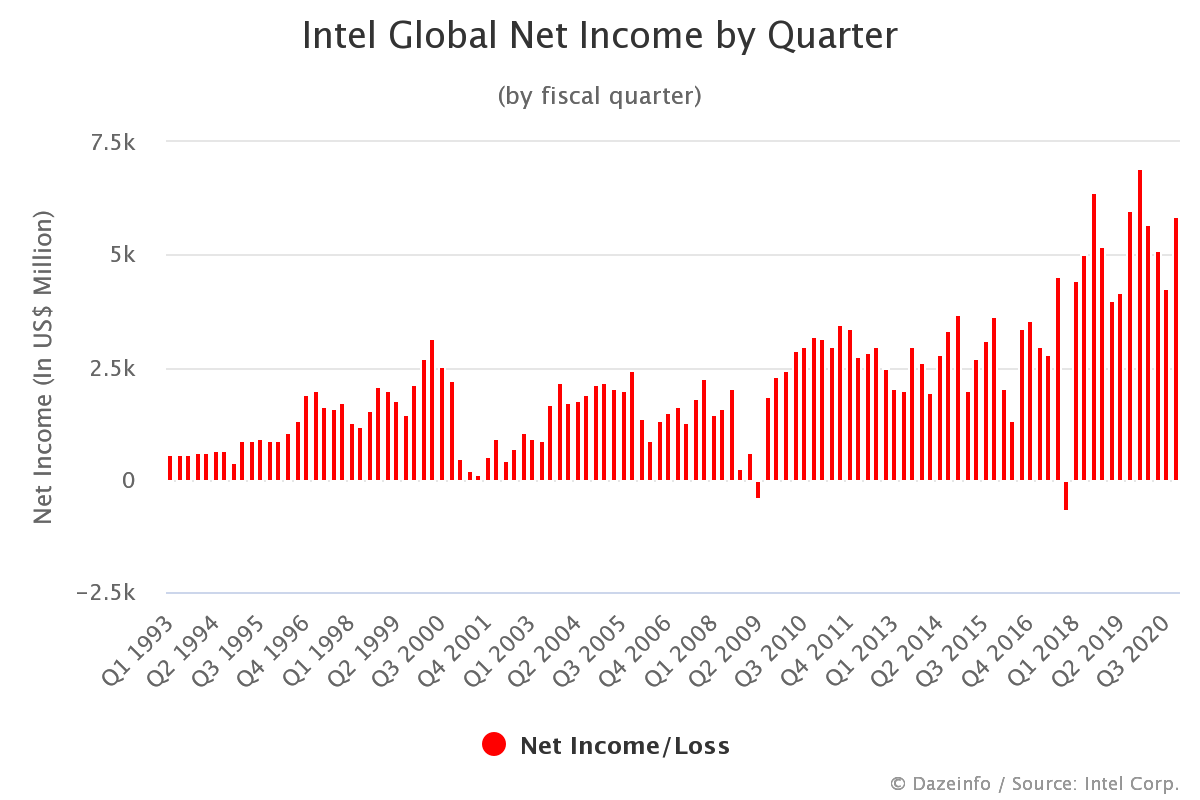

Intel posted its second worse loss ever in the last quarter of 2022, with net income plummeting 114% for a quarterly loss of -$664 million. If Intel is the silicon canary in the economic mine and an indicator of how much money is going into enterprise or cloud hardware refreshes, things are not looking healthy.

"To various degrees, all our markets are being impacted by macro uncertainty, rising interest rates, geopolitical tensions in Europe and COVID impacts in Asia, especially in China" Intel said.

The chipmaker is targeting cost savings of up to $10 billion annually by end-2025 even as it embarks on a significant organisational transformation and invests heavily in process technologies.

On January 10 Intel unveiled its “Sapphire Rapids” fourth generation Xeon CPUs, which introduce a brand-new microarchitecture to the data center, showcasing nearly 50 new CPUs and a new data centre GPU line code-named Ponte Vecchio. The new 4th Gen Intel Xeon chips achieve a 55% lower and 52% lower total cost of ownership (TCO) for AI and database workloads respectively, versus 3rd Gen Intel Xeon Scalable 8380 Processors.

Intel’s new “On Demand” will make you pay extra to unleash chips

The 4th Gen Xeon chips feature a wide range of different built-in accelerators.

That gives customers the ability using software to dynamically adjust their performance for different workloads. e.g. The Data Streaming Accelerator or “DSA” (illustrated below) is designed to offload common data movement and data transformation tasks that cause overhead in data centre scale deployment.

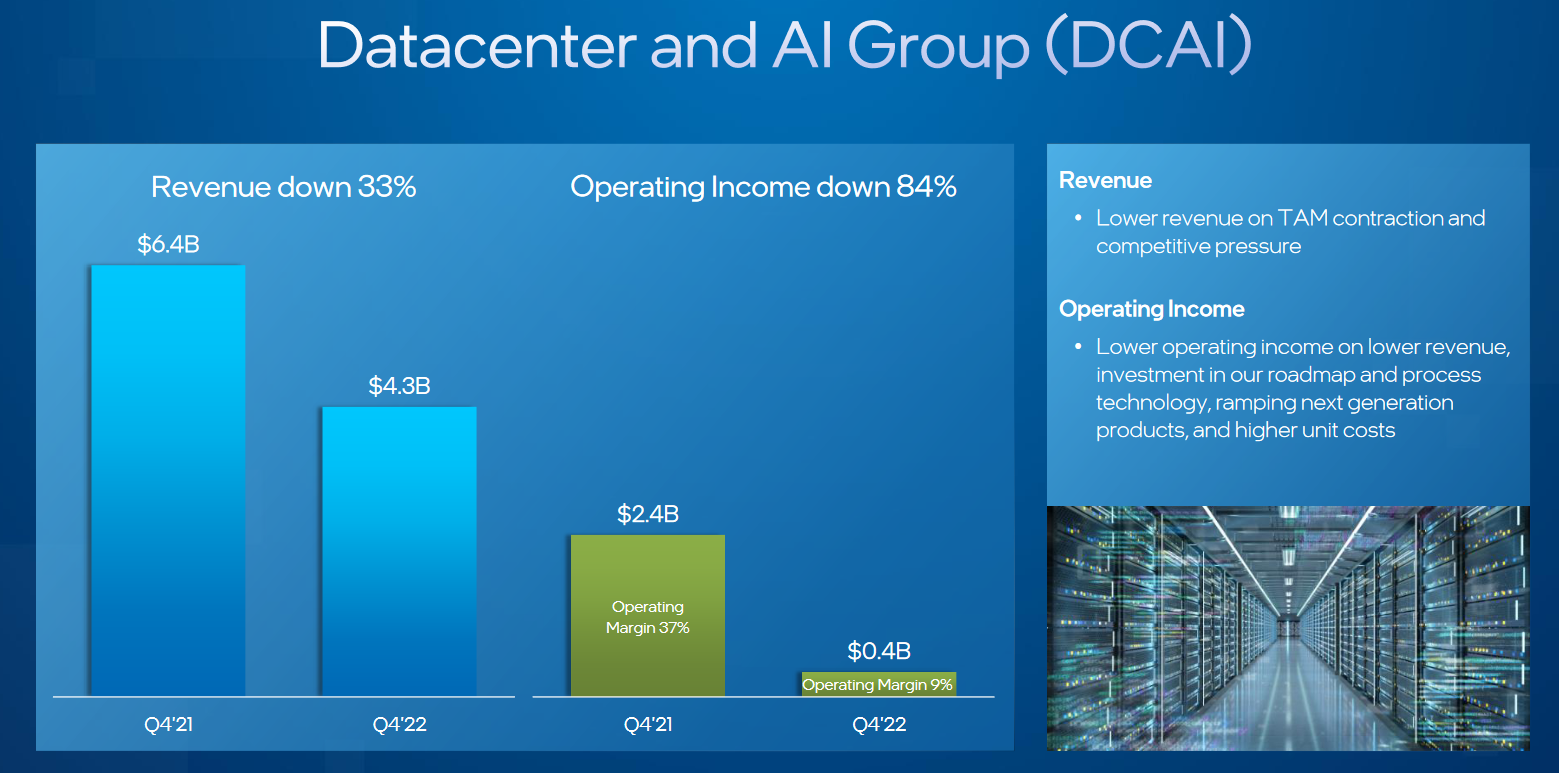

Operating income for Intel's data centre segment plummeted 84% in the last quarter of the year (versus Q4 2021) – as revenue for the segment fell $2.9 billion however: “While all segments have weakened, enterprise and rest of world, especially China, continues to be weaker than hyperscale” said Intel’s CEO Pat Gelsinger.

He added: “However, we'd highlight that the correction in enterprise and rest of the world, where we have stronger positions, are further along than hyperscale” – emphasising in an analyst Q&A: “We are a touch optimistic that China will come back and enterprise will come back more rapidly than the cloud.”

Intel losses: "We lost share, we lost momentum"

Challenged by analysts on how Intel could regain falling market share in the data centre sector, CEO Pat Gelsinger said: “Our customers were anxious for a great product from Intel. Obviously, we would have liked it to be earlier… but we are now shipping a very high-quality product [Sapphire Rapids, shipping January 10].”

He added: “We realize that we stumble, right? We lost share. We lost momentum."

Among other cost savings measures, effective January 2023, Intel increased the estimated useful life of certain production machinery and equipment from five years to eight years: "We have identified nine different subcategories for operational improvement that our teams will aggressively pursue" Gelsinger added on an earnings call.

“We think [the market] stabilises this year, and we're going to be building a road map that allows us to regain leadership for the long term in this critical market” Gelsinger said. (Intel's full earnings presentation is here.)

He claimed early traction on the Sapphire Rapids fourth generation of Xeon chips is strong, saying Intel was "on track to ship one million units by mid-year” -- and that the company is on track

with autonomous driving technology segment MobileEye a key bright spot for Intel after a tough quarter. Mobileye increased revenue by almost 60% year-on-year in Q4: "Calendar year 2022 design wins, including supervision, are projected to generate future revenue of approximately $6.7 billion across 64 million units" said Intel CFO David Zinsner, adding "full year revenue of $1.9 billion was also a record for Mobileye, growing 35% year-over-year. Fourth quarter operating income of $210 million represents 71% growth."

Intel CFO Zinsner concluded: "We're a high fixed cost model. So we suffer the consequence of that, obviously, when revenue is declining, but we also get the benefit when revenue is expanding.

"What is currently a headwind does turn to a tailwind as the business recovers."