Back when Cutover founder Ky Nichol was working in the space sector he grew obsessed by the sublime precision of operations in space; the human-machine collaboration that enabled faultless automated docking to the International Space Station, for example. (Nichol did undergrad work with NASA developing impact crater mathematical models for the Shuttle Programme, then went on to lead engagement with the European Space Agency on the ISS for consultancy PCUBED – a company that specialises in project and change management).

Going on to work as a consultant with clients ranging from the Nuclear Decommissioning Authority, to the Ministry of Defence; via the London Olympics and major banks (where he helped separate critical operations in the wake of the 2008 financial crisis), he saw up-close-and-personal the extent to which sprints so often rapidly fell off from cutting edge tool sets into “so many spreadsheets, phone calls, emails, unstructured data".

Nichol founded Cutover in 2013 with the aim of creating a tool that could create and run fully automated runbooks; one that could incorporate tasks, tickets, communications, and data from across a complex stack and bring everything into one dynamic, automated view. Along with his co-founders he took an early build to the Barclay’s Accelerator, where the bank itself rapidly found use-cases. (Cutover has carved out something of a niche for itself in the financial services sector, where complex ecosystems of operations running across fragmented frankenstacks are too often the norm – but has major customers in retail, manufacturing, and other sectors).

Today The Stack can exclusively reveal that Cutover has raised $35 million in a Series B funding round, led by Eldridge, alongside existing investors Index Ventures, Sussex Place Ventures and Contour Ventures. The raise will help it ramp up its engineering and sales teams this year. It comes as Cutover doubled revenues during 2020 after winning some landmark projects -- it now names three of the five biggest US banks as customers, and has a strong hub in New York. We’re making Cutover our fourth “one to watch”: a monthly feature on startups that we expect to become household names/highly valuable. (Previous startups that The Stack selected are cloud data warehouse specialist Firebolt; climate data innovator Persefoni, and homomorphic encryption leader Enveil).

What is Cutover?

The phrase "single pane of glass" gets widely derided for its overuse by vendors and to give Cutover credit, we didn't spot it in the collateral we've seen. What the company does though is bring together workflow execution, orchestration, audit, analytics, event observability, instrumentation and more in precisely that.

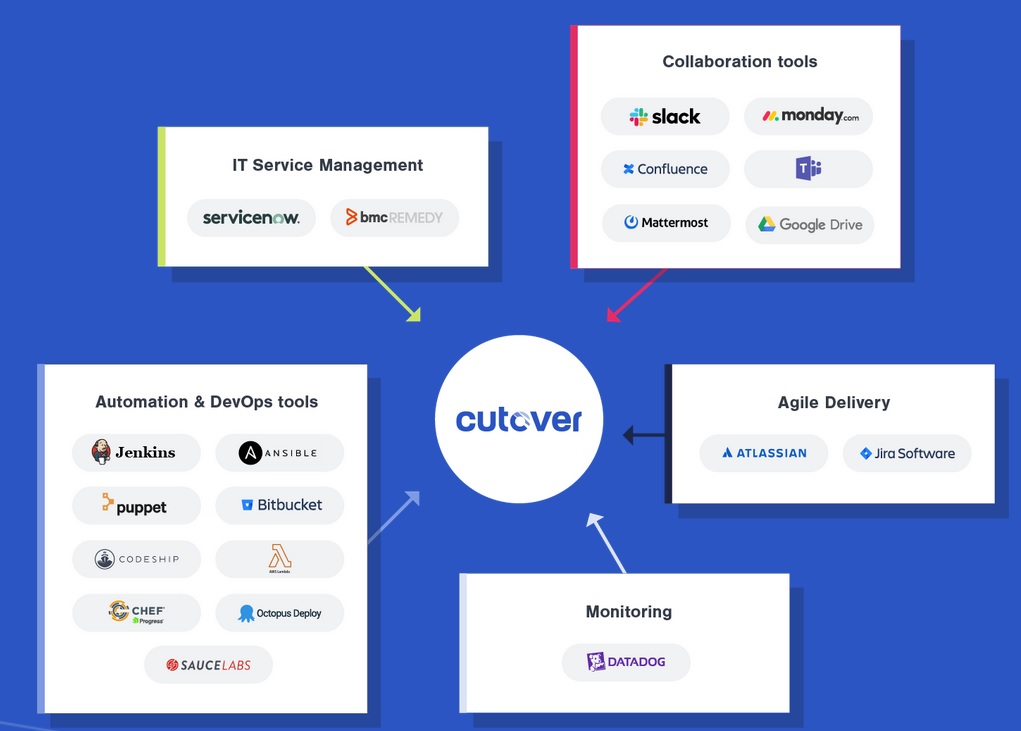

By integrating with continuous integration tools like Jenkins and Ansible used to help build and deploy software, manage pipelines, and push software builds, as well as Agile delivery and DevOps tools, such as JIRA, Atlassian and Bitbucket, enterprise collaboration platforms like Slack, Teams, and many others (ServiceNow, bmcREMEDY, DataDog etc.), Cutover get a birds-eye view of unified change planning data; surface system of record data to aid search and filtering; use infrastructure or applications attributes to support automation; consume triggers from third party systems, such as alerting or monitoring, and use them to trigger actions in Cutover.

A compelling use case for Cutover is preparing companies and trading infrastructure for IPO.

As founder Ky Nichol puts it to The Stack: "We've orchestrated many of the top name IPOs you could think of in the last couple of years; bringing those IPOs to market in the last 48 hours on Cutover.

"In that last 48 hours before you're going to trade you need to make sure that you're ready for the volumes of trade that you're going to get, electronically. A large number of systems need to be configured for that; from simple things like getting the ticker ready, to particular regulatory and governance activities. Essentially, it's a about 400-ish activities that are densely linked in terms of dependencies that business and technology teams and machine jobs have to do before being ready to trade. Needless to say, that needs to go smoothly."

The company's ability to support complex change management projects has seen it adopted by banks, technology, retail and insurance companies to release software, perform cloud migrations, enact operational resilience, respond to incidents and more; all in a way that leaves a clear and comprehensive audit trail.

That's won it both fans and today, that substantial $35 million in backing.

As Michele Trogni, Operating Partner, Eldridge, puts it: “Cutover’s unique ability to enable organisations to accelerate their digital strategies with confidence drove our interest in leading this financing round. When I think of the strategic problems organizations are trying to solve across financial services, technology and wider, Cutover is the missing link, systematically providing the orchestration to move faster together with the audit trail and observability to steer and control. What I like the most is being able to see where our deliverables are across the business and diagnose the root cause of success and failure, and I think that is a game-changer."

Cutover plans to double-down on its ability to support incident response and operational risk, add more open API connectivity to allow customers to easily incorporate Cutover into wider workflows, push further from financial services into the technology vertical. As an Advanced Technology Partner and ISV to AWS meanwhile, and with a strong partner ecosystem including Deloitte -- which listed it in its 2020 UK Fast50 Fastest Growing Technology companies -- Accenture and CSTechnology, expect to hear a lot more from Cutover.