Yesterday Kaseya announced it was buying cloud backup provider Datto for $6.2 billion, prompting an immediate channel backlash and at least one controversial take from Kaseya on the negative reaction.

The deal will see Kaseya -- which provides IT management software to Managed Service Providers (MSPs) -- take the just-recently-floated Datto private again, with funding from Insight Partners, Temasek and TPG . The price represents a 52% premium on Datto’s mid-March share price, which had been trading below its flotation value.

MSPs reacted with considerable concern to the news, with many unhappy at the shrinking of options for remote monitoring and management and other services. A common concern was the possibility Kaseya would extend its three-year-contract policy to Datto’s services. Kaseya's took a beating on the news with many MSP partners suggesting that its support was poor, claiming issues with service availability, and product development.

Reaction on the MSPs subreddit was pretty universally negative, with an entire thread, titled “An open letter to Kaseya”, consisting of comments only containing “:(“ The main discussion thread on the deal stretched to hundreds of comments, all of them negative. Kaseya was hit by the Revil ransomware group in May 2021 -- which used a SQL injection vulnerability in its remote access and vulnerability management software Kaseya KSA to deploy ransomware into the networks of panicked MSP customers in a supply chain attack that hurt thousands.

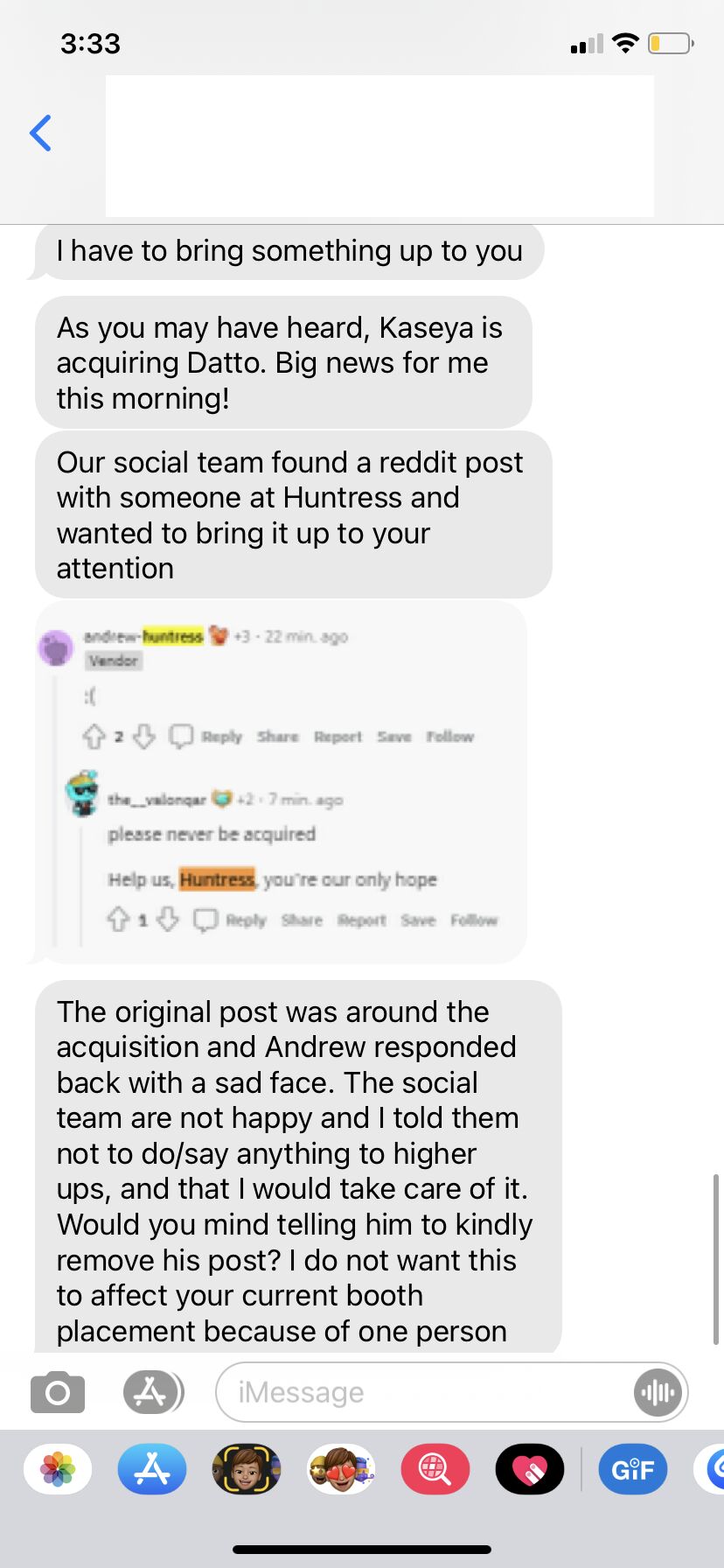

Partner threatned over comment on Kaseya Datto deal

One of those comments, another sad-face, from Andrew Kaiser, VP of sales at security platform Huntress Labs, sparked its own sub-drama. As Kaiser posted on LinkedIn, Huntress’s Kaseya contact got in touch with the firm with what appeared to be a threat against Huntress’s booth space at Kaseya Connect.

“Sadly it’s far too common for larger vendors to bully smaller vendors like this. These things happen quite frequently, but most are unwilling to talk about it due to the likely repercussions,” said Kaiser in his post.

“Investment from Private equity doesn’t have to be a bad thing for our industry. Datto thrived with the backing of Vista Equity Partners and kept many of the qualities that made them great even after going through an IPO.

“So far our industry doesn’t have the best track record of consolidating other vendors, but I sincerely hope for the sake of the thousands of MSPs impacted by this deal that the leadership team at Kaseya can prove us wrong with this one,” he added.

See also: Datto's CISO on image-based backup and the ransomware endemic

Kaseya SVP for corporate marketing and comms, Dana Liedholm, replied to Kaiser’s post with a conciliatory statement: “We understand that many strong opinions are being voiced throughout the channel and that is natural and acceptable. I’ll reiterate my excitement, and ask for your grace in accepting our apology for what seemed like a threat. Huntress is a valued partner and we look forward to a continued relationship.”

Huntress played a significant role in tracking the impact of REvil’s ransomware attack against Kaseya last year.

Lingering concerns around the ransomware incident is one of the key drivers of negative sentiment against Kaseya judging by online comments, with many questioning the ability of Kaseya to keep its systems and partners secure.

(Just last week the Dutch Institute for Vulnerability Disclosure (DIVD) published the full list of vulnerabilities it found when researching Kaseya’s Virtual System Administrator (VSA) platform, the target of REvil’s attack. After the attack by apparent Russian actors it emerged Kaseya had been warned about security flaws years earlier.

The Kaseya vulnerabilities included:

- CVE-2021-30116 - Unauthenticated credentials leak via client download page

- CVE-2021-30117 - SQL injection in Kaseya VSA Unified Remote Monitoring & Management (RMM)

- CVE-2021-30118 - Unauthenticated Arbitrary File Upload with Web server rights

- CVE-2021-30119 - Authenticated reflective XSS

- CVE-2021-30120 - Bypass 2FA

- CVE-2021-30121 - Semi-authenticated local file inclusion

- CVE-2021-30201 - Unauthenticated XML Entity Attack (XXE)

Kaseya Datto deal 'has a lot of MSPs very concerned'

Even on the normally more restrained LinkedIn, publicly expressed sentiment around the deal was almost entirely negative. Comments from MSP executives included “Sold their soul to the devil”, “Kaseya: where good products go to die”, “Not a good thing for MSPs” and “I can't think of anything worse to happen”.

On a post announcing the deal by Greg Jones, EMEA business development director at Datto, reactions were split between congratulations and concern around the deal.

One comment on the post, by David Hodgson of Realtime IT Solutions, said: “Some very diplomatic responses here Greg, but this has a lot of MSPs very concerned! What I don’t understand is how as a partner I had to hear this in a Reddit post and not from Datto themselves.”

Meanwhile, Datto's competitors clearly know an opportunity when they see it. Arvind Parthiban, CEO and co-founder of SuperOps.ai posted: "Rest in peace Datto, Inc. It's time to switch to SuperOps.ai, your first year is on us."

In a statement to The Stack, Kaseya's Liedholm said Datto would remain as separate companies for several months: "We do not have any plans nor can we project on contract terms until the transaction closes.

"Per our FAQ page here, Datto customers will see no changes to their current contracts or pricing after the transaction closes. Looking to the future, both Datto and Kaseya will continue to provide MSPs with affordable software that fits their budget and allows them to grow their businesses."

To MSPs with concerns, Liedholm said: "I would like to reiterate the following: Kaseya is thrilled to announce the agreement to acquire Datto. This partnership will combine Datto’s world-class customer experience and support with Kaseya’s complementary products and strategies that drive innovation and global market development.

"Together, we can provide MSPs around the globe with broader and better integrated solutions to tackle their most pressing challenges. Both Datto and Kaseya have a commitment to helping our Partners succeed, so this acquisition provides even more opportunities for innovation across the MSP channel," she added.

Strong feelings about Kaseya's Datto acquisition? Get in touch.