi, Bentley, Lamborghini, and Ducati models under its “Progressive Brand Group” – which reported an “operating result” of €2.08 billion.

(Cariad reported operating losses of €2.05 billion.)

Arno Antlitz, VW’s CFO, blamed a “challenging market environment” and said that the poor earnings showed an “urgent need for significant cost reductions and efficiency gains” – reports suggest three German plants are at risk of closure and that Cariad could see 2,000 jobs cut.

(Cariad’s page says it employs “6,000 developers, engineers and designers." Cariad itself holds stakes in more than a reported 40 automotive tech firms like VAIVA or Volkswagen Infotainment. Its mandate is to build a “unified and scalable” software platform for VW Group passenger brands, including its embedded VW.os, and "Automotive Cloud" or VW.AC.)

Cariad in 2022 outsourced an unspecified amount of development to Systems Integrator DXC's subsidiary Luxoft.

One automotive software specialist Paul Roman, speculated with regard to the broken slider example above that "The problem is that the software gets developed somewhere at a cost center with no possibility to test for such interactions, as the workbench is not available at the supplier side. Then QM [quality management] comes in and tests the software according to the requirements... Depending on the company, there's proper QM people which go above and beyond, or there's just checklist guys. I'd bet it's a bit of the latter that happened here..."

Audi veteran Andrew Fellows, Global Head of Automotive and Mobility at technology consultancy firm Star, told The Stack: “VW’s inflexible internal culture, higher manufacturing costs and rigid infrastructure have left it vulnerable to competition from nimbler Chinese EV rivals.

“VW’s ability to compete has been held back by overcapacity in Europe, high cost levels, and an obstructive bureaucracy… While Chinese manufacturers are launching software-controlled EVs within 24-36 months, Western companies require 3-7 years from design to launch.”

VW urgently needs to “speed up its product development lifecycle. Reducing time-to-market and the cost of production are vital” he added.

The poor VW results, blamed in part on a sharp decline of sales in China, saw labour unions threaten strikes amid plant closure proposals.