Telecommunications companies have been among the largest technology spenders this year, IBM CEO Arvind Krishna said on the company's earnings call -- as telcos continue aggressive efforts to transform their core networks amid an industry-wide shift to virtualised infrastructure and new services.

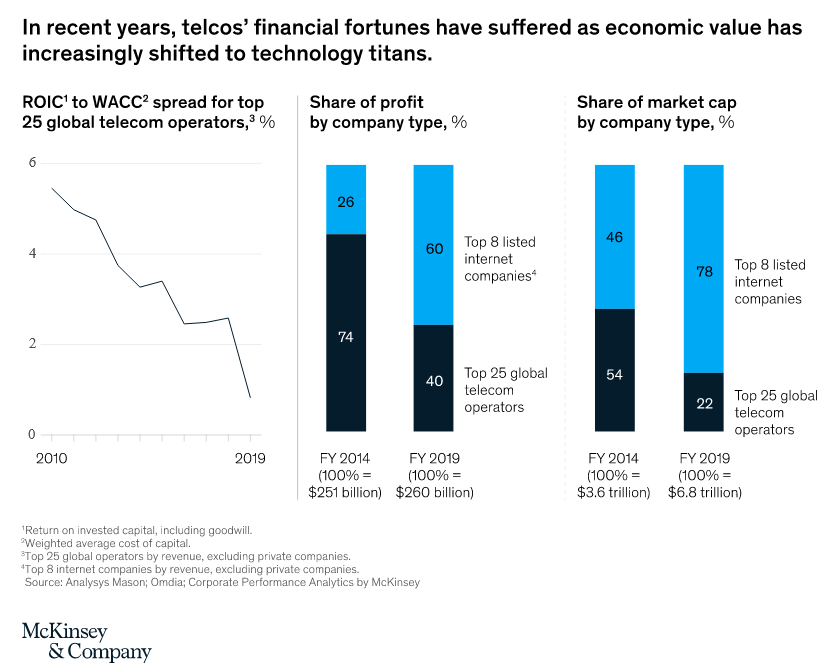

As McKinsey noted in a recent report, strong headwinds in the telco sector have seen operators respond with a "mix of efficiency measures, digitization efforts, structural changes (such as network sharing), and productivity improvements. In parallel, many expanded into new industries... that formula has been running out of steam."

(As an earlier Bell Labs whitepaper put it over five years ago: “Much of the telecom industry — especially in hyper-competitive markets like Europe — finds itself in a tightening corner. The industry that enabled the web revolution is now at risk of being marginalized to the role of mere access provider, as nimble OTT, web-scale companies and cloud service providers innovate more quickly.” Efforts to combat this trend are clearly still ongoing, and as IBM's Krishna noted, it's involving significant spending on digital transformation.)

See also: 5G adoption hits 1 million new users daily, as telcos test network slicing

With consumers moving to ever more bandwidth-heavy activities like remote learning, gaming, and videoconferencing, many telcos are still scrambling to shift from a world in which network functions are running on specialist dedicated hardware, to one in which virtualisation has rendered physical functions as software – which can be run as VMs or containers over general-purpose servers instead.

It's a shift that has seen everyone from Ubuntu maintainer Canonical to Microsoft eye a bigger bite of the pie; the latter in 2020 swooping on telecommunications virtualisation specialist Affirmed Networks for an undisclosed sum — "snatching a company that runs an AWS-hosted virtualised telco core from under Amazon’s nose".

AWS meanwhile recently announced that its AWS Wavelength service was now available in London on Vodafone -- as the duo team up to grab an early slice of an emerging market for applications that require ultra-low latency, but which benefit from the power of the cloud: think game streaming, augmented reality, and machine learning closer to the source of data than standard cloud SaaS might allow.

Expect that spend highlighted by IBM this week to keep growing.

As McKinsey notes: "Today, operators generate an average of 10 to 15% of their revenues outside of core connectivity. There are a few exceptions, notably in the United States and Japan, following large M&As; generally, though, these ventures remain subscale and at challenging profitability levels.

"Going forward, operators will need to couple big bets with a clear reallocation of resources and management bandwidth while reinventing themselves across all parts of the business (for example, sales moving toward solution selling, operating model transitioning to a more digital-native agile model, emphasis on new capabilities with data and software developers at a premium). The focus will likely move more toward B2B, with edge computing, managed services, and broader ecosystem plays."