Goldman Sachs is embarking on a restructuring that puts a new “Platform Solutions” technology business at the heart of its offering and rolls its retail banking operations into wealth management -- with CEO David Solomon saying he wants to "build modern digital products and in the process, diversify our revenues and funding mix”.

The move is a tacit acknowledgement that a consumer focus has failed to meaningfully pay off in the wake of 2016's launch of its retail bank Marcus -- "it doesn't make money at the moment. I'm not going to go further than that" Solomon told analysts, explaining the Goldman Sachs restructuring on a Q3 earnings call late Wednesday.

The Goldman Sachs restructuring comes as the firm reported a 43% fall in net income; notably steeper than an equivalent 17% fall at JPMorgan, 25% fall at Citi, and 29% fall at Morgan Stanley during the same quarter – and emphasises the extent to which technology continues to drive significant disruption in the banking sector.

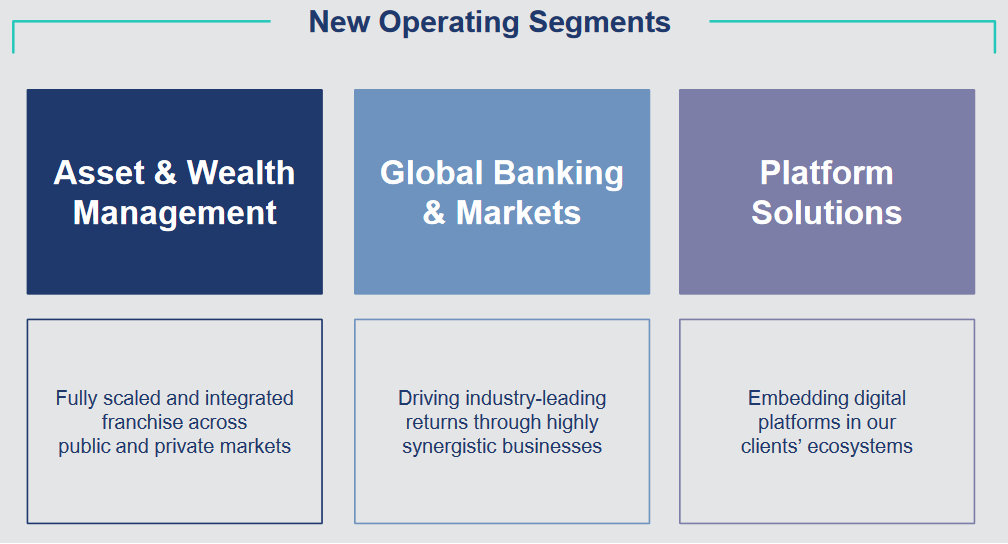

The bank will now operate as three primary units, as it moves to integrate its Asset and Wealth Management businesses (making its direct-to-consumer activities like retail banking part of Wealth Management as part of that restructuring), as well as combining its Investment Banking and Global Markets businesses into one unit.

Goldman Sachs restructuring puts BaaS, SaaS at heart of its offering

The new Goldman Sachs Platform Solutions unit will consolidate firm-wide fintech platforms and initiatives.

CEO David Solomon described it on the earnings call as an “end-to-end primarily cloud-based technology platform business that embeds our best-in-class financial products and services into our clients' ecosystems”.

He added: “This segment will enhance our focus on building platforms that deliver digital financial services capabilities to corporate and institutional clients” -- using Goldman’s Transaction Banking platform (“a differentiated developer-centric cloud-based product”) as one example of successes he'd like to replicate.

The move is, regardless, a striking one given existing "Platform Solutions" or technology services that Goldman Sachs monetises ultimately account for what Solomon freely admitted were less than 5% of current revenues.

In the Goldman engine room old school, open source rub shoulders

Transaction banking spans cash management, corporate payments, liquidity management, and trade finance.

Goldman Sachs built GS Transaction Banking in 2020 entirely on AWS-based services and offers it as Banking-as-a-Service (BaaS) to clients via a self-serve web interface. Whist it has been described by Amazon as "built from scratch" it was done so using building blocks that include a range of SaaS services from third-parties. (The payments component of GS Transaction Banking for example, is provided by cloud-native SaaS provider Volante.)

Goldman Sachs technology innovations

Goldman Sachs has both bought and built extensive technology platforms in recent years. Acquisitions this year include GreenSky, the world's largest fintech platform for home improvement consumer loan originations, for $2.2 billion in March 2022 and Dutch asset manager NNIP (which has built some powerful data-gathering and processing tools that harness neural networks to power ESG analysis) in a deal that closed in April 2022.

Other homegrown technology platforms include Legend, an open source data platform that includes a user interface to collaboratively express data models and a query generation capability with connectivity to commonly used data stores -- this lets users "navigate data models and create complex queries and REST APIs without having to worry about database connectivity or writing SQL" as Goldman engineers detailed in depth last month.

Despite these innovations, some analysts were left openly confused on the call both by the pivot to monetising technology offerings in an already saturated fintech world and by the change of heart on retail.

As Wells Fargo Securities analyst Mike Mayo put it quizzically on the Q3 call: "For the last 150 years, your strength has been serving your corporate relationships, investment banking. That's your legacy, too, the strength there.

"When I'm looking at this third division, Platform Solutions, the first two divisions are based on how you address the clients based on distribution, 'One Goldman Sachs' -- whereas the third division, Platform Solution, seems to be based on how you manufacture solutions. So that just seems like a little disconnected."

Solomon said: "It's very generous of you to account 150 years of history, but I'd just highlight the firm looked very different in the 1860s than it looked in the 1920s, than it looked in the 1960s... Of course, our Investment Banking and markets business... will continue to be core to who we are... But we also have 11,000 engineers here, and we're doing some very, very interesting things as the world is changing and the world is evolving with technology. What Platform Solutions represents is a handful of smaller business opportunities relative to the scale of Goldman Sachs that we're investing in where we think we have a capability to serve our clients... It's still small relative to Goldman Sachs. It's less than 5%, but we think it's an opportunity worth investing into as we continue to broaden the scope and scale of what Goldman Sachs can do for our clients."

The firm is not tearing up Marcus nor abandoning consumer offerings as part of the Goldman Sachs restructuring, Solomon emphasised: "For our direct-to-consumer strategy, we will focus on existing deposit customers and consumers that we already have access to through channels like Workplace and Personal Wealth rather than seeking to acquire customers on a mass scale... Our Marcus deposit customers remain core to our broader efforts. I'm very proud of the team in our Consumer business... the growth from zero to over $110 billion of deposits over the last six years, we have 15 million customers on the platform. I think we have a very unique credit card technology that's differentiated. We have a couple of extraordinary partnerships. We have some very good things, but one of the things I think we've learned is that the ability to scale that, and attract customers, and the direct-to-consumer business needs to be focused in a more directed way.

"So we're focusing it by aligning it with our Wealth business where we have access to millions of people. And so I still see a terrific opportunity to take what a really, really interesting digital products and in being aligned with our Wealth business, provide those products and services to clients and customers at Goldman Sachs."