HSBC wrote-down $1.3 billion in software impairments in 2020, as the bank saw profits tumble 30% to $6.1 billion after tax in 2020. The multinational -- which has been stripping out legacy tech in a bid to cut costs and improve agility -- vowed, meanwhile, to "increase and accelerate our investments in technology".

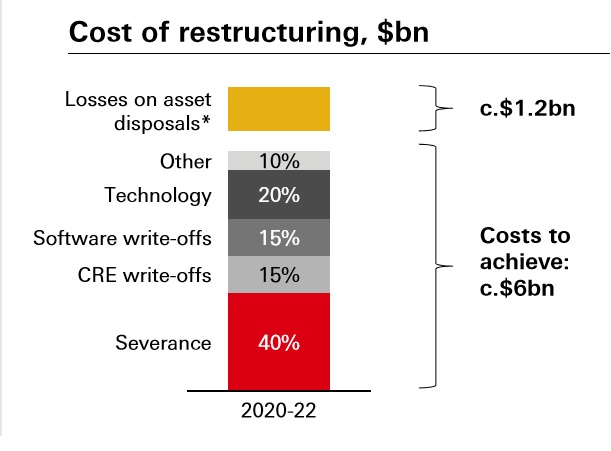

The findings came after the bank in early 2020 vowed to slash software costs $900 million (£691 million) by 2022 under a global restructuring; a process which it said would see it trim existing IT costs by $1.2 billion.

It did not provide further details about the precise nature of the $1.3 billion software impairment -- revealed in today's annual report -- other than to say it was "primarily relating to businesses within HSBC Bank plc, our non-ring-fenced bank in Europe, reflecting underperformance and a deterioration in the future forecasts."

The multinational is working aggressively to shrug off as much legacy software as possible. In July 2020 it signed a long-term deal with AWS to "drive innovation, automate key processes, and enhance operational efficiency across a range of personal financial services".

The contract will see it tap cloud-based compute, containers, storage, database, analytics, machine learning, and security, among other tools.

Adjusted operating expenses meanwhile were down 3% to $31.5 billion during 2020, with the bank ending the year with total assets of $2.9 trillion. It plans to continue to boost an already significant IT and digitalisation budget further even as it trims costs elsewhere, executives said.

"We intend to increase the pace at which we digitise HSBC through higher levels of technology investment", said CEO Noel Quinn: "This underpins everything that we want to achieve. It is how we intend to win new customers and retain them, to become more agile and efficient, to create richer, seamless customer journeys, and to build strong and innovative partnerships that deliver excellent benefits for our customers.

"We have an opportunity to meet the growing market need for sophisticated, robust and rapid payment solutions, and to lead our industry in applying digital solutions to analogue services, such as trade. We therefore intend to protect technology investment throughout the cycle, even as we reduce spending elsewhere."

The annual report provided a snapshot of the huge scale of the bank's response to the Covid-19 outbreak, with it having to deliver laptops, desktops or virtual desktop infrastructure to over 78,000 staff.

"We continue to invest in transforming how software solutions are developed, delivered and maintained," the bank added in its annual report, released today, saying it will "concentrate on improving system resilience and service continuity testing. We have enhanced the security features of our software development life cycle and improved our testing processes and tools. We upgraded many of our IT systems, simplified our service provision and replaced older IT infrastructure and applications. These enhancements led to continued global improvements in service availability during 2020 for both our customers and employees."