Way back when, it was mostly the big beasts of the financial world pulling datasets from specialist providers like S&P Global. Typically they’d do that in a desktop environment, datasets were somewhat siloed – because making it all align was a hell of a lot of heavy lifting -- and any such Big Data use was the work of specialist teams.

That world has democratised dramatically in recent years -- in no small part as the cost of storage and compute have fallen. Corporates are also increasingly hungry for data, and how they get it is changing notably, says S&P Global’s Warren Breakstone; an industry veteran who’s worked in banking and information services but now leads the Data Management Solutions business for the $2 billion Market Intelligence Division at S&P Global.

“The fastest growing part of our of our business today is Data Management Solutions – that today is about a third of our total revenue” he tells The Stack in a call on March 22. “And clients are increasingly looking to bring data directly into their environments through data feeds, or APIs, the cloud; providers like Snowflake.”

A traditional client community of investment managers and other capital markets players is being joined by more and more large enterprises too. As Breakstone puts it: “They’re trying to unlock value that is resident within their own data, but also increasingly in combination with third-party data. It’s an increasingly competitive market out there and data is increasingly being looked to as a way to help fuel better decisions; whether it be pricing decisions, targeting new clients, entering new markets or even just improving existing products and services.”

Kensho gets put to work...

Back in 2018, New York-headquartered S&P Global acquired Kensho Technologies Inc. ("Kensho"), a provider of next-generation analytics, artificial intelligence, machine learning, and data visualisation systems

“We are thrilled that Kensho will become part of S&P Global as its new class of analytical tools will help us accelerate transformation across our entire company," said S&P Global’s CEO Douglas Peterson at the time.

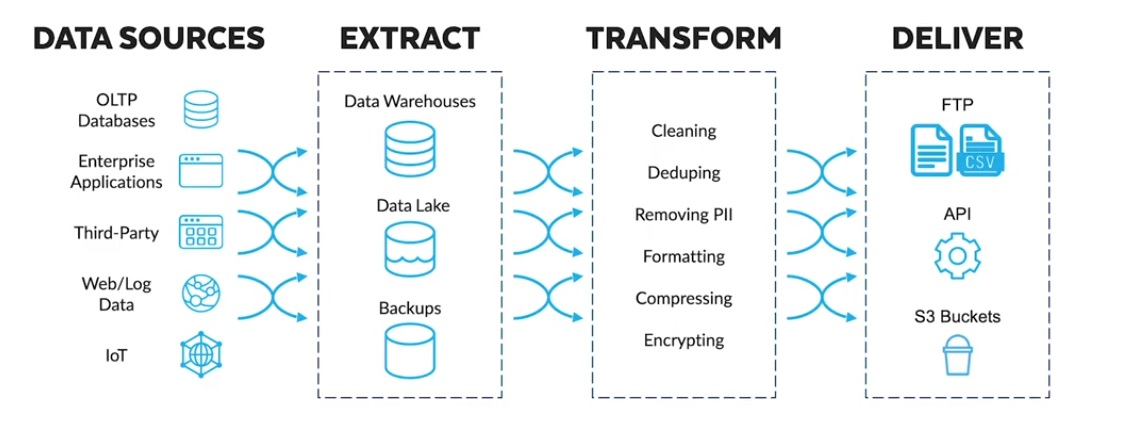

There was no doubt where Kensho technology would be pointed first: S&P Global promptly put Kensho’s tools to work internally across its own data; working out how to optimise data delivery, ensure better integration and optimisation between the data sets it provides – including alternative data from third-parties – and exploiting Kensho’s sophisticated natural language processing capabilities to help it translate simple queries by clients into actionable insights. (It’s hard to underestimate and worth remembering just how much tedious grunt work can be involved in readying datasets for analysis.)

The deal seems to have been something of a game-changer for S&P.

As Warren Breakstone puts it to The Stack: “For the better part of the past two years we've used a lot of the Kensho technologies and data scientists to help us with our internal data challenges: linking our data, preparing our data, ingesting data… then what we did most recently is productise those solutions or many of the control solutions to also make them available and showcase them on the S&P Global Marketplace.”

S&P Global Marketplace: A sprawling data bazaar

The S&P Global Marketplace launched in 2020 and Breakstone describes its growth as “explosive”.

The marketplace does what it says on the tin: lets subscribers peruse a sprawling array of datasets: over here, company level exposure to carbon risk data; over there, time series sentiment on the Chinese Market; over here, pre-market notifications from the FDA; over there, machine readable transcripts data from earnings calls. Analytics grade historical weather data; 10,000 company ESG scores… it’s quite a bazaar.

With its own shop front modernised, S&P Global turned its eye to how customers are consuming data, and soon saw alignment with data cloud company Snowflake, which had recently launched its own data exchange that it was positioning as a neutral, user-friendly home for cloud users to pull in third-party data (from providers like S&P), add their own datasets, run analysis, and present findings via a range of dataviz UIs (pick your poison).

As Breakstone notes: "Some of our customers are on AWS, some are on Azure, GCP. We wanted to offer a cloud-agnostic distribution channel that moves the onus away from tech and makes data use a business process."

Snowflake's push to help customers move away from a legacy of data transfer via APIs or extracting data to cloud storage, and instead let them explore and analysis real-time data in a Snowflake account was a canny move to position the provider as a major data hub and S&P Global was an enthusiastic early adopter.

As Breakstone notes: "This has opened up a whole new opportunity for us and for our clients, not just as an additional distribution channel, not just for the data, but to enhance it with compute power."

With the help of Kensho S&P has been able to clean the data it structures and delivers, make sure all the data sets it offers are linked to each other via the marketplace and then surface possibilities for clients using AI. If they choose to do that via their own Snowflake account, they can input Xpressfeed, other data; output relational tables: the data cloud company supports ANSI SQL, so queries can run with minimal transformation.

As he puts it: "If you're using one of our data sets and then you look to use the second data set, your ability to now get value out of the second database is now very quick; our clients can start unlocking value much faster."

The partnership has opened up fresh opportunities.

Using an analytical backend built on a combination of Databricks and Snowflake tooling, S&P Global is now approximately a month away from launching a new product, "S&P Global Marketplace Workbench", that will allow clients the ability to interact more directly with its data via Snowflake using a programming language of choice for the purpose of research and analysis. That should go live in April, Breakstone tells The Stack, adding: "We really want to just continue to move up that value curve of our clients."

Is your organisation using data in creative ways to deliver value for customers?

We want to hear your stories, whatever vertical you're in. Get in touch.