As Intel struggles to get 7nm chip production off-the-ground, Taiwanese foundry TSMC this week said it was launching risk production of a cutting edge 3nm node this year, with volume production on track for the second half of 2021. Semiconductors produced on that new process will have a 70% logic density gain, up to 15% performance gain and up to 30% power reduction as compared with 5nm, TSMC's CEO claimed.

The CPU production process involves etching images onto a piece of silicon. The smaller the manufacturer can make the transistors, the more calculations they can do without overheating and the more cores they can add per chip. Smaller, faster, cooler chips, in other words. (TSMC produces semiconductors of varied stripes for chipmakers/designers ranging from Intel to AMD, NVIDIA to Google; Apple to Qualcomm.)

"We are confident our 3 nanometer will be another large and long-lasting node", CEO C.C. Wei said on the TSMC earnings call. Within coming years these will find their way into formidably fast smartphones, data centre servers and more. Computing is not slowing down soon. (The company declined to comment on anticipated 3nm penetration into x86).

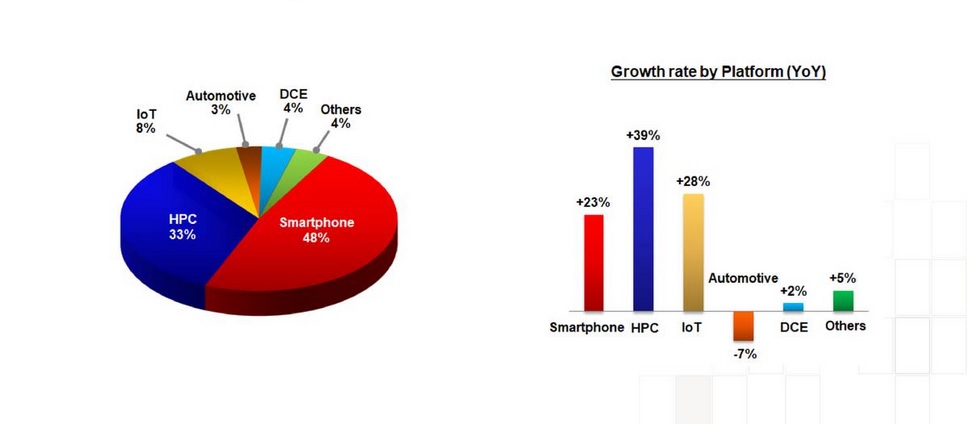

Smartphone, high-performance computing (HPC) and Internet-of-Things (IoT) chip demand from semiconductor foundry TSMC was rampant, growing 23%, 39% and 28% respectively year-on-year in the last quarter, with CFO Wendell Huang noting on the Taiwanse firm's earnings call that "our utilisation rate… was at an extremely high level."

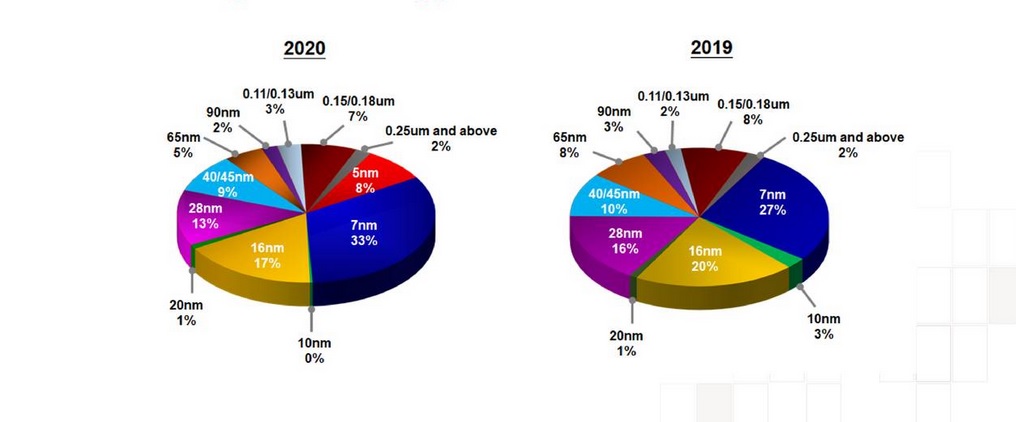

(Overall, smartphone accounted for 48% of 2020 revenue. HPC accounted for 33% and IoT accounted for 8%. The revenue contribution of TSMC's advanced 5nm nodes came in at 8% of 2020 wafer revenue).

Capex. Huh. What is it good for?

The foundry had capex of $17.2 billion in 2020. It's ramping that up by up to $10+ billion in 2021 to a range of $25 billion-$28 billion.

"About 80% of the capital budget will be allocated for advanced process technologies, including 3 nanometre, 5 nanometer and 7 nanometer [processes]" said CFO Wendell Huang, Thursday, Jan 14.

The end of Moore's law is making it harder and more expensive to squeeze more out of semiconductors, but TSMC said it "we believe a higher level of capacity, capital intensity is appropriate to capture the future growth opportunities", adding that the company's capital intensity range was "between 38% and 50%", with capex tripling between 2010 and 2014.

TSMC earnings call: Customers stocking up on inventory.

Once bitten, twice shy, meanwhile: chip buyers are stocking up after being burned by the sudden Covid-19 outbreak in 2019, CEO C.C. Wei said on the earnings call: "We expect the supply chain and our customer to prepare a higher level of inventory... for a longer period of time, given the industry’s continued need to ensure supply security."

Explaining widely reported issues with automotive chipset deliveries, the CEO told analysts: "The automotive market has been soft since 2018. Entering 2020, COVID-19 further impacted the automotive market. The auto supply chain was affected throughout the year and our customers continued to decrease their demand in the third quarter.

He added: "However, the automotive supply chain is long and complex, where many of our technology nodes has been tight throughout 2020 due to strong demand from our other customers... as demand from the automotive supply chain is rebounding, the shortage in automotive supply has become more obvious. In TSMC, this is our top priority and we are working closely with our automotive customer to resolve the capacity support issue."

On 5G, the CEO added: "We believe 5G is a multi-year mega trend that will enable a world where digital computation is increasingly ubiquitous, which will fuel the growth of all four of our growth platforms."