Tech company valuations have ballooned to over $35 trillion: a figure that places their combined value as higher than the whole of the US's $20.81 trillion GDP in 2020, according to new research from Dealroom.

The data comes as another piece of research by 451 Research, S&P Global Market Intelligence revealed investors spent $40 billion on technology vendors in the first six months of 2021, with valuations soaring.

The brace of investment reports put a fresh spotlight on the strong appetite for technology companies among investors -- global VC investment across other industry verticals also hit all-time highs in H1.

As Dealroom notes, in calendar H1 of 2021, VCs invested more than €259 ($305) billion globally, up from €114 billion for the same period in 2020, with Europe outstripping the US and China as the fastest growing region for VC investment. There has also been an explosion of billion-dollar tech firms - since January, more than two unicorns have been born every day, Dealroom reports.

2021 tech company valuations.

451 Research, S&P Global Market Intelligence, also pointed to soaring valuations in a July 7 write-up: Through the first half, the median multiple paid by a sponsor for a VC-backed technology startup has jumped to 8x trailing revenue, from a steady 4x over the previous three years.

For a snapshot of investor appetite for tech firms, look no further than some recent IPOs: cybersecurity vendor SentinelOne, for example, recently hit a $10 billion+ valuation after its recent listing -- on sales of $46.5 million and a $75 million operating loss (year ending January 2020).

"Since Covid-19 took hold, the tech sector has proved to be resilient and a safe investment for venture capitalists following the economic downturn which has impacted retail, aviation and the hospitality industries severely over the last 18 months” Dealroom said in a July 8 report.

The company added: “Due to this resilience of the tech sector, governments around the globe are increasingly recognising tech as a strong economic and growth engine, creating jobs and attracting investment which is helping to drive the post-COVID-19 recovery.

"This has, in turn, intensified global competition for startups and capital."

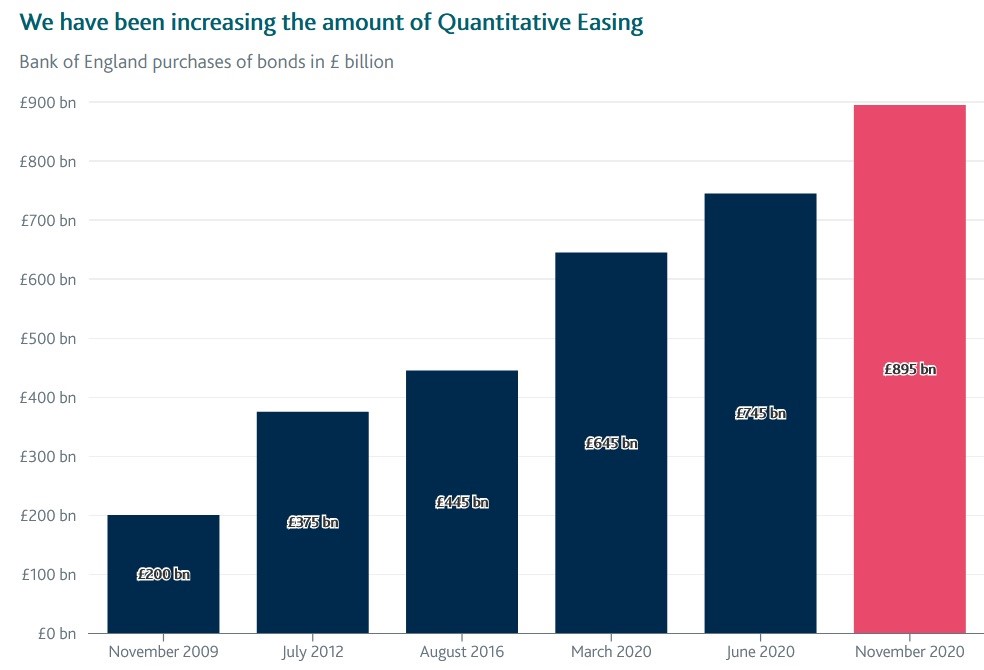

That is, of course, only half of the story: a seemingly endless flow of government support for financial markets has turned economic orthodoxy on its head over the past 13 years and a fresh influx of central bank liquidity has pushed risk appetite up to levels that would previously have been thought to be insane.

(As Wolf Richter of the Wolf St. blog points out, even the average yield of CCC-and-below-rated bonds, "ranging from 'extremely speculative' to 'default is imminent with little prospect for recovery'" dropped to a new record low of 6.83% in early June "as investors apparently don’t mind exposing their capital to the massive credit risks offered up by CCC-and-below-rated junk bonds, for a “real yield” (adjusted for CPI inflation) of just 1.83%.")

Even emerging and frontier markets have got in on the action, with many introducing their first unconventional monetary policymeasures in the form of asset purchase programs (APPs) during the pandemic, as the IMF notes -- "most of the interventions aimed at boosting confidence and improving market functioning, and targeted the government bond market, although a few countries (BEAC, Brazil, Chile, Ethiopia, Hungary, Israel, Korea, Mauritius, and Norway) aimed at the corporate or bank bond market," the IMF noted earlier this year.