Starling Bank profit will quadruple to £250 million pre-tax in its 2023 Annual Results on almost £600 million of annualised revenue, in a coup for the fintech, run by CEO Anne Boden.

The astonishing performance comes in no small part on the back of support for small and medium-sized enterprises (SMEs) that have long been hugely underserved by High Street banks.

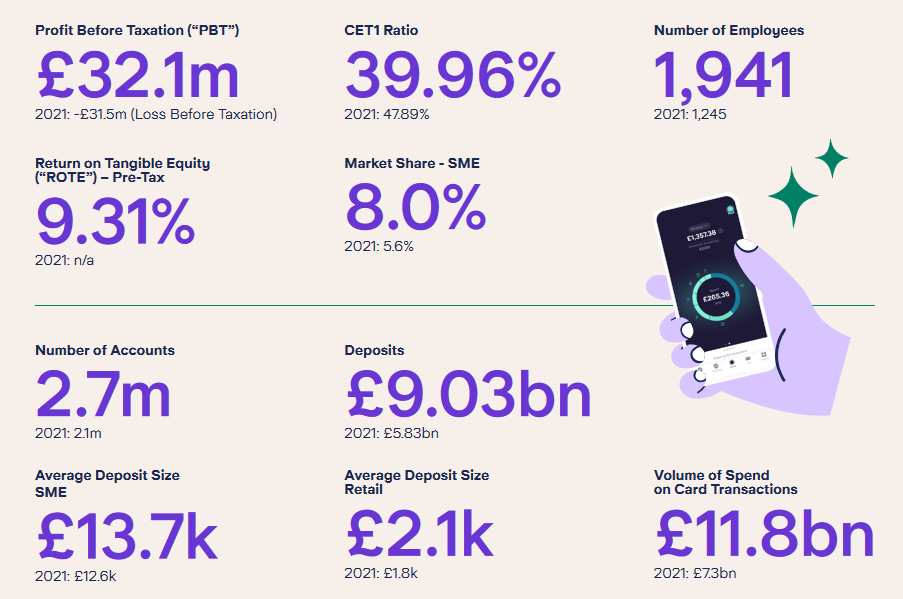

Starling Bank now has 520,000 small business accounts, or 8.9% market share. As of the end of December 2022, total deposits stood at £10.7 billion, Boden said in her annual letter to customers.

In it, she took what appears to have been a not-so-subtle dig at rival Monzo, saying: “Starling was always the underdog; the diligent, hardworking, socially aware, tech-savvy fintech. Never as cool as those businesses run by those 30 year old tech bros. But as we have seen, markets have a nasty habit of correcting.”

She added: “One thing that Starling will not change in 2023 is our commitment to innovation.

“While we have lofty ideas about our part in the evolution of financial services, we built Starling to deliver banking services and products that are really useful. What I’m most proud of in the last couple of months is the launch of free virtual cards” she said, also name-checking Engine, Starling’s new Software as a Service (SaaS) subsidiary that is led by CEO Sam Everington, who was previously Starling’s Head of Engineering.

Anne Boden said: “We’ve big ambitions for Engine, a cloud-native, full-featured, and flexible banking platform which we believe will help us become a world-leading technology company” – Engine is a 100% Starling-owned subsidiary that licenses its proprietary API-centric tech platform. Starling describes it as a modular “bank in a box” that includes APIs to "deliver self-service digital operations for complex retail and SME banking requests.”

Starling Bank profit comes as UK FinTech investment continues

Boden added: "We’re profitable, very well capitalised and have no need to raise money. It’s no accident that we have never sought a silly valuation, even when the prospect of one was dangled before us."

(Boden in the bank's last annual report, published July 2022, emphasised that "in yet another endorsement, all of our investors participated in the recent £130.5 million internal round that completed in April 2022 at a valuation of £2.525 billion, more than double last year’s Series D valuation of £1.1 billion. The bank reported revenues of £188 million for that year, with profit largely driven by increases in net interest income of 123% to £121 million "mostly from increased lending activities and investment of free capital and customers’ deposits.")

Her letter came as the UK’s fintech sector attracted $12.5 billion of capital in 2022, down 8% on 2021. (That put it in second place globally: Overall, the US received the most investment in 2022, bringing in over $39 billion in FinTech capital. India attracted $5.5 billion, Singapore $4 billion, and Germany $2.9 billion.)

That’s according to the UK’s fintech industry body Innovate Finance. Commenting, Jayakumar Venkataraman, Managing Partner at Infosys Consulting, said: “The UK still remained strong compared to global competitors.

“Traditional banks are saddled with legacy technology infrastructure that impacts their ability to respond quickly to market demands and deliver innovative products and services to their customers.

“Increasingly, they are seeing more partnerships with fintechs as a viable solution to this. This partnership approach ranges from simple go-to-market collaborations to strategic investments into fintech companies, to outright acquisitions. Most of the leading banks have made such strategic investments in fintechs in the payments space, lending, KYC, and wealth management domains. Banks like Citi, JPMC, BNP Paribas, MUFJ are some of the more active players investing in the fintechs to gain strategic and competitive advantage.

“We expect this will continue, with more and more banks seeking out these future-makers. No one wants to get left behind and we will see more activity especially in emerging spaces like cloud-based solutions and ESG, as banks look to drive cost optimisation and push on… in their own and their clients' journeys toward net-zero.”