NoSQL database and platform provider MongoDB has hit $1 billion in revenue run rate, just five years after hitting the $100 million revenues mark, with the company also ending its Q4 with 33,000 customers. Its managed multicloud database service MongoDB Atlas now represents 58% of revenue after growing 85% in the year.

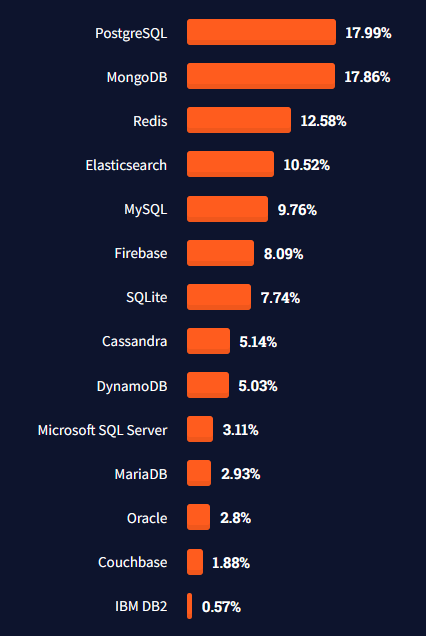

Its growth comes as demand continues for flexible databases to power modern data applications, although the market remains dominated by Oracle and Microsoft's "traditional" SQL offerings as DB-Engines data shows.

CEO Dev Ittycheria told analysts on an earnings call: "Hundreds of millions of new applications will be developed over the next few years as most organizations now recognize that a competitive advantage has to be built rather being bought with off-the-shelf software. The developer experience of working with data has become increasingly complex... The hyperscale cloud providers are reinforcing this by taking a bag-of-tools approach by introducing many proprietary point solutions. This approach pushes complexity on to developers to wrangle these data technologies in their applications and develop workarounds to address scalability and performance."

The New York-headquartered company reported:

- Annual revenue of $873.8 million

- Net annual loss of $306.9 million, or $4.75 per share

- An 80%+ growth in deals sourced by the cloud vendors in Q4

The company said it added 8,200 new customers over the past year. Many have come via cloud hyperscalers, despite many having rival platforms, MongoDB said that demand for its own cloud-based managed database services was delivering a lot of revenue for the hyperscalers (the workloads run on compute/storage etc. underpinned by cloud providers after all) with Ittycheria noting: "As people may remember, in early 2018, AWS introduced a competitor, a clone of MongoDB and know some worries about how that relationship would evolve.

"And I'm pleased to say that I feel like the relationship has never been stronger. We have deep relationships in the field. We partner more on deals... AWS has recognized that MongoDB drives a lot of demand to their platform... the pot really spans all major cloud providers [and] I think what we have shown first with Google as we started working with them very closely, given their ambitions to grow their business quickly is that we could partner effectively and help them acquire a lot of new customers, a lot of new workloads onto their platform.

Follow The Stack on LinkedIn today!

"This did not go unnoticed by some of the other cloud providers. We're also doing a lot of business with Azure. So I would say our win rates are still very high against them when we go head to head against them.

(Some context: relational databases like in which you pre-define your database schema based on your business’s requirements and set up rules to govern the relationships between fields in your tables long dominated the database world. In them, related information is stored in separate tables, then linked through the use of foreign keys and joins. While such databases are fast, powerful and deeply entrenched in many businesses, any changes in schema require a migration procedure that can take the database offline or significantly reduce application performance; both unpalatable, at best, in today’s enterprise or organisational environment. More flexible non-relational databases that allow rapid development and iteration of applications are surging in use as a result.)

COO Mike Gordon added: "For the full fiscal year 2022, we had positive operating cash flow of $7 million... the first full year in our company's history that we generated cash from operations."

What's driving the MongoDB growth? "We're seeing enterprises increasingly get comfortable with moving mission-critical workloads to the cloud", CEO Dev Ittycheria noted, suggesting that customers were seeing "real optionality of not just starting on-prem and moving to the cloud, but going from one cloud provider to another... I think we have the customer proof points to give people confidence to really move mission-critical workloads to Atlas."

Pressed by Morgan Stanley's Sanjit Singh on the "hiccup" many companies face at the $1 billion revenue mark before scaling higher, Ittycheria noted that the company was doubling down on selling to key verticals: "We're going to be focused, increasing on verticalisation. We are seeing a lot of traction in key vertical industries.

"You're going to see us organise our sales teams more over time with a vertical orientation. You'll also see us going after what we call digital natives, which are kind of fast-growing mid-market customers who are building software and not just buying software and they will, obviously, see a lot of value from MongoDB."