Environmental, social, and governance (ESG) reporting software sales will likely pass $1 billion in 2024 according to Deloitte, as regulatory regimes around the world demand more data from both corporates and investors.

The EU’s Corporate Sustainability Reporting Directive (CSRD) for example has more than quadrupled the number of companies that need to furnish sustainability disclosures from around 12,000 to more than 50,000.

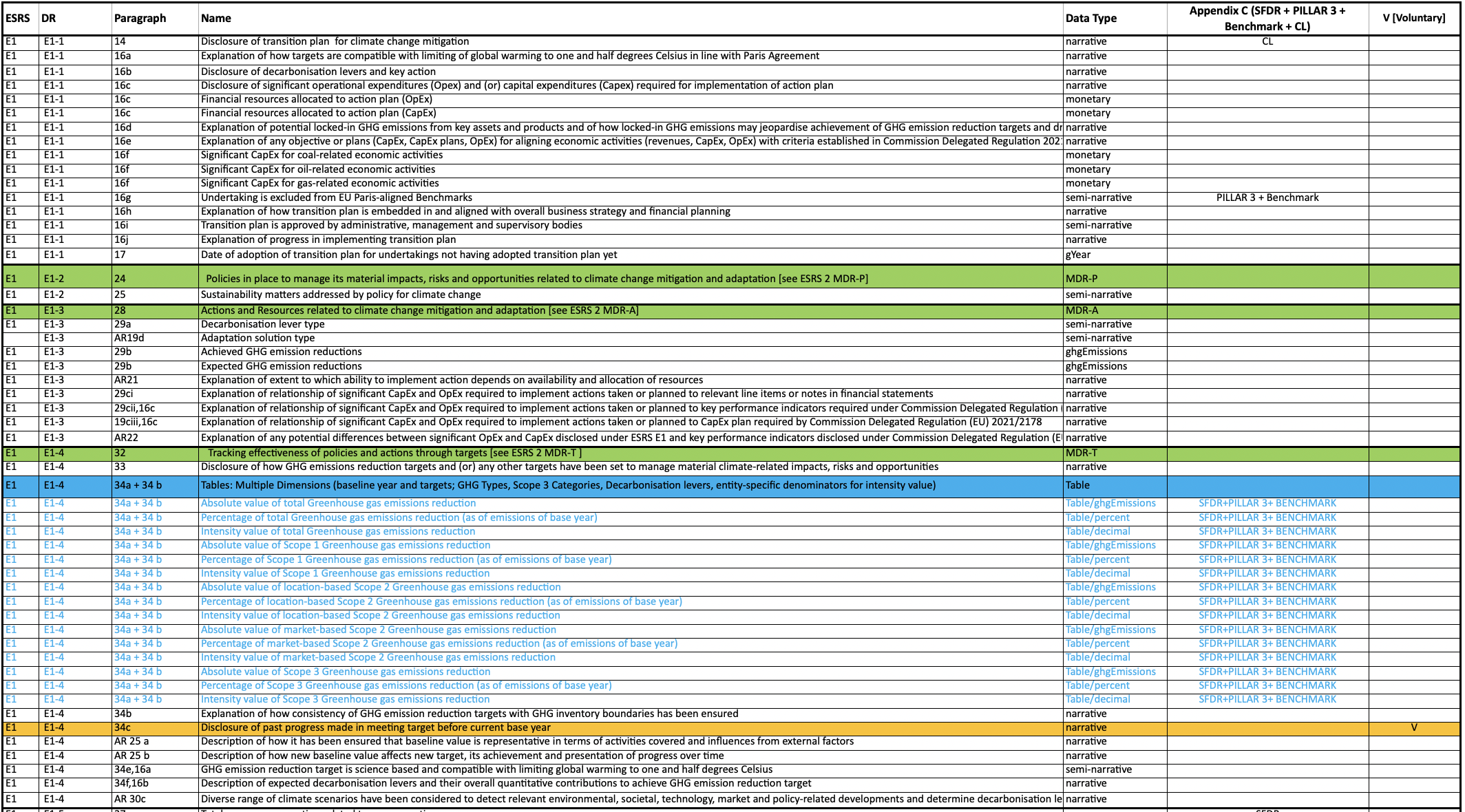

Its European Sustainability Reporting Standards (ESRS) were adopted in July 2023, showing that companies need to make a huge 1,178 disclosures across 12 categories to be compliant with the CSRD. That, and investor pressure on corporations to disclose their emissions as investors look to drive down the carbon impact of their portfolios (itself something of a dark art), has driven a proliferation in sustainability reporting software.

As Deloitte noted today: “The solution-provider market is crowded, comprising pure-play ESG analytics players, ERP companies that have acquired and bolted-on ESG functionality, professional services companies, and tech giants. Pricing varies widely with different structures based on the types of emissions reporting required,” it added.

See also: Increasing influence: 66% of new Chief Sustainability Officers report to the CEO

This shift means not just more sales for technology vendors selling such reporting software – but also impact on tech procurement and processes.

To customers, IT providers are a source of Scope 3 emissions and their own data centres and operations are also in the spotlight. (As research house Gartner projected in 2023: “By 2026, 70% of technology sourcing, procurement and vendor management leaders will have sustainability-aligned performance objectives for their functions…”)

Telco BT is a good example. Its Head of Sustainability recently told CSO Futures [disclosure: owned by The Stack's publisher] that BT is now providing emissions data to its clients based on metre readings from ‘comms rooms, data centres… and so on, as a way of baselining our total impact from an ICT perspective”.

With customers lobbying for more granular data on their IT providers’ carbon emissions profile, in 2023, the company started using the Greenhouse Gas Protocol’s ICT Sector Guidance to provide a more accurate baseline of end-to-end emissions from its global networks.

BT’s Sarwar Khan said, in an October 2023 interview: “We're now using that as a way of conducting our analysis, and quantifying the different levels of impact all the way from energy, but also Scope 3 carbon emissions impact, and we're breaking down the numbers into the different lifecycle parts as well… we now include things like embodied emissions, which would have been very difficult to ascertain before.”

Andie Wood, VP for regulatory strategy at Workiva, emailed in response to Deloitte’s prediction: “As sustainability reporting requirements continue to evolve, businesses now have clearer reporting requirements but increasing process complexity as they aim to report their ESG statistics in a transparent and cohesive story to varied stakeholders, while updating existing reporting practices to new requirements.

"Going forward, it’s clear that ESG reporting is going to fall under greater scrutiny — which means that the dotted line that exists between finance, sustainability and audit teams needs to be strengthened. A huge factor which is likely to be causing this projection of sales is the speed at which organisations are being asked to evolve when it comes to reporting. Standards and requirements such as the ISSB and CSRD with ESRS have been finalised, leaving many companies knowing they need to improve their reporting capabilities, but being unsure where they need to start and how to get there. Just as mandates have been mounting gradually, stakeholder expectations have seen a sharp rise. Shareholders in particular are demanding transparency and rigour, and assurance that they can trust the data and insights provided to them,” she added.

As Alison Taylor, sustainability professor at NYU Stern School of Business, has earlier noted, there can be perverse consequences when it comes to making sustainability reporting a central part of actual sustainability functions, including “legal paranoia and an overwhelming new compliance, check the box approach to the whole topic” – adding that sustainability disclosures are about as efficient as displaying calories on menus, “which in one study, encouraged people to cut 8 calories a day”.)

Many large organisations like insurer Zurich have handed the responsibility around sustainability reporting to their finance function.