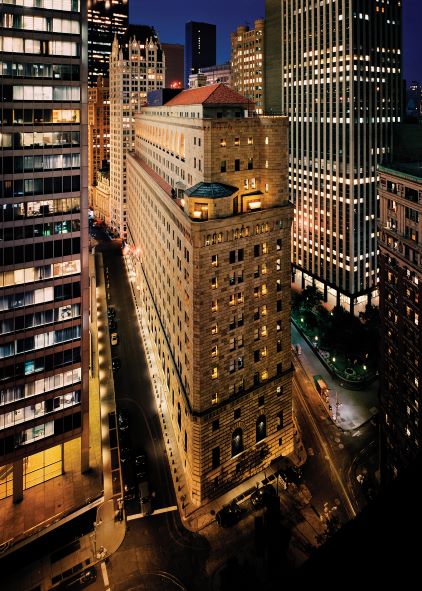

Pamela Chase Dyson is Chief Information Officer (CIO) at the New York Federal Reserve, one of 12 regional banks of the United States’ Federal Reserve System – and one which has several critically important responsibilities, including conducting open market operations, intervening in FX markets, supervising financial institutions, and storing hundreds of billions in gold for foreign central banks, governments, and other international agencies.

As the experienced technology leader tells The Stack’s founder Ed Targett however, her journey to this role at the heart of the financial system started back in the late 1980s as a graphic designer working for a consultancy; fresh from a college degree in Applied Design and getting to grips with the Interleaf programme – the first commercial document processor software that integrated text and graphics editing. As she puts it with a laugh: “I built charts and graphs/tables, and I built content. This is about the in the mid to late 80s, where desktop publishing was coming to the forefront. The company that I worked for went out and bought a system literally over a weekend and said, ‘this is how we're going to develop proposals going forward…’ so I had to learn to use it fast."

Looking back, she recalls: “I spent a lot of time learning that system, which ran on Sun Solaris boxes. I became an expert on it, and I left for Westinghouse because they had bought the same system and they wanted me to implement it there. [I then] got a call from the US International Trade Commission saying, ‘hey, we hear you're an expert in this system. Would you be interested in coming into the work into the [federal] government?’

"It was the first installation of that publishing system in the federal government. So I went there to administer it – for the first time, not as a standalone system. They wanted to network the system, administer it, work with other systems. So I went and got a certificate in LAN administration. "As a result, for a long time, I was a network administrator as well as a graphic artist. I ran Ethernet cable; I wrote scripts; I ran backup and recovery activities.

"That was really my proper foray into information technology – getting my certificate as a network administrator. I took a tonne of classes in the Unix, Solaris world. I had my graphic design career and then had to build up this other career; this more technical engineering-type, network administration-type career, on the side. I took a tonne of courses in LAN administration: developing scripts, crontabs, backups of servers, adding users."

Learning in a hands-on way, she even had to "learn how to run cabling and logically connect the networks.”

CIO Pamela Chase Dyson: “And other duties as assigned… I've always embraced that”

Not just anyone makes it from graphic designer to CIO of one of the highest-profile organisations in the financial world. That took real hard work and an endless capacity to pick up new skills and take on new opportunities, however tough. (Dyson's phone carries the motto: “The dream is free; the hustle is sold separately”.)

That was an ethic instilled by her parents, she tells The Stack: “That means both the virtues of hard work, and also taking advantage of every opportunity that you have.

"I was never one to say ‘that's not my job’.

"Those who have had long careers in the federal government know that the last sentence of that job description reads ‘and other duties as assigned’ – I’ve always embraced that. I certainly was always curious about the whole demand stream or life cycle of things; why it worked the way that it worked. So I’ve never stayed away from areas that were outside of my comfort zone. I always felt that to be intriguing and found that it has helped me broaden my horizon.

"Starting with the aspiration or that dream is fine. But it has to be rooted in the expectation that you're going to have to do a lot of hard work to get there. You have to be your greatest champion"

“You have to have the internal combustion to do the hard work that it takes to achieve that. Starting with the aspiration or that dream is fine. But it has to be rooted in the expectation that you're going to have to do a lot of hard work to get there. In order to do that, you have to be your greatest champion. And part of that is understanding what your strengths and weaknesses are. More importantly is understanding that you've got to put in the work. That's the only way that you're going to get there. And when you do that, you appreciate it more. So for me, I've gotten a lot of pleasure out of knowing that I could almost stand in any room or in any situation as a CIO, as a woman of colour, and talk fluently about my experience because of that.”

The CIO role at the New York Fed

The CIO role can vary quite widely among organisations. At the New York Fed, Dyson is not just CIO, but executive VP and head of the Technology Group -- responsible for the strategic planning and governance of the Bank’s information technology (IT), and the provisioning and delivery of technology services to the Bank. She is also on the Bank’s Executive Committee.

As she puts it: “Technology is viewed as a critical function of the bank. In a lot of ways the New York Fed is a technology organisation; every mission-critical operation that we run relies on technology for us to be able to achieve that. So the CIO is a partner with the business leaders and we work together. The technology strategy at the New York Fed is one of the pillars of the overall bank strategy because, again, it is the thing that enables mission activity for the bank.”

Data centres and much physical hardware are operated out of the Federal Reserve System’s national IT centre in Richmond, Virginia, but with the New York Fed running a sweeping range of complex applications, its challenges are numerous – and supported by a technology group of over 400 employees. Dyson – in the role for two years, after joining from the U.S. Securities and Exchange Commission, where she was also CIO – is busy making changes however. As she puts it: “We are going through a transformation. We have a number of embedded technology organisations at the New York Fed, but we are now centralising technology roles and functions to realize more efficiency in our technology program. At the end of that, we'll be leaner and more agile in governance and product delivery.”

“We miss a lot of opportunities because we have these monolithic processes in terms of how we deliver technology.”

Why the shift? “Embedded IT is a model that can work if it is calibrated… but one of the things we identified when I came on board about two years ago is that we did not have clear standards in terms of how we delivered solutions, how we managed and operated solutions, and how we overall applied technology services in the bank. That led to that inefficiency, longer times to market, a lot of solution duplication because technology was being developed in business silos. Our North Star is to be a leader in technology and central banking. In order to do that, we need to break down those silos. We need to be more nimble. We need to be quicker to market. We need to deliver capability quicker as technology emerges.

Digital transformation: from the cloud to CI/CD

“The reason we're bringing things to the centre is we want to drive technology up to an enterprise level – and we need to be able to clearly see all of the work that's being done across the bank. The other thing is we've been a very custom-built solution organisation.

“We want to be able to leverage more modern technologies and we want to do more buy-and-configure versus build-and-customise, because that had gotten us into a lot of technological debt and has limited the depth of our technology options.”

It sounds like a meaty challenge, we suggest, to the sound of a warm chuckle that suggests it’s one Dyson is embracing with relish – and executive support. As she puts it: “It's a cultural shift. [While] we're talking specifically about technology transformation and evolution, really, it's a huge change management initiative. We have to work hand-in glove with the business. We are partners. We have to collaborate with them. We have to talk about their vision and strategy; how that aligns with our vision and strategy; how that advances the mission of the bank. It is a journey, and it's a journey that we cannot do in isolation. That requires a lot of engagement.”

“Our three pillars are around people, technology and tools, and resiliency. This work really aligns with where we want to go as an institution in terms of our three primary objectives. I can't do it in isolation. I need the support of my business partners and my peers at the executive level. It is helpful that we have buy-in from the very top”, she adds.

A big modernisation project is clearly happening. Can she be more specific about where the focus is? “Yeah, sure. We had a lot of custom-built legacy applications that we really want to modernise and move to more modern platforms. Most of that it will be cloud-based, whether it's PaaS or SaaS, or our own cloud provisioned solutions. In order for us to do continuous integration and continuous delivery, we have to move to a more DevOps, cloud-based infrastructure and platform for that. It’s less about various vendor products, it's more about how we will develop going forward. We have to move to a more agile delivery framework…

"We have applications and services around payment systems; auction systems; trade systems. We also have CRM where we manage our assets and customer relationship management. We have people, human capital systems, because everything starts with our people. And we're looking at how we can build our mission critical systems leveraging modern technology solutions and platforms.

“A part of that is having our people be able to work anytime, anywhere, under any conditions. If this is not a mandate for technology, I've never heard one. And so we're trying to look at how we can modernize our systems to allow for that type of resiliency. This presents opportunities for us to reengineer and reimagine the way we do our work.”

Leading from the front

What of Dyson’s leadership style or lessons learned, after a high-profile career, not just as a CIO, but a – still too rare – black woman at the top of the IT world? “I think one of the things that makes a team successful is when they know they are delivering on a key element of the mission; that no matter what they do, if it's answering the phone calls, knowing that specific task advances the mission of the organisation," she says.

"My position has always been that to be a leader is to be a catalyst for change; but more importantly, a catalyst for empowering the people who work for me. My real job as a leader is to put myself out of work. If I'm doing my job well, I'm developing the people around me. I'm positioning them and removing roadblocks for them. End of the day, I want them to be better than I am; I want them to bring a new perspective to everything that we do. I just view my role as a leader as empowering that and empowering people to do their best possible work from every position that they have.”