Those who believe in some Platonic ideal of capitalism – staunch opponents of state intervention and robust advocates of letting markets find their own equilibrium – look away now. A sweeping new 108-page review of the UK’s fintech environment is a curious compendium of interventionist policy proposals (teetering on the edge of full Command Economy: all dollops of tax-payer's cash and three-year plans) with calls for competition regulators to ease off with their well-meaning but pesky interventions into the free functioning of the market.

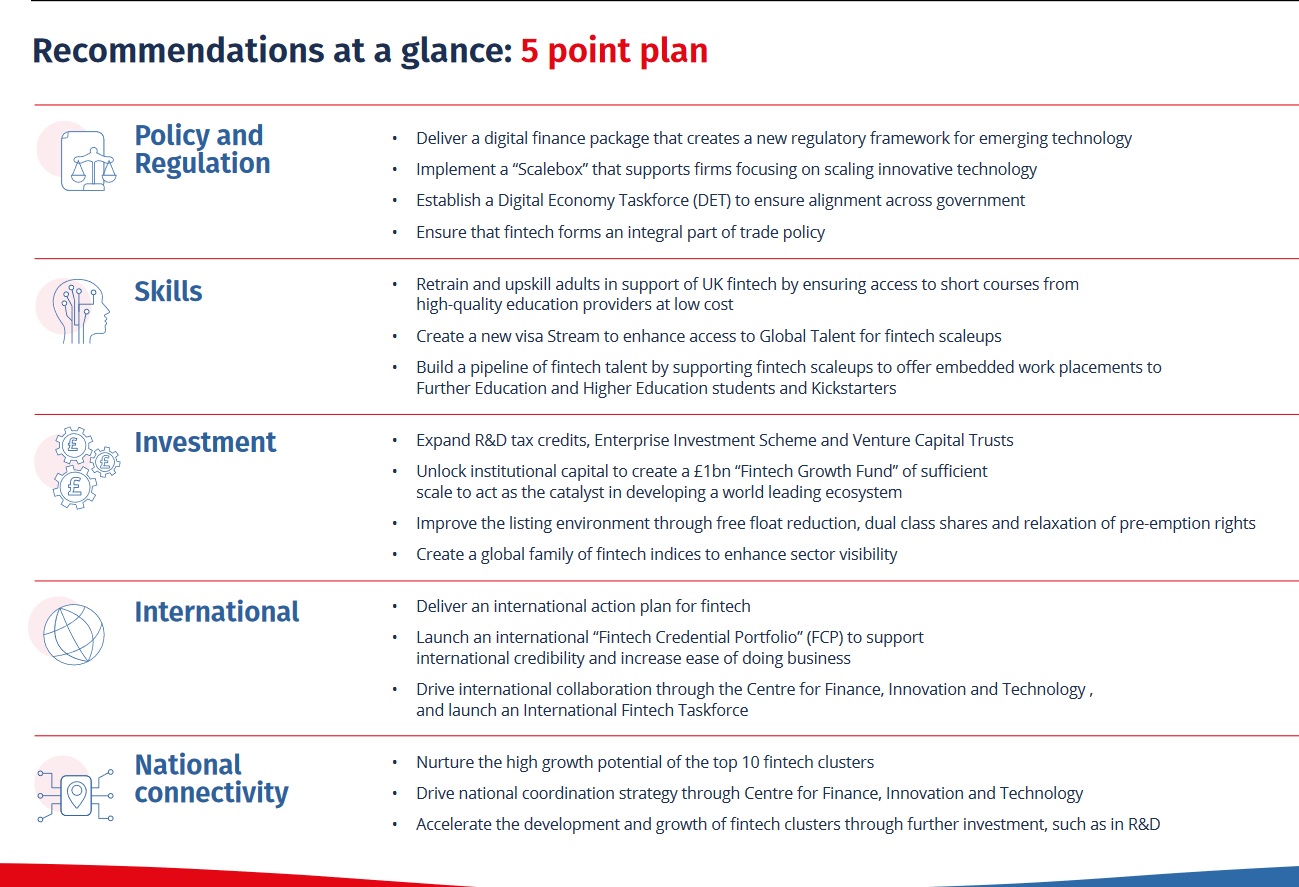

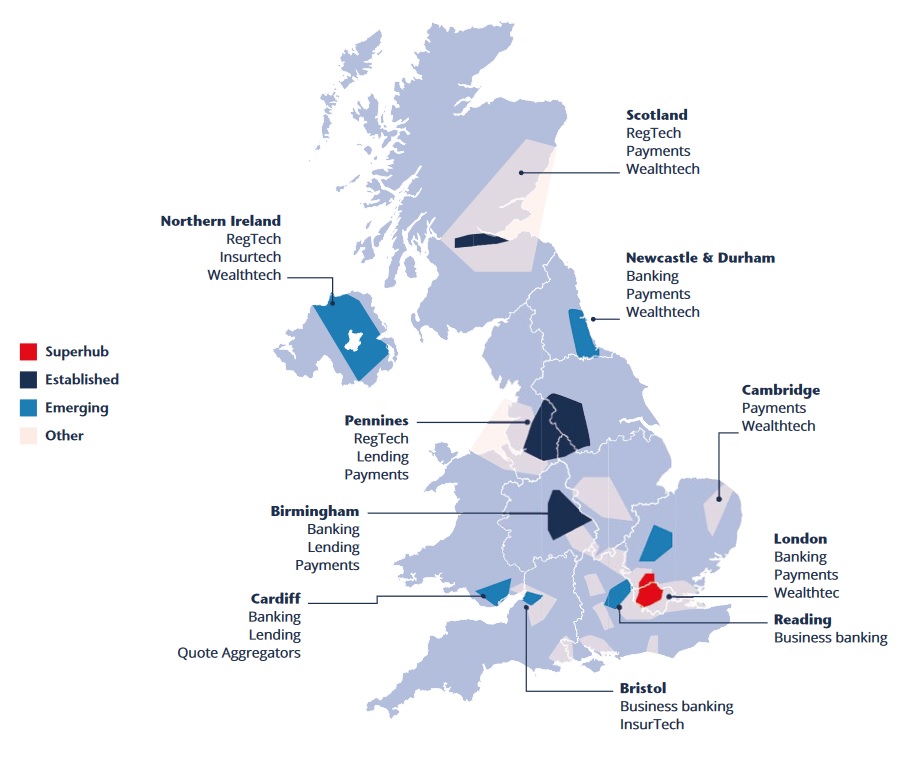

The Kalifa Review, published Friday February 26, urges everything from the “diversion” of UK private pension scheme moneys to a “Fintech Growth Fund”; a “three-year strategy” for the UK’s top 10 fintech clusters; a government-backed Centre for Finance, Innovation and Technology to “coordinate targeted fintech policies”; while simultaneously urging liberalisation on everything from competition rules (“consolidation will be critical”) to regulations governing what fintechs need to do when they go public (“relaxation of pre-emption rights”).

Perhaps this schizophrenia should not be unexpected. The UK’s undeniably innovative fintech community is both the birthchild of creative policy making – thanks to the FCA and its sandboxes – and now its frustrated ward, as Brexit simultaneously undermines London’s centrality as a financial services hub and renders it increasingly challenging to secure the global talent that so deeply underpins the fintech community. (The report’s authors urge action on the latter point with yet another streamlined visa scheme for fintech scaleups; we fear fated to die in a dustbin of identikit proposals for every conceivable industry in the bowels of the Home Office).

And many warmly recognised the need for robust government action. As Imran Gulamhuseinwala, Trustee, Open Banking Implementation Entity put it, for example: "The innovation and the infrastructure we’ve built hasn’t happened by chance. PSD2 applied to all EU countries, yet it is no coincidence that the UK has more regulated providers in the open banking ecosystem than the rest of Europe combined. We have been able to attract talent and investment through a centralised and co-ordinated approach."

Rewind: "What is the Kalifa Review?"

The Kalifa Review is an independent report commissioned by the Treasury in 2020. Its objective was “supporting the growth and widespread adoption of UK fintech, and for maintaining the UK’s global fintech reputation”. It was led by Ron Kalifa, OBE – former CEO of the Worldpay Group – with input from 50+ other members of the review, including a strong Big Four contingent, the fingerprints of which are notably present: KPMG led the “policy and regulation” segment; EY the “international competitiveness” segment. It comes as the UK fintech ecosystem has grown to represent an estimated 10% of global market share and generate £11 billion in revenue.

Among its proposals: creating a $1 billion scale-up fund; assembling a “broad set of actors including fintechs, financial institutions, technology providers, data-led businesses, digital ID vendors, industry advocates and regulators” to assess the best way of creating a unified “Digital ID”; expanding tax credits for the sector; and finding other ways to provide backing amid a climate in which 89% of fintech investors have highlighted the significance (and cost of) financial data sets to their business model. (“A tax credit relating to the costs of such data sets would provide a valuable source of cash / capital for critical investment to accelerate their R&D”).

The report met with a generally warm reception.

One reader, Dr Louise Beaumont, Chair, Open Finance and Payments Working Group, techUK, described it to The Stack as “the Bangers ‘n’ Mash of reviews… It’s solid, sensible sustenance suitable for an industry which is emerging from its scrappy start-up phase and growing into its scale-up boots. The Review recognises that we must make the UK an attractive place to innovate: competition-igniting regulation; a rich supply of talent from all four corners of the UK and, of course, from overseas; deep pools of investment flowing all the way from funding first ideas to fuelling IPOs; and a warm welcome for inward investment plus enthusiastic support for export. There is much to do – and Wednesday’s Budget will tell us whether Rishi Sunak believes, as Ron Kalifa does, that FinTech is the future of Financial Services.”

Others were less so sure. James Berkeley, a strategic advisor to a number of UK startups, noted: “A great many people confuse capitalism with being all about creating new incentives. It is not, it is largely about removing the disincentives and protecting your vulnerability to the risks you are taking.

He added tartly: “Academic-bureaucrat-consultants with something to prove have an incentive to make things look over-complicated, while real world risk-takers with real world skin in the game do not have such insecurity. They are not embarrassed of making those things that are simple, simple! e.g. Why focus on internationalisation (diversification) if your highest-margin, lowest-risk of failure are much closer to home? Why create public funding vehicles? Funding will find innovative businesses and superior entrepreneurs.

Berkeley’s view is in the minority, if the 30+ responses to the report The Stack received is any indication.

The shadow of Brexit

The shadow of Brexit (and its impact on both talent availability and the broader financial services sector, with equivalence still an open question) lay over almost every response; the crispest being a plaintive single line from Mark Davison, MD UK&I of fintech unicorn Deposit Solutions: “An agreement on equivalency would be welcome”, he said, admitting that “probably isn’t a sustainable solution to support any long-term plans.”

(Catherine Birkett, CFO of GoCardless agreed: "For UK fintech to maintain its position as the world’s most important investment hub, British financial services firms must be allowed to continue trading with the EU with an equivalence deal. If this is not possible, it will be imperative for the government to negotiate attractive individual contracts with trading partners worldwide – opening up international trading and talent corridors to strengthen the industry’s hand outside of Europe..."

Samar Shams, immigration partner with Spencer West LLP, works with a number of fintechs.

She said: "Many of my fintech clients feel overwhelmed by costs or inflexibilities in recruiting foreign talent to successfully compete on a global scale. Brexit and the COVID-19 pandemic are increasing the administrative and financial pressures on those organisations as they seek skilled workers… Places such as Canada, France and Australia are already addressing the global arms race for talent with recent changes to their immigration laws, and the UK must move quickly to retain their leadership in the sector or risk falling behind."

The point is an emotive one to many UK fintech founders; several of whom moved to the country to launch their businesses as immigrants. Daumantas Dvilinskas, CEO of TransferGo, told us: "I'm pleased to see that the recommendations delivered today focus in on the importance of attracting global talent to boost the fintech workforce. This is a subject close to my heart being a immigrant who has chosen the UK as the base for my own fintech business.

"The UK's fintech community has continued to progress since the Brexit vote, but we've already seen stagnation in productivity, hiring of talent, cautious investment and lack of confidence in the nation's economy. If the UK is to achieve its ambition of being a world leader in fintech, it needs to cultivate an environment that attracts, maintains and encourages further development of the skills we need to flourish, regardless of where the individuals are from."

A strong government hand? It's needed...

"Competitor jurisdictions such as Singapore, Australia and Canada are investing heavily across many of the areas we have looked at, including capital, skills and direct support for fintechs", recognises the Kalifa Report, adding "the pandemic has accelerated digital adoption globally in a way that marketing or policy never could. This is creating opportunities for jurisdictions that are quickest to diagnose what’s happening and nimblest to capitalise on the opportunities for fintech."

Few demurred. As Anders la Cour, CEO, Banking Circle put it: “Globally, FinTech is one of the fastest growing and exciting industries. The UK has always been a hub for startups and businesses in the space, driving competition in Europe and the rest of the world. But as the Kalifa report reveals, the UK is at risk of losing its leading position. This would be hugely disappointing to the industry and the country, which has always been proud of its trailblazing position in the financial world.

He added: "As a result of the pandemic, last year fintech funding was down compared to 2019, but COVID-19 also accelerated the focus on digitalisation, especially in the financial services sector, and this means there has never been a more important time to embrace innovation. The UK government needs to capitalise on this as a matter of urgency. The Kalifa report sets out sensible recommendations, which as a growing employer in the FinTech space, we’d be excited to see in action."

Yishay Trif, CEO at Moneynetint agreed, telling The Stack: "The Kalifa Review is one of the clearest, more foresighted strategy documents for the fintech sector for many years. It rightly focuses on equipping people with the skills they need to contribute to the industry - and to remain relevant in workplaces increasingly adopting robotics and automation - while including practical proposals for how we can increase collaboration and talent acquisition to keep the UK tech competitive internationally.

“The sector as a whole must rally behind these efforts... For too long, the UK has struggled to plan for a digital world and made piecemeal efforts, like teaching schoolchildren how to code. The Kalifa Review promises a strategic approach to the biggest economic question in generations: how the UK, with all its latent talent and ingenuity, can thrive in an ultra-competitive, post-Brexit landscape. We urge every business leader to get behind the recommendations in this report, and so secure their own and the UK’s future as digital leaders.”