Natwest has moved from zero to 900 million API calls per month within years, as Open Banking uptake grows.

That’s according to Jonathan Haggarty, Natwest’s Head of “Bank of APIs” Technology – an API ecosystem that brings the retail bank’s services to partners -- who said the bank now connects to 270 companies.

He told delegates at a MongoDB event on November 15 : “They’re quite big numbers – in that they were zero a few years ago – but they’re also quite small numbers, in that we expect 10X growth in coming years.”

Natwest API ecosystem is growing fast

He was speaking days after Natwest released three new APIs to support corporate, commercial, and institutional customer demand for real time payments and automated reconciliation.

(The new APIs are part of NatWest's host-to-host package Bankline Direct, which integrates with corporate Treasury Management Systems (TMS) or Enterprise Resource Systems (ERP) for payments and reconciliations.)

The bank has built its API ecosystem on Google’s Apigee API Management platform, he said, with customer data used to deliver new innovations and for analytics stored in a MongoDB database.

Singing the praises of using Software-as-a-Service (SaaS) like Apigee, Haggarty noted: “When people develop on SaaS they spend 80% of the time on customer value instead of on versions, scaling, tenanting, infrastructure…

He added that when organisations are forced to wrangle too much infrastructure themselves that tends to eat into time that could be spent on customer propositions, saying that [with] APIs [that we run/build ourselves] we probably spend 20% time on customer propositions [instead of the 80% if it was SaaS].”

He added that he did not want to be wrangling with infrastructure.

“We want flexibility: The ability to go from nothing to experimenting.”

"A secret base, inside a volcano, surrounded by gnarly guards"

“Our data gives us great insight into the UK economy as a whole” said Haggarty.

“But sometimes it feels like a secret base inside a volcano surrounded by gnarly guards: it’s very restricted.”

That’s changing, he suggested, not least because Natwest’s growing API ecosystem lets it “push a bunch of JSON data into MongoDB [which makes it] “easy to go from simple to quite complex information" and also makes it easier to obfuscate user details through data masking for customer privacy.

(To add a new column in a SQL database, you need to alter the table and executing the "alter table" command can be complex and time-consuming. noSQL databases like MongoDB make it easier to change your database schema as application demands evolve, giving far more fluidity for developers to innovate on data.)

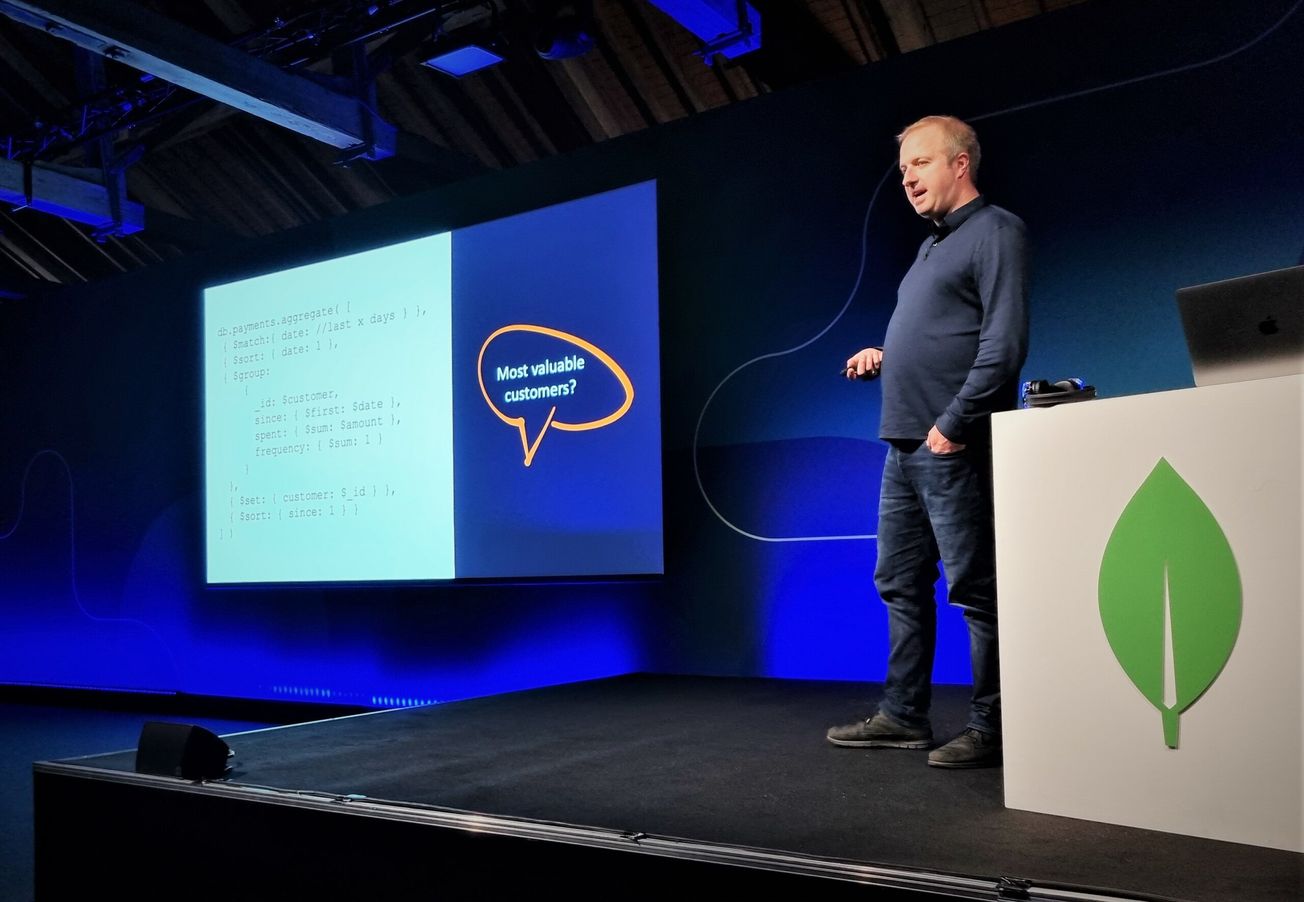

This is letting the bank surface customer data insights for partners via its API ecosystem, for example “where customers are on the e-commerce spectrum”, the “best time [for retailers] to push discounts” as well insights on “most valuable customers” – with data being used for problem solving; analytics and insight; and reporting.

Companies can “find out what are your best sellers and group them by category: socks, train tickets, computer games etc., sum up what people spent on those things, and sort them [giving] real insight for customers.”

“We’ve gone from 1% of developers being able to build cool stuff to 95%.”

With recruitment and retention of talented developers a priority for many in the industry, Natwest’s Haggarty noted that “we’re investing more and more in developer experience.”

He said: “We’re looking at things like backstage.io – an open platform for building developer portals – to use as a landing page on day one (for new developers) to come to who can learn about how we do things, build a UI, build a mobile application, harness data; trying to treat these things almost like customer journeys.”

“The bank is quite good at mapping out the good and bad parts of customer journeys. We’re trying to do that with developer journeys too; asking how long it takes to build an app, to surface the data.”

Natwest's Q3 earnings call (October 28) showed that its investment in digital transformation is paying off tidily: 90% of retail customers and 84% of commercial customers now interact with Natwest digitally.

As Natwest Group CEO Alison Rose put it on an earnings call: "We are making this easier and simpler as we continue investing to improve customer journeys: 72% of retail bank accounts and 96% of credit card applications are now opened with straight through processing and we’re seeing this feed through into continued improvement in customer satisfaction... our Retail NPS is now 20 compared to just 4 in 2019, our affluent score has increased to 29 from minus 2, and we have one of the leading scores in Commercial Banking at 22."