Micron is cutting spending on memory chip fabrication by 50% in 2023 and slashing 10% of its workforce, or some 5,000 jobs, with the semiconductor firm’s CEO Sanjay Mehrotra warning the memory market is facing “the most severe imbalance between supply and demand in both DRAM and NAND in 13 years”.

Micron executives are taking a pay cut, after revenues fell 47% year-on-year in its fiscal 2023 Q1, and operating margin tumbled to minus 2%,from an operating margin of 35% in the prior year. Despite ending the quarter with $12.1 billion of cash, executives moved to “bolster liquidity” by raising $3.4 billion in debt.

Join peers following The Stack on LinkedIn

The company’s DRAM revenue was down 41%. NAND revenue was down 37%. That’s partly down to macroeconomic headwinds and partly down to companies having stocked up on memory hardware in the wake of supply chain headwinds caused by the pandemic and now facing their own market slowdowns.

Neither the enterprise data centre nor the cloud are immune from the market malaise, Mehrotra said. He told investors that “in data center, we expect cloud demand for memory in 2023 to grow well below the historical trend... [and] end demand at cloud customers is not immune to macroeconomic challenges.”

Micron memory market warning comes amid innovation

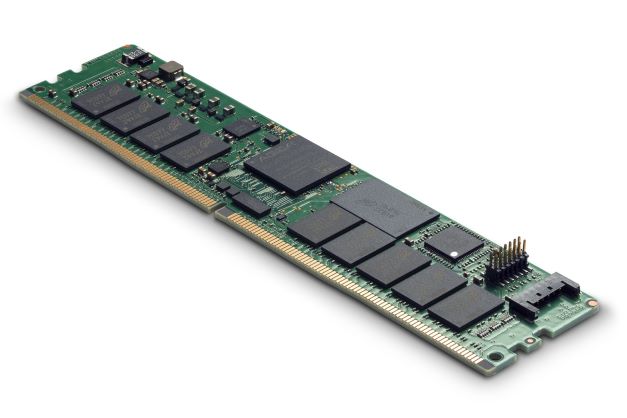

The memory market slump comes just as Micron began production on its 1-beta DRAM production node, which it claims delivers “around a 15% power efficiency improvement and more than 35% bit density improvement [and] will be used across our product portfolio, including DDR5, LP5, HBM and graphics…”

Earlier this month Micron also began shipping what it claims is the “world's most advanced client SSD, featuring 232-layer NAND technology”, its new Micron 2550 NVMe SSD which features 100% higher write bandwidth and more than 75% higher read bandwidth per die than its prior generation SSD.

It also comes as the computing industry starts to adopt DDR5; the latest standard for computer system RAM, which Micron claims enables up to an 85% increase in system performance over DDR4 DRAM, for data-intensive applications that require more CPU compute capacity and higher memory bandwidth.

Rollout has been slow however. Micron’s CEO said on the earnings call: “DDR5 is extremely important for data center customers as the industry begins to transition to this new technology in calendar Q1. As modern servers pack more processing cores into CPUs, the memory bandwidth per CPU core has been decreasing. Micron D5 alleviates this bottleneck by providing higher bandwidth compared to previous generations enabling improved performance and scaling. Feedback from our customers across the x86, and ARM ecosystem suggests that Micron leads the industry with the best D5 products. We expect server D5 bit shipments to become more meaningful in the second half of calendar 2023, with crossover expected in mid-calendar 2024.”

The company meanwhile said that it is “exercising supply discipline by making significant cuts to our CapEx and wafer starts while maintaining our competitive position” – its fiscal 2023 CapEx is being lowered to a range between $7 billion to $7.5 billion from the earlier $8 billion target and the $12 billion level in fiscal year '22, while it expects its “fiscal 2023 WFE [wafer fab equipment] CapEx to be down more than 50% year-on-year.”

The company added: “For calendar 2023, we expect industry demand growth of approximately 10% in DRAM and around 20% in NAND. For both years, demand in DRAM and NAND is well below historical trends and future expectations of growth largely due to reductions in end demand in most markets, high inventories at customers, the impact of the macroeconomic environment and the regional factors in Europe and China.”

Questioned by analysts about a slowdown in cloud memory demand, CEO Mehrotra added: “Digitization trends ultimately do remain positive. Cloud definitely helps drive that efficiency that businesses seek in an environment like this. We do absolutely expect that once we get past the current macroeconomic environment and macroeconomic weakening, longer-term trends for cloud will remain strong.”