Natwest has appointed Deutsche Bank’s Scott Marcar as its new Group Chief Information Officer (CIO).

Marcar, currently CIO for Deutsche’s investment bank, starts September 5. He began his career at JPMorgan and previously spent seven years at Natwest between 2007 and 2014, including as CIO, Markets.

The new Natwest Group CIO will sit on the bank’s Executive Committee and report directly to CEO Alison Rose.

He said: “It’s a tremendous privilege to be joining NatWest Group at such an important time for the bank and its customers. The bank has an ambitious strategy built on one clear purpose; championing potential, helping people, families, and businesses to thrive. And I look forward to focusing on how technology can help.”

Natwest is the largest business bank in the UK as well as a major retail bank. It is currently in the second year of a £3 billion investment program, most of which is being invested in data, digitalization and technology.

CEO Rose said on the bank’s most recent earnings call that the benefits of that investment were “increasingly clear”, claiming that “ almost 90% of retail customer needs are met digitally” with improved customer journeys resulting a sharp improvement in Net Promoter Scores: retail is at 17, up from four in 2019.

Natwest digital transformation

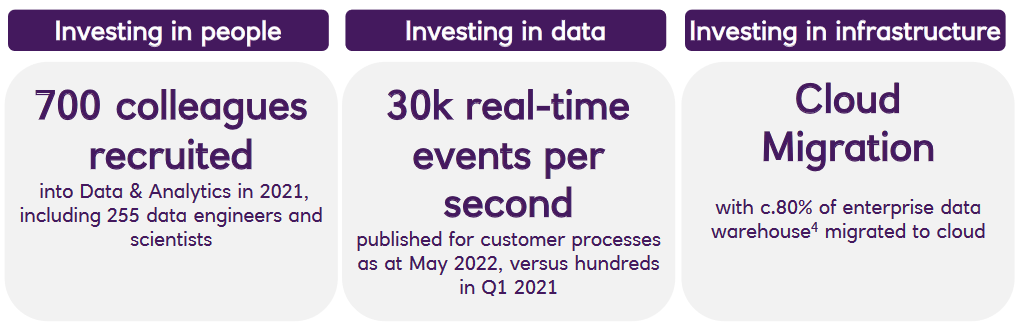

The Natwest digital transformation efforts that Marcar will ultimately oversee include significant investment in improved data tools that are allowing the bank to improve personalised messaging. As of June 2022 it had seen 2.3 million personalised prompts acted upon by customers in 2022 to date versus 1.4 million in FY2021.

As Chief Data and Analytics Officer Zachary Anderson noted in a June 2022 investor presentation: "At NatWest, we have a unique data asset. In the breadth and depth of our customers, and as a result, their data.

"We are a leading UK bank serving 19 million customers across every region of the UK [and...] process one in four of all UK payments, giving us a huge scale advantage when it comes to data and understanding our customers. In the Data Warehouse that I run, we're adding over 750 million financial transactions a month and that includes over 100,000 different unique data attributes from 200 data sources, across 68 million accounts."

Connect with the team & follow The Stack on LinkedIn

He added at the time: "We have over 200 data sources from our state of I.T applications feeding our central data warehouse. While these applications remain a mixture of on-premise and cloud based solutions, we are increasingly using our cloud adoption of the central data assets to be able to drive insights... 80% of the central enterprise data engineering warehouse has been migrated into cloud, enabling faster speed to insight and making the first step towards decommissioning legacy data storage platforms possible."

Earlier this year meanwhile the bank plead guilty to criminal money laundering charges brought by the Financial Conduct Authority — after a UK customer paid £264 million in cash into their account, unquestioned, between 2011 and 2016; the first criminal prosecution of a bank for money laundering by the FCA.

In an April 2022 investor Q&A the bank said it had invested “almost £700 million in the last five years and we are planning to spend over £1 billion in next five on investing in the detection and prevention of fraud and financial crime. We now have more than 5,000 staff in specialist financial crime roles…”

As CDAO Anderson added in his presentation, AI tools are also helping significantly: "[In 2021] we deployed a machine learning model that risk scores every alert and enables a 55% efficiency gain in the alerting process for those teams. That's real hours and time save so they can focus on complex cases. Overall, digital simplification and operational improvements through the use of data and AI are key drivers of our cost reduction targets."