Micron's net income nearly doubled year-on-year -- from $491 million to $803 million -- as the memory chip heavyweight reported fiscal Q1 2021 revenues of $5.77 billion, up from $5.14 billion for Q1 2020. The improvement came despite a power outage affecting DRAM production in Taiwan on December 3; that incident was rapidly followed by a 6.7 magnitude earthquake on December 10.

The two events have reduced available DRAM supply for Q2 and hit costs however, Micron admitted, although it claimed investment in recent years in facilities’ redundancy and cleanroom control "substantially mitigated" the impact. The incidents have been factored into an otherwise bullish outlook by the Boise-based memory company, which has net capex allocation of ~$9 billion for fiscal 2021.

Companies are in 2021 introducing new CPU's and compute architectures, which will have more cores, which will have more channels, more DRAM attach rate, CEO Sanjay Mehrotra said on an earnings call, adding that " this trend of more memory in the cloud environment will continue; it's here to stay for considerable period of time."

The CEO also alluded to supply chain tightness elsewhere in the industry, saying shortages "some of our customers are experiencing... relate to general tightness in the foundry space, logic, 8 inch, 12 inch nodes", adding that "we do not see for this quarter any specific shortages in terms of our ability to supply product to our customers."

CEO Sanjay Mehrohtra noted began shipping Micron's "most advanced" 176 layer NAND chips during the quarter, adding that "in DRAM, we made good progress on our 1-alpha node and are on track to begin volume production in the first half of calendar 2021." The NAND chips he cited started shipping in November. They have a data transfer rate of 1,600 MT/s on the Open NAND Flash Interface (ONFI) bus, a 33% improvement on previous iterations and intriguingly, swap polysilicon in the replacement-gate architecture, for "highly conductive metal wordlines".

Micron says the change will help it drive aggressive cost reductions. (The process uses a different method of etching memory cells onto the wafer; using a metal control gate allows programmes to write data faster and reduc the complexity of the read algorithms.

(You can read about the technique in detail in a whitepaper here).

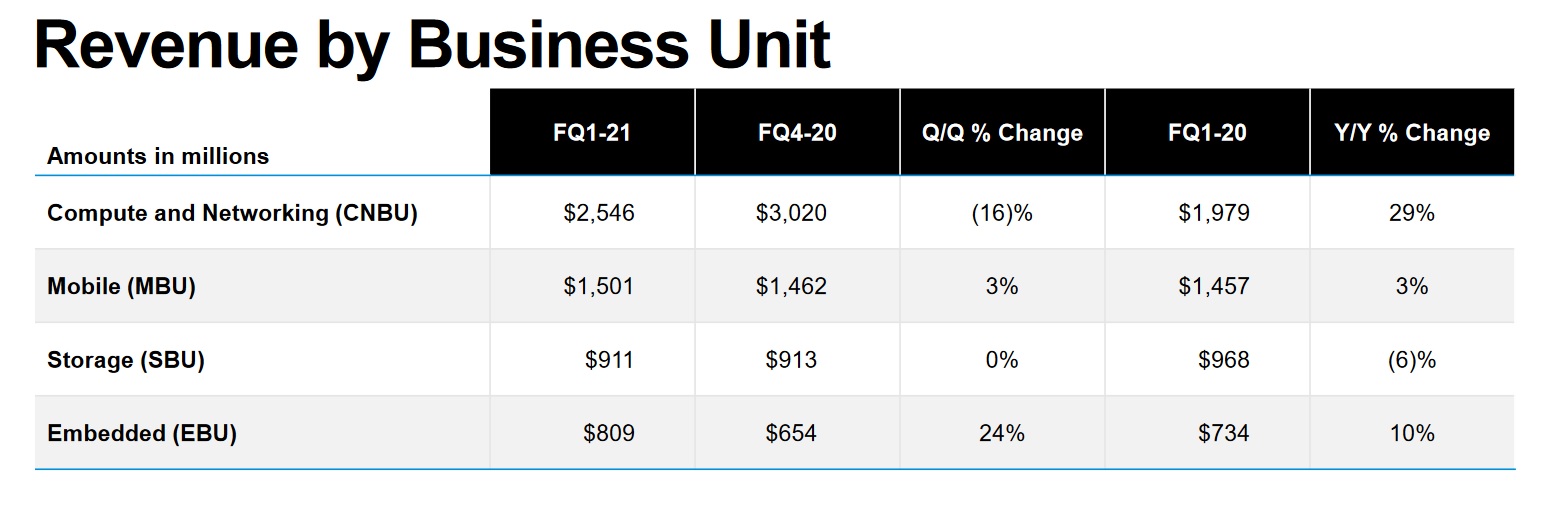

The company's compute and networking segment revenues were up 29% on fiscal Q1 2020, meanwhile, although they fell 16% on the previous quarter "with ongoing enterprise weakness". Mehrotra added: "We believe DRAM is past the bottom of the industry cycle and expect improving trends through calendar 2021 as the digitization of the global economy continues."