It's not been an easy year for Intel. So a positive market reaction to mixed earnings announced last week Thursday may have lifted spirits at the chipmaker.

Sadly, the moment was to be brief. The very next morning, Intel was booted out of the Dow Jones and Nvidia took its much-coveted spot, sending its share price scuttling back into the bad place it's occupied throughout 2024. The gloom had resumed.

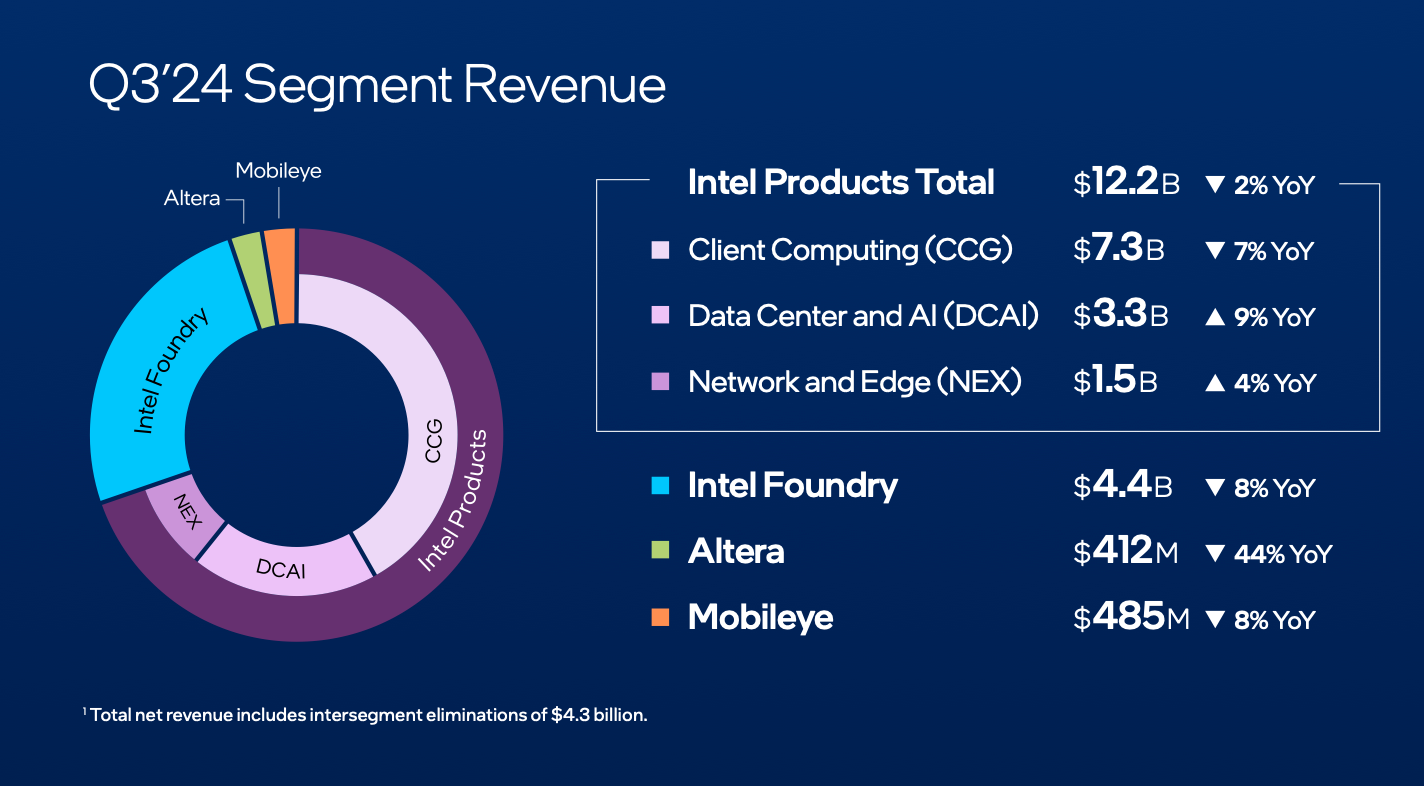

Intel’s Q3 2024 earnings were a mixed bag, revealing above-midpoint revenue of $13.3 billion and reductions in capex, headcount and operating expenses. They were certainly better than the bloodbath of the previous quarter, which announced 15,000 job cuts, suspended dividends and sent its stock into a nosedive.

Investors were buoyed by news that data centre and AI revenue had beaten analyst expectations, soaring by a third of a billion dollars on the previous quarter to $3.35 billion. They were also lifted by CEO Pat Gelsinger's report that foundry customers are showing "strong interest" in Intel's upcoming 18A chip, which uses RibbonFet, its version of a Gate-all-around (GAA) transistor architecture the company described as its "biggest innovation" since it introduced FinFETs to high volume manufacturing in 2011.

Capex for 2024 is now expected to drop to $25 billion for the year and then further to as low as $20 billion in 2025 - a stark contrast to the huge $75 billion AWS announced for 2024 last week.

In an earnings call, Gelsinger said the company was taking "aggressive actions" to " lower our cost, improve our efficiency, and enhance our market competitiveness".

"First, we completed the vast majority of our head count actions during Q3 and we are on track to our greater than 15% workforce reduction before the end of the year," he said. "These were hard but necessary changes that are reducing complexity and making us a leaner, faster and more agile company. Second, we have reduced our capital expenditures by over 20% relative to the plan we had entering the year."

He added: "Our stepped-up focus on efficiency and execution across the business is having a positive impact. We have a lot more ahead and we are acting with urgency to deliver on our priorities. We need to fight for every inch and execute better than ever before, and our teams are embracing this mindset as we build a leaner, more profitable Intel."

Intel is now "maniacally focused" on fab efficiency, allowing it to "produce more with less over time", and is working to "implify and streamline parts of our portfolio to unlock efficiencies and create value" by "reestablishing product portfolio leadership". The company is also narrowing its focus to push forward fewer projects so that its " top priority" is the maximisation of the value of its x86 franchise across the edge, client and data centre markets.

After a brief stock rally following the results last Thursday, Intel's share price then tanked when it was officially removed from the Dow Jones Industrial Average prior to trading on Friday. Meanwhile, Nvidia's headed skyward.

"The index changes were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector respectively," S&P Dow Jones Indices wrote. "The DJIA is a price weighted index, and thus persistently lower priced stocks have a minimal impact on the index."

Many famous companies have been kicked off the Dow, including Salesforce in 2020 and Cisco in 2009. General Electric was removed from the Dow twice in its early history - first in 1898, before rejoining the next year, and again in 1901 before returning in 1907. It remained a staple for over a century until it was replaced in 2018.