In Spring 2020 BAE Systems saw a management buyout of a security operations centre (SOC) and team originally set up to help protect the Olympic Games in London 2012, but since expanded to take on work for a sweeping range of financial services and other commercial clients as a Managed Security Services Provider (MSSP).

Dubbed SY4 at the time, its team had to grapple with not just launching during a pandemic, but finding a physical home after the complex process of separating from its defence contractor parent company. The company in May 2020 successfully moved into a 3521 sq ft. office space within the Grade II listed Marshall’s Mill building on the South Bank of Leeds and relaunches today (February 15, 2021) under the new brand Talion.

CEO Mike Brown -- who teamed up with BAE Systems' veteran Keven Knight to lead the buyout, beating six other bidders after a tense and protracted spin-off that saw their initial bid rejected several times before they won out -- told The Stack that Talion will be offering the 24×7 monitoring, triage, remediation, threat assessment, vulnerability management, and professional services you would expect of an MSSP.

Brown notes: "It's been David vs Goliath: we were competing against many of the billion dollar MSSPs."

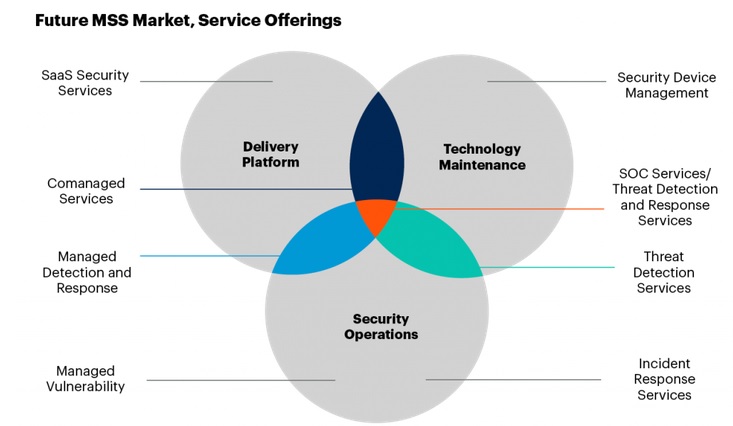

The launch comes as a the MSSP market evolves, with Gartner in 2020 dropping its Managed Security Services Magic Quadrant in favour of broader market guide, saying "the diversity in naming and deliverable functions makes it nearly impossible for buyers to simply compare capabilities... Many more organizations that do not primarily specialize in security or directly identify as an MSSP have entered the market."

In this competitive, but also fragmented market, what makes Talion CEO Mike Brown think Talion can compete? He says: "Right out of the gate our customer base is FTSE 250 and Fortune 500. We're not trying to eke our way into growing from SMB into Tier 1; we're already there... our structure is very flat: 70% of our employees, our analysts, they're engineers; they're the people that run the business, and the management layer is very thin".

He adds: "The biggest complaint that customers have about their relationship [with MSSPs] is lack of transparency, lack of collaboration, and a lack of control. That's why companies switch from one vendor to another hoping that they can get that kind of collaboration. We want to change the way that the MSSP world works; go from this black box approach, to [being] open and transparent. We need to collaborate."

He claims Talion has already beaten "two of the three of the major MSSPs in the market" to opportunities in 2020 even as the company was midway through its rebranding and finding a new home. (Talion names a "British semiconductor and software design company" as one key customer and Brown says it is targeting financial services, insurance, manufacturing, and construction as key verticals it is going after).

"If 2020 was the year of survival, 2021 is the year of bringing the boom".

As research house Forrester found in its own review of MSSP performance, the "happiest customers didn't sign on with their vendor just to outsource and replace the security function at their organization. Instead, their MSSP supplements and augments their internal teams. Look for midsize MSSPs where collaboration and teamwork are interwoven and prioritized as much as technical capabilities. The best MSSPs strike this balance for all of their customer relationships." As Brown acknowledges, Talion will live or die according to how well it can execute this vision.