Persefoni, a startup that is building an "ERP system for carbon data" has raised $9.7 million in a Series A funding round just six months after its launch. The company has developed a SaaS platform that allows enterprises and investors to calculate and manage their carbon footprint in-line with the Greenhouse Gas Protocol.

The company, selected as an early "one to watch" by The Stack, lets users report the full spectrum of Scope 1, Scope 2, and Scope 3 emissions in different formats like GHG Protocol, SASB, TCFD, SECR, GRI, and CDP. Users can integrate it with Oracle or SAP systems via API to pull data, run analysis and get suggestions to cut emissions.

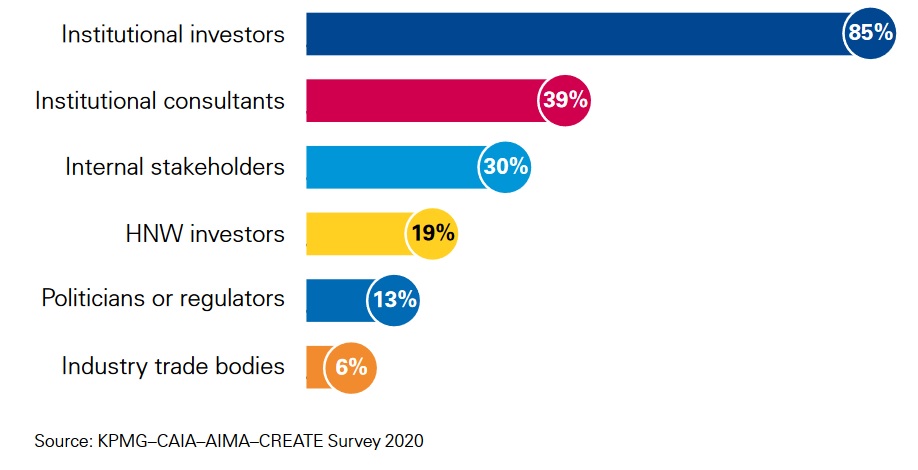

Its emergence comes as institutional investors drive growing demand for improved emissions and other ESG data disclosure by companies. More than half of respondents to a recent BlackRock survey cited the poor quality of of ESG data and analytics as the biggest barrier to broader and deeper implementation of sustainable investing.

(Data direct from companies -- mandated or voluntary -- meanwhile typically currently spans a mix of quantitative and qualitative data. Few stick to the same format or guidelines and fewer still make it machine readable.)

See also: Should estimating the power consumption of AWS EC2 instances really be quite this hard?

A trio of traditionally energy vertical-focussed funds participated in the Persefoni Series A: Rice Investment Group led the round, with GP ETP and Sallyport Investments also investing. Persefoni intends to use the funds for business expansion, product innovation, recruitment, and to scale its business internationally, the company said.

CEO and co-founder of Persefoni Kentaro Kawamori is a former Chief Digital Officer at an energy company. The startup initially aims to build a core customer base in certain industry verticals including extractive industries -- but ultimately aims to provide sustainability disclosures and reporting not just to and from portfolio companies but back to LP’s, co-investors, and regulatory agencies via one platform.

It has already secured global clients including Private Equity firm TPG.

See also: A major new ESG report casts light on a complex market: Our digested read.

"On the back of a banner year of net-zero commitments from governments, asset managers, and organizations the world over, we saw the venture and software investor communities wake up to what is the formation of the largest regulatory compliance software market since the introduction of Sarbanes Oxley," said Kentaro Kawamori, CEO and co-founder of Persefoni. "We applaud the efforts of financial regulators around the world who are implementing carbon and climate disclosure requirements. Such regulation is one of the most impactful ways to get companies accounting for, and reducing, their carbon footprint."

Speaking to The Stack earlier this year, Kawamori noted that "realistically right now most companies are still uploading data for assessment manually... If you want to do manual, data uploads, we can support that. Many sustainability teams are probably doing it all in flat files and CSP files. We can support that process, but we take care of the calculation and the reporting side of it. When you’re ready to automate the data ingestion processes, we can add native integrations to other SaaS products so you can simply link those in an integration portal.

"So you’ll be able to take a vendor payments file, an expense file and an accounts receivable file, drop it in the platform and it’ll auto-categorise carbon calculations based on the source of that data.”