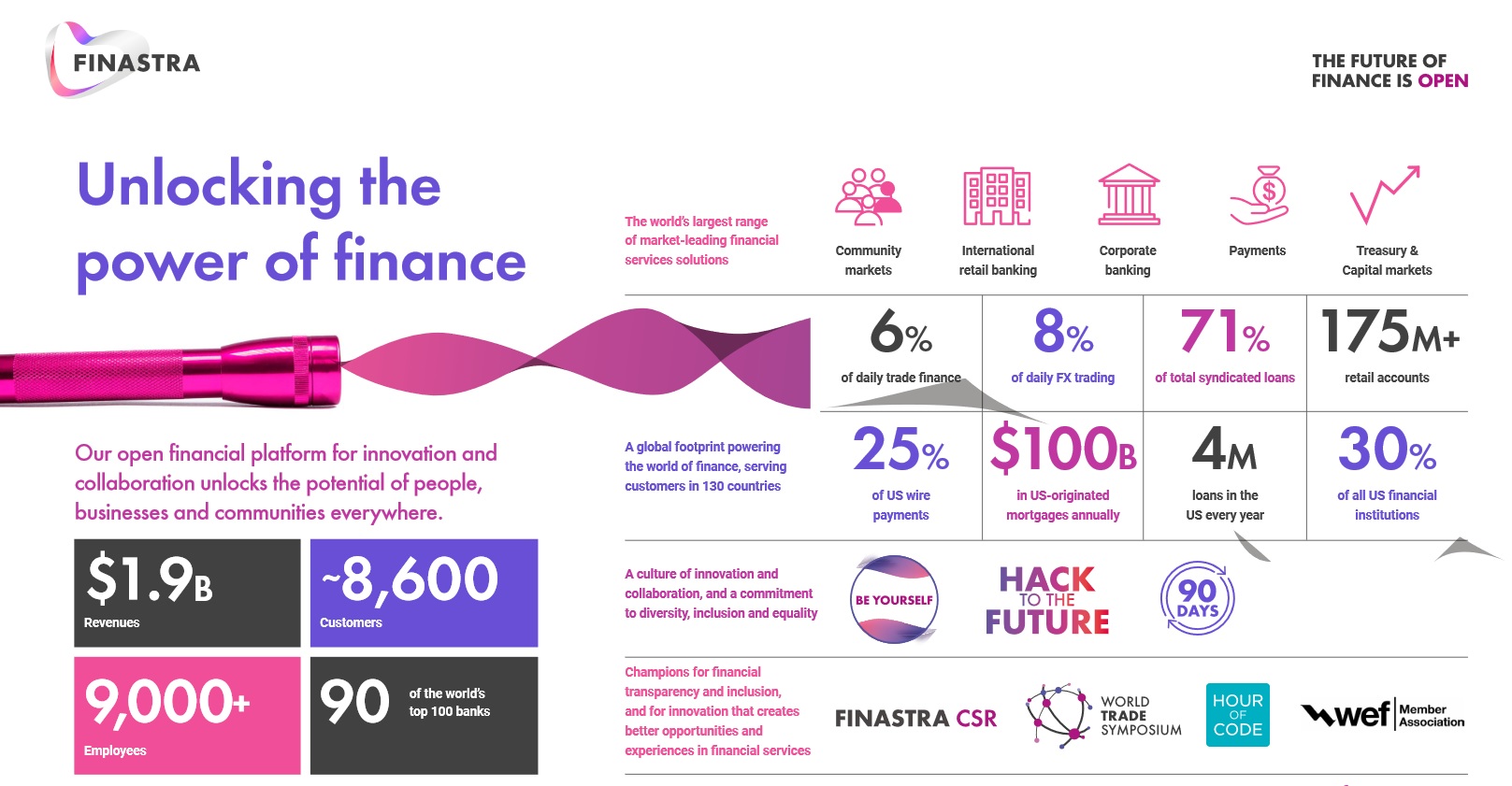

Finastra, formed in 2017 by the combination of Misys and D+H, is the largest pure-play software vendor that serves the entire financial service industry – with over 8,600 customers, including 90 of the world’s top 100 banks. As a snapshot of its footprint, the London-headquartered multinational settles 71% of all syndicated loans globally, provides infrastructure to support 175 million retail accounts, and powers some 25% of all US wire payments.

Take a look at its Wikipedia entry however, and you’ll see the word “legacy” heavily in the crowd-sourced entry. Three years ago, that might have been fair. The entire underlying infrastructure of most financial services institutions goes back decades and Finastra has traditionally supported most of it, from settlements to treasury to cross-border transactions, via cash management or any other of its portfolio of services.

From 2018 under new CEO Simon Paris, however, Finastra’s been aggressively streamlining its portfolio and redefining its vision – as banks and other financial services institutions around the world rethink their operating models, underlying technological dependencies, and eye fresh forms of revenues. (Something that would have put a company staying still at risk of losing rapidly innovating customers.)

The market’s changing fast: most customers, as Finastra Chief Product and Technology Officer (CPTO) Eli Rosner notes in an interview with The Stack, want to turn cost centres into profit centres. They want to get significantly more creative in the services they provide and how they provide them, and they are open to new channels.

To meet their needs, Finastra has had to innovate hard itself, swapping out its own underlying IT infrastructure for a microservices, multitenant and containerised stack, streamlining its offering down to 17 core products and services – “two years from now, all 17 of these will be between 70 to 100%, fully cloud native” Rosner says – and introducing an entirely new platform dubbed FusionFabric.cloud built around open APIs.

The release opens up certain core systems and services of Finastra across retail banking, payments, lending, corporate banking and treasury & capital markets via open, RESTful APIs. Services available via FusionFabric.cloud for capital markets customers, for example, include Vector Risk (cloud-based automation of credit and market risk calculations in the trading book); and for retail banking customers Cybernance, a fully hosted SaaS application that provides an automated framework for cybersecurity management and reporting.

As Rosner puts it: “FusionFabric.cloud has three main components: 1) a developer portal, 2) a runtime environment, and 3) an App Store. The developer portal exposes the capabilities of all the core systems, we have invested millions of dollars to expose them through a standard RESTful API -- so now we've opened one side of the network. And on the other side of the network, we enable fintechs, SIs, banks, anybody who wants to leverage those APIs to access the core solutions of others that want to do that. So essentially, we enabled open banking by opening our solutions and participating in the financial ecosystem.

“Lately, we've become players in Banking-as-a-Service, where we enable our customers to be providers of Banking-as-a-Service, and embed finance capabilities into the customer journey of brands. For example, we have a project with Seattle Bank, where the bank is a provider to [mobile banking app] Google Plex, around open accounts, open deposits, lending; a little bit of payment, and we are the fabric that makes the thing click. The next generation of our transformation is really to become an orchestrator of open finance.”

As CPTO, Eli Rosner heads up a team of around 4,000. His remit is broad, “from inception of innovation, ideation, understanding the market, managing the portfolio, defining what we're going to deliver, where, to who, the persona, the channel, the pricing, the value prop, the actual development and operations” and spans product strategy, product management, and the “whole development lifecycle of actually developing the code with software engineers, QA engineers… we practice Agile and SAFE (Scaled Agile Framework for the Enterprise) – as well as overseeing the operations of the data centre of some of our SaaS solutions.”

The new, more open and containerised product strategy has opened up opportunities for both Finastra and its customers, as the fintech positions itself less as a provider of fixed services and more as a flexible platform of open services that allows it to function as a useful hub for its own customers to interact.

As Finastra CPTO Eli Rosner tells The Stack: “Several banks are coming to us and saying, ‘listen, we acquired cash management software from you… [now] we would like to be the providers of cash management-as-a-service in our whole region; we have 50 other banks in the region, but we want to be the provider.’

“We have another major credit card provider that says, ‘listen, we have a network to augment Swift. But instead of [individually] integrating with each of the banks to move money, since you have many thousands of banks on your platform connected to FusionFabric.cloud, why don't we do a one-to-one integration between our network and your platform; and then all the banks that you have could become our customers?’

“Finastra is a very attractive asset to talk to those companies simply because we have so many customers. So essentially by integrating once with us, they get a go-to-market channel that they didn't have before. Instead of doing one-to-one, point-to-point integrations, they do one-to-many.”

What kind of pressures has that put on Finastra’s own internal systems?

As Rosner notes: “In 2002 Jeff Bezos famously wrote an email saying ‘All teams will henceforth expose their data and functionality through service interfaces.’ He also wrote: ‘Anyone who doesn’t do this will be fired.' I’m not Jeff Bezos and I didn’t write an email like that, but what we’re doing with Finastra is similar: the APIs we’ve developed for external use, we use internally, so they are well integrated.

"We've also developed a complete data pipeline [delivered via a combination of Azure and DataBricks tools], all the way from acquiring data, ingesting data, cleaning the data, updating the data in real time… So if you’re a bank the developer goes to our developer portal, there’s a data API; they see the CSV, they see the schema, they say ‘I want to use this data’; the bank permits it, a sandbox is created, data is copied, they develop an algo, and give it to the bank…”

As he notes: “We defined a six-step journey modernizing our products and migrating them to the cloud, that is essentially over time ‘hollowing the core’ little by little. First of all it is making an SOA architecture, then it’s about attacking it from the outside in in terms of user experience; then it’s making sure that the data tier can be multi-tenant. And those steps are not mutually exclusive. But the main takeaway is don’t go for a ‘big bang’ approach."

“Banks,” he adds emphatically, “do not want to run systems in parallel.”

“They’ve told us that very clearly. If you leave the legacy system there and build the new one then run it in parallel, it makes you lazy – and running two systems gets very expensive.”

Finastra CPTO Eli Rosner on tackling algorithmic bias: "This is real, we're investing a lot of money in this"

Yet Rosner’s team and Finastra haven’t just been chewing over architectural questions.

The financial services world is more algorithm-powered than ever and, as no shortage of observers have noted, increasingly is at risk of baking bias into boxes that will go largely unseen and unchallenged.

Finastra’s keen to tackle the problem head-on, earlier this year commissioning KPMG to prepare a 33-page report on the risks of algorithmic bias in financial services.

(As the report notes crisply, “in simple terms, algorithms are a set of mathematical instructions that enable computers to complete a specific task, for example, pricing an insurance policy. They span a continuum of complexity, from simple rules-based approaches through to algorithms that learn with greater autonomy… Biases can manifest themselves within data being used in the algorithm, in the way an algorithm is designed, and even in how the algorithm is used; i.e. in interpretation of the results by a human).

Algorithms are being used to make direct decisions on customers based on their data, in turn impacting customers’ choices and behaviour. The KPMG/Finastra report specifically explores two key use cases – credit scoring and decisioning (consumer finance), and automated pricing (insurance) – to emphasise the risks of bias. It’s a report that resulted in delivery of a “five-point plan” at Finastra to tackle the threat.

These included: 1) Updating its developer terms for FusionFabric.cloud to demand developers and partners account for algorithmic bias, with Finastra given the right to inspect for this bias within any new application; 2) Creating new proof of concept technologies: such as FinEqual, a digital tool (currently a proof-of-concept that is undergoing testing) that aims to enable bias-free lending by Finastra’s financial services customers; 3) The launch of a global hacking competition that aims to find and celebrate female-led teams pushing the boundaries of AI and machine learning; 4) A push to increase women amongst its top 200 leaders and engineers from 30% to 40% by 2025 and to 50% by 2030; and 5) To work closely with regulators on the issue.

Rosner tells The Stack: “We felt strongly that as data is a core part of our future strategy, we have the responsibility to invest in removing bias. In the last year, with the volumes of loans [passing through Finastra’s systems] increasing, that came to light even more strongly as an issue – with credit risk, and risk rating, and interest rate determinations based on who you are, where you come from, etc. we're investing in a set of tools that can audit our own products for algorithmic bias. This is not a game for us.

“This is real, we're investing a lot of money in this. We’ve hand-picked a diverse, collective ‘SWAT team’ to make sure there’s no case of ‘junk in, junk out’. There’s a lot of development going into this issue.”