Nutanix continues to steadily take workloads from VMware, but as CIOs mull major moves of virtualisation infrastructure, repatriation of workloads to the private cloud and even explore open-source alternatives (is OpenStack set for a come-back?), sales cycles are taking longer…

“As the fiscal year progressed, we saw a higher mix larger deals in our pipeline. These larger opportunities often involve strategic decisions and C-suite approvals causing them to take longer to close and to have greater variability in timing, outcome and deal structure. And as we mentioned previously, we have continued to see a modest elongation of average sales cycles relative to historical levels” said Nutanix CEO Rajiv Ramaswami.

Speaking on a fiscal Q4 earnings call, Ramaswami emphasised that around 80% of the installed base in data centres is “what we call three-tier infrastructure. Separate storage, compute and networking.”

For customers of rivals like VMware that are running hyperconverged infrastructure (HCI) that brings the three tiers together, Nutanix can supplant competitors without customers having to do a hardware refresh.

For everyone else, it means raiding the coffers for fresh hardware.

See also: Hock Tan fights back: Can VMware's VCF 9 stop the horses bolting?

“Now we're also addressing the three-tier market, to your point, one aspect of our partnership with Dell is that we said they would be the first that we would support at external storage, Dell PowerFlex. The whole idea of doing that is now we can find an easier insertion into feature deployments without having to change out the hardware. Now that solution is… only going to be available sometime next year,” he added.

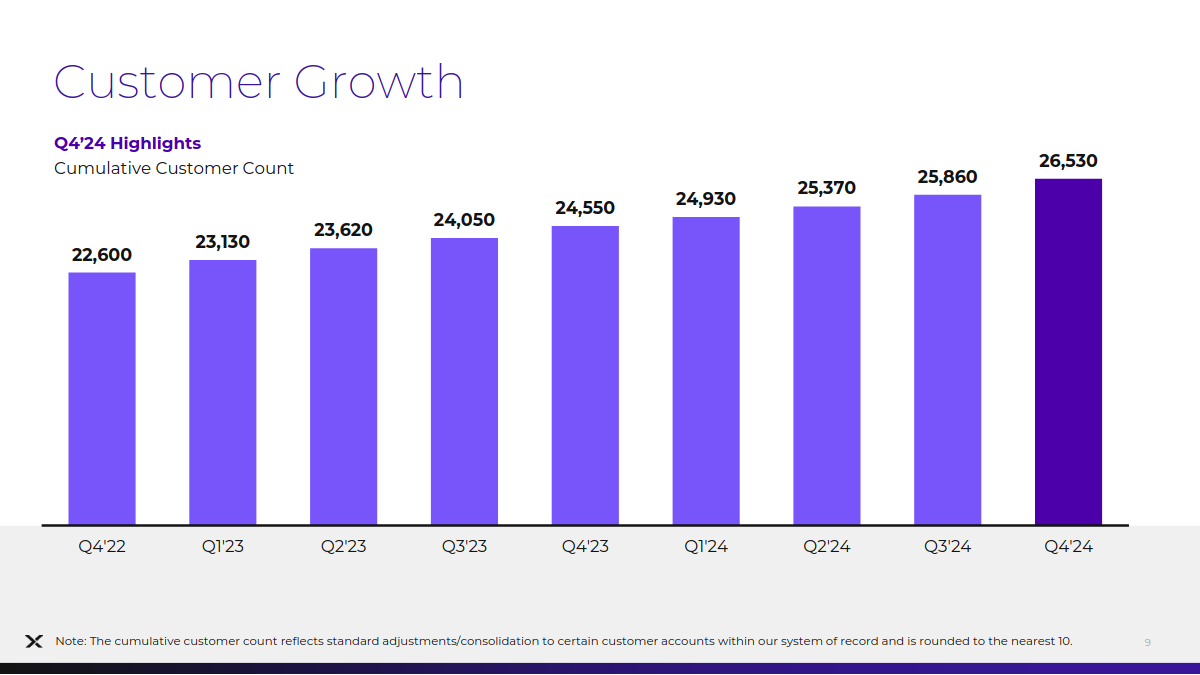

Ramaswami was speaking as Nutanix reported full-year revenues of $2.15 billion, up 15% year-on-year. Solid performance, but the virtualisation specialist’s CEO suggested those elongated sales cycles were a trend that meant despite it landing a “multimillion-dollar” deal with a Fortune 100 financial services firm and the highest number of new logos in three years, land and expand wins were “below our initial expectation” as he put it.

The earnings capped a busy year for the company.

Early in the summer it revealed a new Nutanix Kubernetes Platform for customers, for example. That lets users manage multiple compute clusters; whether on Nutanix on-premises, or clusters running in non-Nutanix environments, including hyperscaler Kubernetes services.

See also: “I need to always have levers” – Wells Fargo’s platform chief

“It’s an opportunity to run in a containerized manner on infrastructure delivered by someone else,” as Nutanix SVP Lee Caswell put it pithily – and was the first time that Nutanix had made parts of its HCI stack available outside of a hypervisor delivered or managed by the company.

That’s all part of an industry-wide push in this space to offer more integrated VM and container-management including for those looking to build out private cloud environments serving multiple application teams.

As Ramaswami put it to The Stack earlier this year, Nutanix had already “had the Kubernetes distribution from a runtime perspective. What's new with NKP [is] two things. One is the ability to orchestrate all the other pieces of the puzzle you need to get a Kubernetes environment going.

“In addition to the base Kubernetes you need load balancers, you need roles-based access control, you need a networking stack. There are open source components available for all of these things, but they have to be stitched together; we automate all of that. Number two, is providing visibility and management of clusters in a consistent way wherever the clusters are running. Your clusters might be running on Amazon or Azure or on-prem, or on the edge. And with NKP, you get a consistent single pane of glass through which you can manage all those clusters.”

See also: Containerise everything? What Nutanix’s evolution says about the changing face of IT – and the rise of the platform engineer

Analysts on the call circled back again and again with the same question: How much more of VMware’s market share could Nutanix poach?

“Historically, Nutanix has been quite strong in what I would call the smaller side of enterprises and the higher end of commercial mid-market.

“Over the last few years, we have deliberately made it further upmarket towards larger enterprises, because that's where we are under-penetrated and the biggest TAM opportunity sits. So we have realigned our segmentation over the past few years to focus more on that market.

Now the products are ready. We have done a lot of work on the product side. The GTM side, now we're ready. We've got some good partnerships. Now we also clearly understand that when you get to the large customers, the G2K accounts, for example, or the Fortune 100-type accounts, those are going to be more competitive… those engagements tend to be long, they tend to be bigger, but to very fruitful if and when we do win it.

“As you can see here, we are starting to win some of those” said Ramswami. But there is clearly, still, a long way to go…