Six years after an exercise flagged the risks of a “prolonged technical outage” in the core settlement engine of the Bank of England, efforts to “seek to understand and mitigate legal barriers” to one proposed mitigation are unfinished – although progress on a core hardware and software replacement continues to make progress.

That’s according to an annual report from the bank on the Real Time Gross Settlements (RTGS) renewal – a project to rebuild one of the most systemically important pieces of financial infrastructure in the UK that consultants tasked to investigate a nine-hour outage in 2014 described as "difficult to understand and maintain."

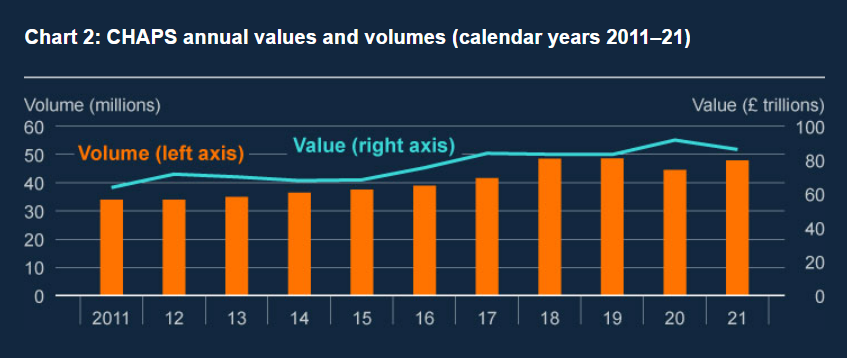

Through RTGS the BOE provides ~£700 billion in settlements every day to direct participants of CHAPS, CREST, Bacs, Faster Payments, LINK, Mastercard Europe and Visa Europe, and others. It is also the mechanism by which the Bank implements monetary policy decisions, and provides liquidity to the UK financial system.

Voluntary postponement is not easy to arrange…

The BoE said: “In 2016, the Bank facilitated an industry wide SIMEX16 [an annual disaster preparedness] exercise which focused on a prolonged technical outage of RTGS. As a result of this exercise, the industry developed the concept of a Voluntary Sterling Settlement Postponement (VSSP); providing that the ability (should a severe operational incident require it) to implement one or more day(s) suspension to sterling settlement in RTGS.”

“Work on understanding operational aspects made good progress in 2020/21 and we have continued to… encourage the industry to seek to understand and mitigate legal barriers to the implementation of a VSSP.”

Postponing RTGS settlements whilst still keeping payments going would be no mean feat legally. The minutes of a December 2020 Money Markets Committee meeting at the central bank suggested that market engagement has been challenging: “The market's preference was for an extended warning, of five business days, prior to a settlement postponement – but it was recognised this might not always prove possible in a live event.”

(Sadly for all parties, “severe operational incidents” don’t typically come with a five-day advance notice.)

See also: Bank of England appoints third CIO in just 12 months

The outgoing RTGS is built on a 26-year-old mainframe (we think)

New RTGS infrastructure will come with robust failover mechanisms and the idea of a VSSP, still being worked through nearly seven years after it was first proposed, is really only for a severe outage that hit failovers too.

If nothing else, the news is a reminder however that when it comes to systemic financial infrastructure, change is very slow indeed ("it's no secret that the Bank of England thinks in decades, not in years" one former RTGS contractor told us approvingly) and effective market engagement not always the world's easiest thing to achieve.

The core RTGS engine has been largely resilient – bar a nine-hour outage in 2014 – but is built on 26-year-old infrastructure. The Bank of England has kept a tight lid on what the existing RTGS infrastructure comprises, but it appears likely that an ageing mainframe and associated database infrastructure are at its heart. (Attempts to explore it further by The Stack with those close to the project met the response that they had signed SC NDAs.)

Plans to switch to a new core ledger system are scheduled for early 2024.

Earlier reports emphasise how badly RTGS renewal was needed. The BOE’s own Risk Oversight Unit in 2014 found that “the underlying technology of the critical RTGS platform has become increasingly difficult to support and maintain with the right set of skills and experience becoming more difficult to recruit and retain.”

Deloitte, meanwhile, noted in its 2015 post-incident analysis, that: “During the 18 years since RTGS was first launched, the incremental changes have resulted in an increase in complexity and a system which is now more difficult to understand and maintain… In combination with the ageing development language used to program RTGS, the result is a system which is… heavily reliant on the skills and experience of the team to support it and more susceptible to errors which take longer to diagnose. There is an increased risk of functional or configuration changes causing errors and if or when the system does fail it may take longer to resolve…”

Work to replace the system has been ongoing for some years. The latest signs from the Bank of England suggest it is progressing well. BOE CIO Sushil Saluja and Executive Director for Payments Victoria Cleland recently told the bank’s “Court of Directors” (its governance board) that her “principal focus at present was on the transition from operational acceptance testing to performance testing”, minutes from the meeting showed.

A big part of the modernisation is a shift to ISO20022 messaging which in theory allows for richer data to help detect fraud, amongst other benefits. This is also progressing. The BoE said: "We launched a ‘Pilot Platform’ in June 2022 that provides a near live-like environment that enables CHAPS Direct Participants to test enhanced ISO 20022 messages ahead of the migration of CHAPS payments to ISO 20022 in April 2023. This is also helping our own business and technical staff to familiarise themselves with new systems and changes to processes..."

The core infrastructure replacement, the Cleland told delegates at City Week 2021, will see it introduce a “state-of-the-art core settlement engine: the heartbeat of the new RTGS service, and of the UK’s financial system.”

See: Accenture customers hit after consultancy's ransomware breach

The renewed service will enable access with a ”simpler and more proportionate onboarding processes including streamlined testing requirements and interfaces such as Application Programming Interfaces (APIs)” she added, “increasing capacity significantly to facilitate more participants" -- who will need patience.

Cleland added that (somewhat frustratingly to the long line of fintechs that would like an RTGS account with the central bank) “as we transition to the new RTGS service, temporarily there will be reduced availability to onboard new participants to RTGS, including to CHAPS, from now until early 2024" (if the deadline is met.)

220+ RTGS account holders affected: Are they ready?

There is a lot of work to do before then and the BoE has made some internal shifts to accommodate it; replacing its RTGS Renewal Committee with a new senior Renewal Executive Board in June 2022 that will make "the final decisions to 'go live' with the implementation of, and transition to, the various states of the new RTGS system".

A lot of market actors will be affected by this change: “Renewal of the core ledger will impact all 220+ RTGS account holders, covering a wide range of banks and other financial institutions” it has noted.

Dr Kimmo Soramaki, founder at DeepTech firm, FNA sketched out how some of this evolving infrastructure is changing how the market operates, telling The Stack: "The way that CHAPS processes payments will be changing. Already today, banks will be able submit payments into two different settlement modes; an RTGS stream where payments are settled immediately, and a Liquidity Saving stream where payments are offset in cycles using smart algorithms to save on liquidity. The new CHAPS will also feature a payment warehousing, allowing banks to send payments for future value dates. These payments can be settled in a morning 'super cycle' simultaneously, again saving on liquidity. These are important features as interest rates are rising and the liquidity is getting more costly. The 2013 changes amounted to £4 billion, and we can expect savings to be substantial as well."

He added, in an emailed comment: "However, to reap the full benefits banks must change the way they submit payments to CHAPS from how they do it today. But how? As a sent payment by one bank is received liquidity for another bank, one bank's behavioural change will affect the liquidity needs of others.

"To understand these complex dynamics, and to optimize the system for all banks, we need system-wide simulations to coordinate their behaviours for optimal liquidity saving in the new environment."

The RTGS Renewal Programme will require a wide range of organisations to make changes to their own technologyA BoE "industry readiness analyst" job description, october 2022

The Bank is hiring to try and get the market ready for the RTGS renewal over the next year.

In October 2022 it advertised for an "Industry Readiness Analyst".

As the job description notes: "The RTGS Renewal Programme will require a wide range of organisations to make changes to their own technology and processes... The readiness of firms to receive this change is critical to financial stability. Within that context, you will contribute to the assessment and reporting of firm readiness.

The role will include... dealing with issues and risks raised by the industry in relation to readiness for migration events. It will also require close communication and engagement with the rest of the Programme team. In particular, you will contribute to developing and implementing the readiness approach for the 190+ RTGS account holders who are not direct participants in CHAPS, although they may participate in other payment schemes."

It's a lot of work to be put on one pair of shoulders (although we're sure they will have support). All involved will be hoping that performance testing goes well, as behind closed doors one of the financial world's biggest recent change management and infrastructure replacement programmes inches closer to the finishing line.

Views -- positive or critical -- on the RTGS renewal programme? What kind of technology changes are you making or opportunities do you see after the change-over? Get in touch.