Intel is slashing 15,000 jobs, suspending dividends and cutting capex 20%.

Those were among the “hard but necessary” decisions by CEO Pat Gelsinger, after Intel posted a painful $1.6 billion loss in its second quarter.

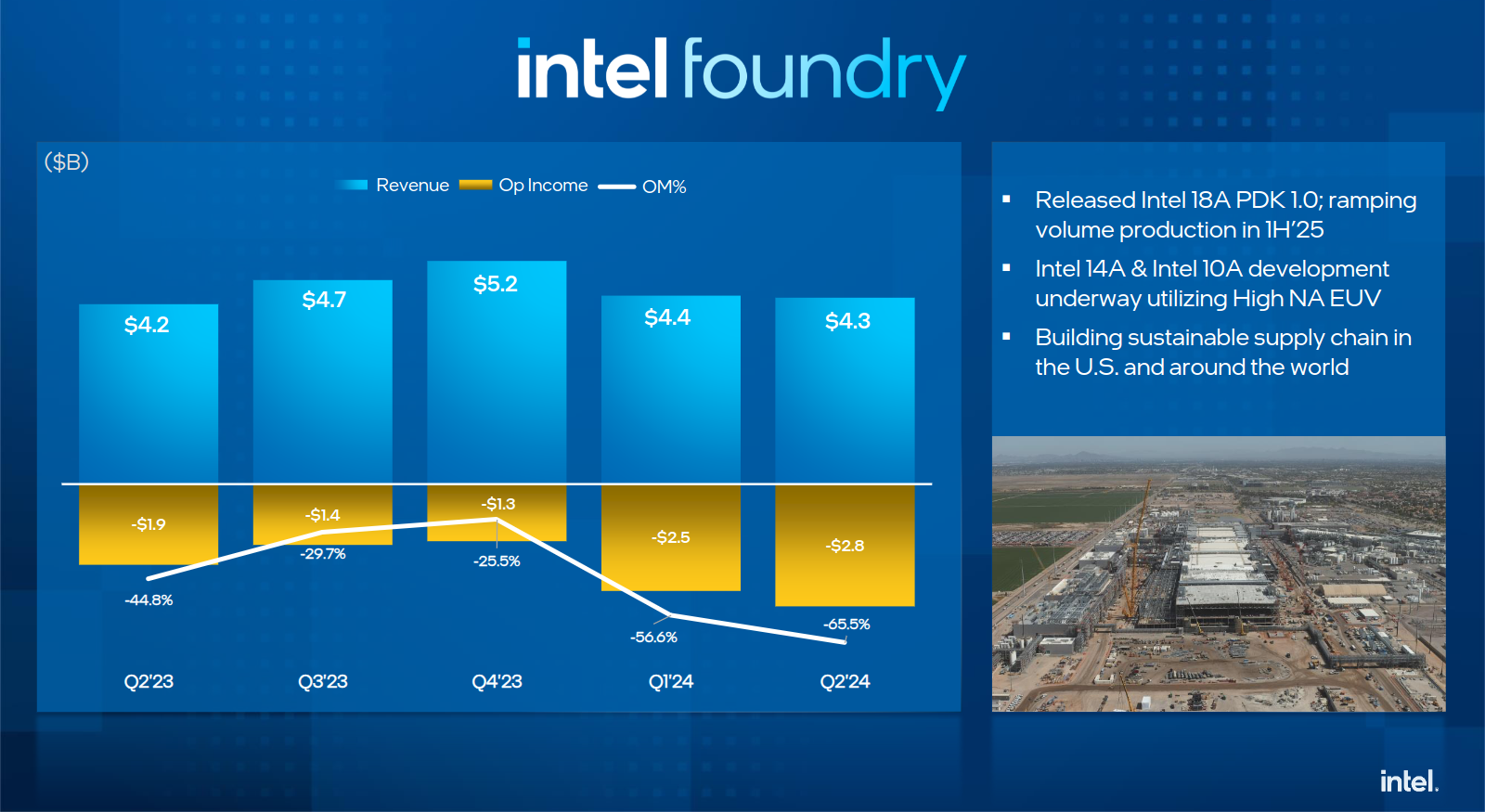

One of the largest rounds of layoffs in Intel’s history comes as its new foundry group and data centre segment divisions both struggled.

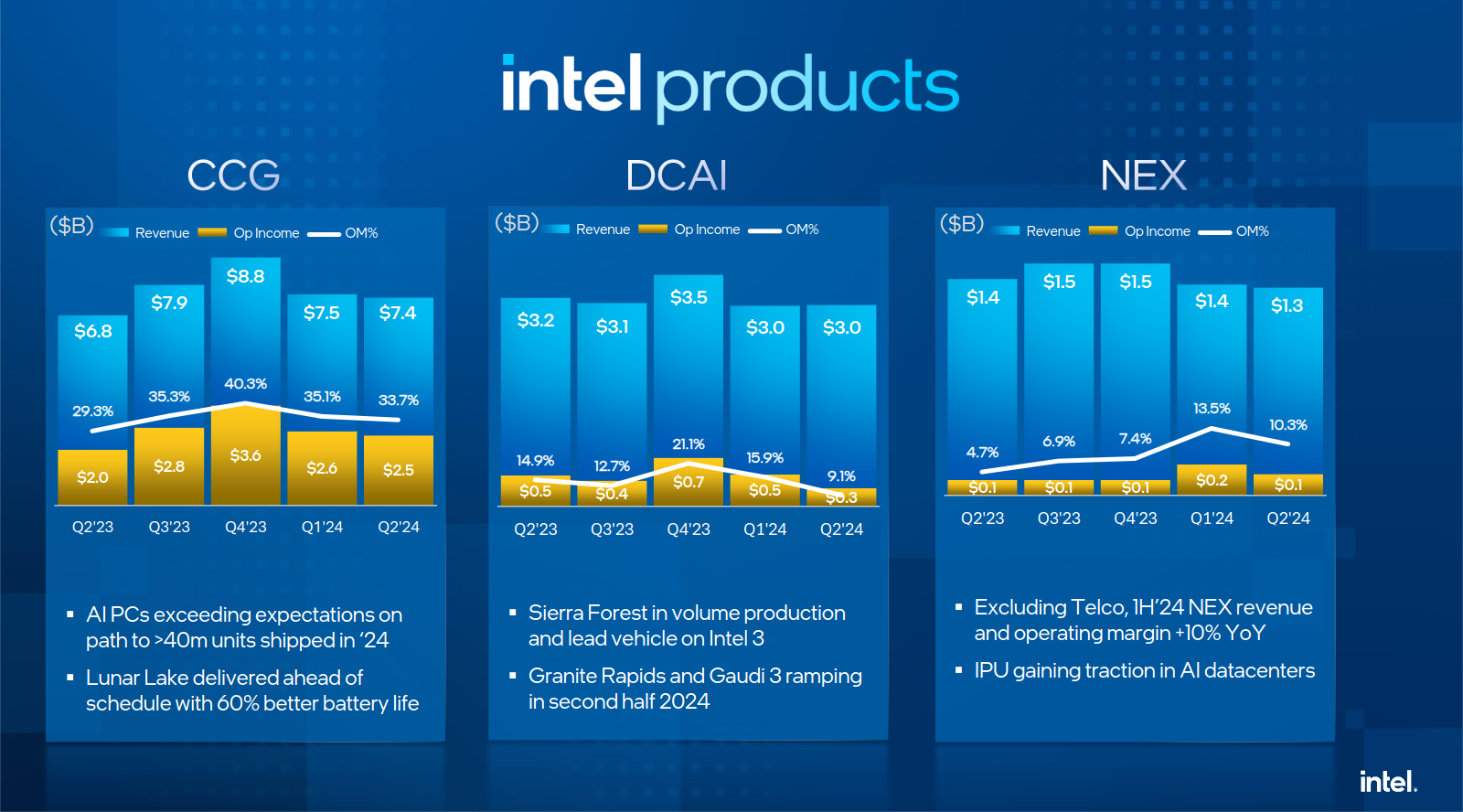

The former posted an operating loss of $2.8 billion and data centre segment’s revenues were down 3% to $3 billion. (Compare that with rival AMD’s 115% rise in Q2 data centre segment revenues, to $2.8 billion.)

At $25-$27 billion in 2024, Intel’s capex will be just 50% of Amazon’s and Microsoft’s – a sum that captures how much air has gone out of the chipmaker’s balloon as major buyers deliver their own custom silicon.

That’s despite what Intel CFO David Zinsner described on the call as “$11.5 billion in grants and partner contributions”

The quarter was so dire that on an earnings call the very first question was “I'm just wondering, have the core issues been accurately diagnosed?”

Join peers following The Stack on LinkedIn

“We are taking the avid step of suspending the dividend at the beginning of the fourth quarter, recognizing the importance of prioritizing liquidity to support the investments needed to execute our strategy” Gelsinger said.

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones” Intel’s CEO added this week.

On a more upbeat note: Intel says its “Gaudi 3” accelerator will ship in Q3.

“We expect Gaudi 3 to deliver roughly 2x performance per dollar in both inference and training versus [NVIDIA’s] H100” said Gelsinger this week.

These hardware accelerators are part of a line that Intel bought with Habana Labs and Intel is using them to bridge the gap to its promised release of a meaningful set of AMD and NVIDIA GPU rivals: Its “Falcon Shores” GPU (for late 2025) and “Falcon Shores 2” GPU for 2026. (In April Intel said it expects just $500 million in Gaudi accelerator sales in 2024)

Gelsinger, referring to a major ongoing turnaround effort, said: “Our team is resolute and determined to finish what we started. Our investments in a global footprint of leading edge capacity continues to weigh on near-term profitability, but long term, they position us to profitably participate in the largest- and fastest-growing parts of the semiconductor market…”

Intel’s shift to a foundry model like Taiwan’s TSMC “uncovered a lot of things, a lot of inefficiencies, a lot of ways that we can drive our capital footprint more effectively” Gelsinger insisted. “Every aspect of that business is being analyzed; how we do maintenance, how we procure chemicals, how we run and price wafers… a clean sheet analysis.

“Similarly, on the product side, we've done exactly that same analysis.

"What does a world-class fabless company look like? And we uncovered quite a lot of areas where we don't leverage industry IPs. We're not using our EDA vendors as effectively. You know, we've done too many steppings… So, many of these things are steps that we're taking to be a world-class fabless company. And these are significant structural steps.”

Intel shifted a lot of production to external fabs as its own failed to keep pace with innovation: “Once we get beyond next year… the resurgence of our internal facilities to start taking on a lot of the capacity that we had to move into external sources should provide some meaningful improvement in terms of profitability” said Gelsinger during an analyst Q&A.

Markets were not appeased and shares fell to an eight-year low.