Pharmaceutical colossus Merck is ramping up the use and “widespread integration of data, digital, and analytics in all areas of our business.”

That’s according to CEO Robert Davis on a July 30 earnings call, as Merck raised its full-year revenues outlook to $63.4 billion-$64.4 billion.

Merck does not break out technology spending in its earnings.

But the company earlier said it continues to move swathes of its IT infrastructure to the cloud, including a “substantial portion” to AWS as part of a migration being led by Accenture. (Like most multinationals Merck is “multi-cloud” and its life sciences business is a heavy GCP user, whilst its “Merck Digital Sciences Studio” relies significantly on Azure.)

AI and drug discovery: Data access, quality remain hurdles

Merck’s Chief Information & Digital Officer (CIDO) Dave Williams is leading that shift as part of a rolling enterprise digital transformation.

Merck’s first Chief Science and Technology Officer Dr Laura Matz, meanwhile, who was appointed to the role in 2021, runs Merck’s tech-heavy global innovation hubs in China, Israel, Germany, and the US.

Dr Matz, an analytical chemist by training, is overseeing initiatives that include work on “digital chemistry” and the use of predictive AI to find optimal formulations that turn an active pharmaceutical ingredient (API) identified in lab tests into something with desirable drug-like properties.

Merck's tech includes own AI SaaS

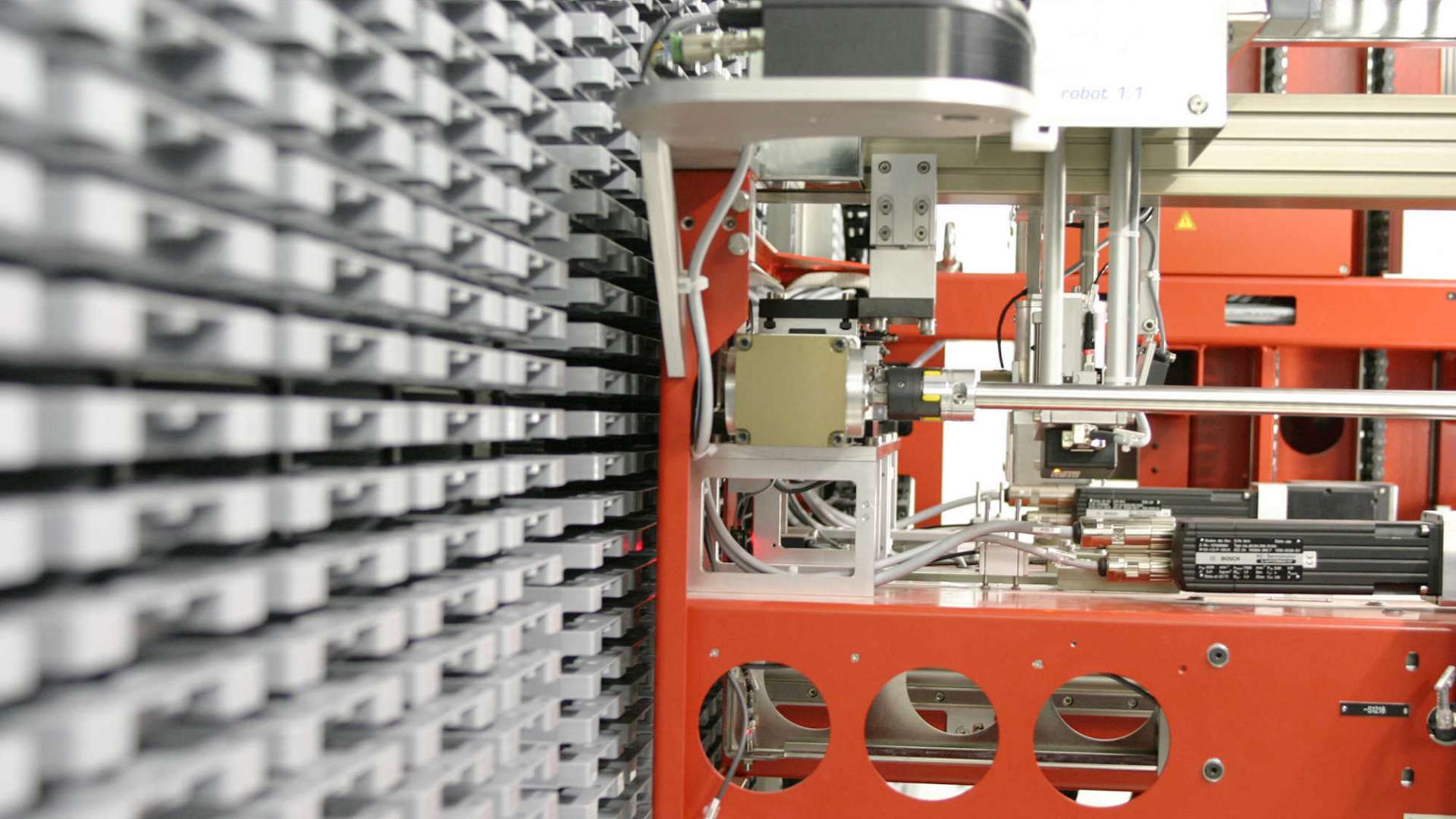

Late last year Merck launched its own cloud-native SaaS, trained on proprietary data, that uses AI to try and speed up drug development; it is available to customers via API (application programme interface).

Dubbed AIDDISON, it identifies compounds from “over 60 billion possibilities that have key properties of a successful drug, such as non-toxicity, solubility, and stability in the body” Merck said.

As Merck told The Stack in December, it is “primarily selling annual licenses for individual seats (i.e., a customer would pay in increasing amounts for 1, 2, 3 users and so on) or enterprise sitewide licenses... AIDDISON licenses can be procured by any interest[ed] party.

“The AI/ML models in AIDDISON are trained on 20+ years of proprietary experimental data from our pharmaceutical division –there is no access to the raw data directly, but the training data will inform the results and predictions a customer will see when they are designing their own novel molecules. In version 4.0… customers will be able to augment our models with their own data – but that will exist only in their own instance of AIDDISON and we will not have any visibility into their proprietary data.

Merck’s total sales for the reported quarter were $16.1 billion.