After record SoftBank losses, CEO Masayoshi Son has warned tech founders to accept devaluations or face a long “winter”, as his company plans "dramatic" job cuts and a halt to investments.

He was speaking on a Q2 earnings call as SoftBank posted a 3.16 trillion yen (£19.3 billion) loss.

Son described the economic outlook as bleak, and said SoftBank and its Vision Funds will remain in “defensive mode” and will need to cut costs. When asked how long this “winter” period would last, Son said stubbornly unrealistic expectations by founders may prolong the pain.

“There are still many business leaders that [think] they can finance at a higher valuation than the last financing round. So, the current situation is that unlisted companies’ value is higher than it should be,” Son said, speaking through a translator. “But unfortunately, unicorn companies’ leaders still believe in their valuations and they do not accept the fact that they may have to see their valuations [fall] lower than they think.

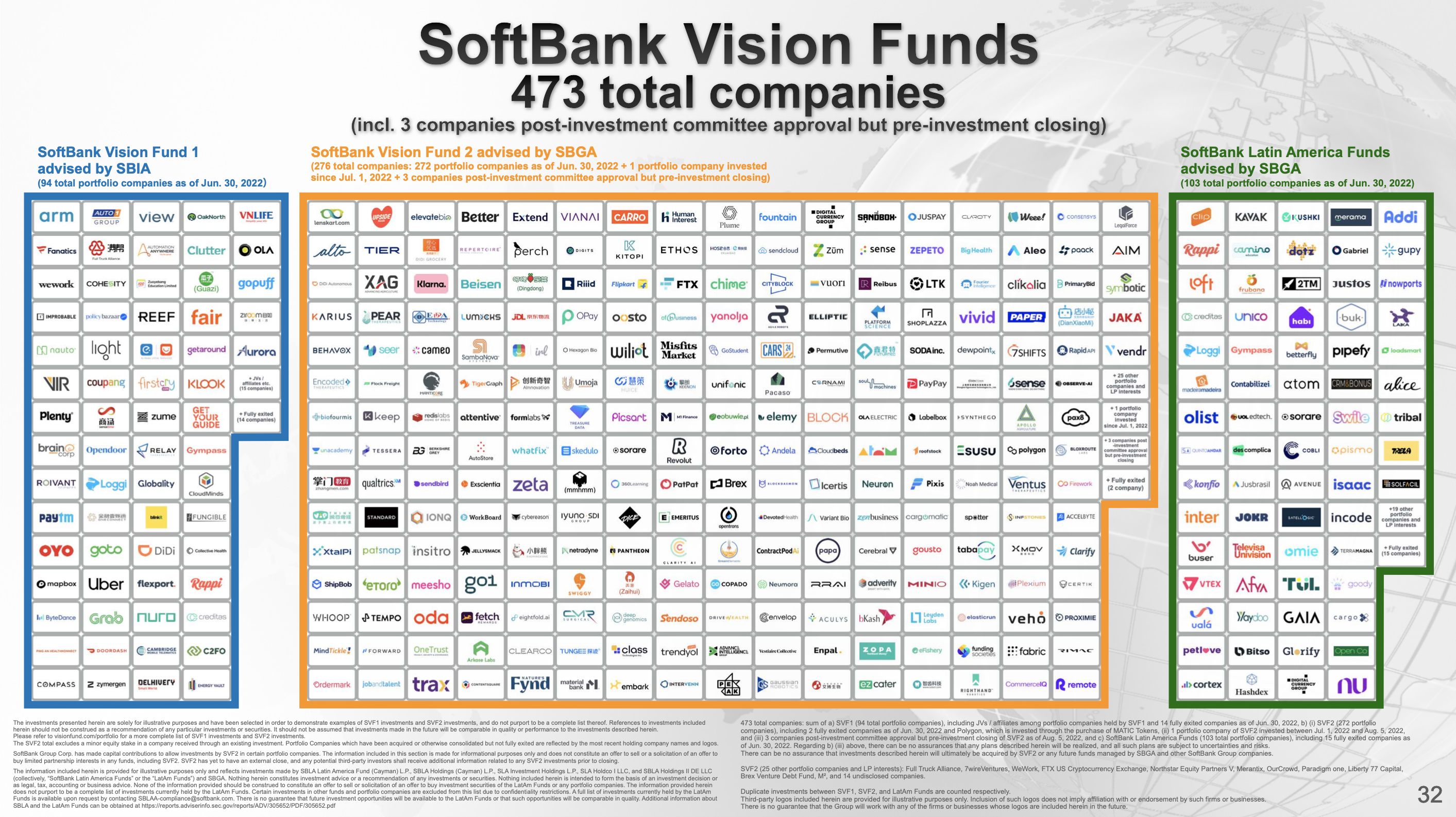

SoftBank, through its Saudi Arabia- and UAE-backed Vision Funds, has made waves in recent years with big investments in companies such as Uber, WeWork and DoorDash, but previous losses forced it to fund new investments directly. Its Vision Funds now own stakes in 473 companies, mostly focused on AI, according to Son.

Record SoftBank losses in Vision Funds

The quarterly earnings report said a number of Vision Fund One companies had posted big losses for the period, including DoorDash (221 billion yen), Korean online retailer Coupang (293 billion yen) and AI firm SenseTime (235 billion yen). The fund’s private portfolio generated losses of 296 billion yen.

For Vision Fund Two, which owns smaller stakes in a wider range of companies, “the fair value decreased in a wide range of investments, reflecting mark-downs of those with recent funding rounds and/or weaker performance, as well as share price declines in market comparable companies” according to the earnings report.

Among the fund’s larger listed investments, SoftBank said the falling share prices of WeWork and AutoStore were the main drivers in declining value.

Outside of the Vision Funds, Son noted Chinese online retail giant Alibaba’s share price had fallen to less than a third of its peak value, from $300 to around $90. Regarding UK-based Arm, which is now unlikely to have a UK IPO, Son barely said anything at all.

“In recent months I talked a lot about the positive news around Arm. But again this time I am not in a positive mode and I need to speak low key in terms of Arm. Things are going well, that's all I can say for sure about Arm today,” he said.

The SoftBank CEO noted around 820 billion yen of the group’s loss was attributable to unfavourable exchange rate fluctuations, which has seen the value of the Japanese yen fall against the US dollar. In contrast to his previously upbeat public statements, Son repeatedly said he was very concerned about the loss.

“[Our] market cap is 9 trillion [yen], but in only three months, we recorded 3 trillion yen of loss. So I would say that that loss is the biggest in our corporate history. And we take it very seriously,” said Son.

SoftBank investment plans curtailed

“Since the market is hurt, some people may say that now is the time to buy as opposed to sell. Well sometimes I feel like that I agree with them. However, remember the portrait of Tokugawa Ieyasu I showed you at the beginning of the presentation: his frowning face is actually my face.

“We have a vision and the vision remains the same. If we pursue that vision recklessly, we may end up losing big – that's something that we have to avoid. So that's why we have a strong discipline in terms of [loan-to-value], making sure that we have liquidity to cover two years’ worth of bond redemption,” he added.

On job cuts, Son said “headcount may need to be reduced dramatically” but refused to give any details, saying discussions were ongoing. But he said there were “no sacred areas” or regions, and “we have to review everything”.

When asked about the wisdom of cutting staff, and potentially eliminating expertise and networks, Son agreed: “That's why I have a lot of headaches that [might be visible on] my head. We have created a great team and relationships and organisations. I feel really bad if you were to reduce them, but the fact is, Vision Fund has recorded almost 6 trillion of loss in the last six months. So not only Vision Fund, but group wise, we have to reduce costs without any exceptions.

“Again, vision remains the same. Our beliefs remain the same. But like it or not we know that we have to reduce operation costs. For new investments we have to be more selective. 470 companies that we have already invested in – without new investment, we need to focus on enhancing the value of the current portfolio,” he added.