Veterans of the never-ending wave of technological innovation tend to be sceptical of its promises, but speaking amid a torrent of hype and media attention for ChatGPT, it’s fair to say that Shuki Licht is all in.

Licht is the Chief Innovation Officer of Finastra, one of the largest financial technology software firms in the world and when I ask him if he is as excited as some about it, his answer is effusive, writes Martin Veitch.

“I’ve been in this [industry] for decades now, so I can appreciate it and I’m in the optimistic end,” he says.

“We are absolutely in at the beginning of the next technology wave in AI -- and ChatGPT makes it something that is very visible and accessible to anyone in the world" he says.

(Licht is speaking as Finastra has started incorporated virtual banking assistant technology into its Fusion Digital Banking platform, for "AI-driven digital experiences at cloud scale"; a capability that builds on a recent partnership with startup Clinc and which will extend the latter's chatbot to hundreds of banks using Finastra.)

London-headquartered Finastra is a fintech that provides the apps behind financial institutions and the marketplaces that act as hubs for fintechs, banks and others to collaborate.

Created in 2017 by PE firm Vista Equity Partners by combining Misys and Canadian firm, D+H, Finastra’s portfolio of software and services includes a universal banking unit that a recent Reuters report suggested could sell for about $7 billion. (Finastra said it “doesn’t comment on market speculation”) and the fintech supports over 8,600 institutions, including a claimed 90 of the world's top 100 banks.

Licht is the person responsible for leading Finastra’s technology vision.

He is a grizzled veteran with deep technology experience, having led NCR’s labs (a very early fintech, if you will) and worked at the software architecture sharp end of silicon giants Intel and Micron. But he sounds positively giddy about the rapid advances being made in AI and large language models such as ChatGPT.

Finastra CIO: The AI revolution is here

“It doesn’t matter how complex your question is or if you have bad English, it always has the right context for your question,” he says of the latter. “The revolution is here and I’m super-optimistic.”

For Licht, AI represents a sort of third big wave if we think of client/server then cloud being the first two, and he foresees it being built into a broad array of use cases: “I believe everything will be automated and a lot of things we are doing today, we will not be doing any more,” he says.

See also: Credit Suisse seeks salvation in digital transformation

Two examples: parsing case workloads with hundreds of pages of documents for review would usually take three days but that becomes a few seconds with AI, and at very high quality he suggests.

In the next generation, Licht says that AI models will not just review, but create such documents after having been trained to generate them with all necessary needs and concepts baked in.

Prime-mover advantage

However, he doesn’t necessarily buy the idea that AI will provide the sorts of democratisation to digital that cloud brought with it. For now, he says, the realms of compute power to create large language models will be concentrated in the hands of an elite few. “You’d need to be Microsoft, Google or someone else in hyperscale … it’s super, super expensive,” he says, but adds that a new stage will be see more API-level access and eventually ‘as a service’-type options.

“We are not there to replace the human being,” he says. “Although we are very close to intelligence of a human being, we are still behind it and we still need collaboration between the computer and the human results.”

Licht is also very much aware the sheer scale of the job ahead, notably in removing the biases that lie within data that has been collected over the years. In the financial sector where Finastra sits, he also sees AI having a major effect in key areas such as information security and anti-money laundering: “Five years ago, in most of the fraud solutions we saw, it was fraud prediction based on very basic statistical data, Machine Learning and anomaly detection. And it would raise a flag based on historical patterns..."

Instead AI is increasingly allow banks to spot previously unseen patterns of transactions or network anomalies; something that can potentially allow AML teams for example to be enterprise enablers rather than just introducers of friction, driving efficiencies and leaner processes.

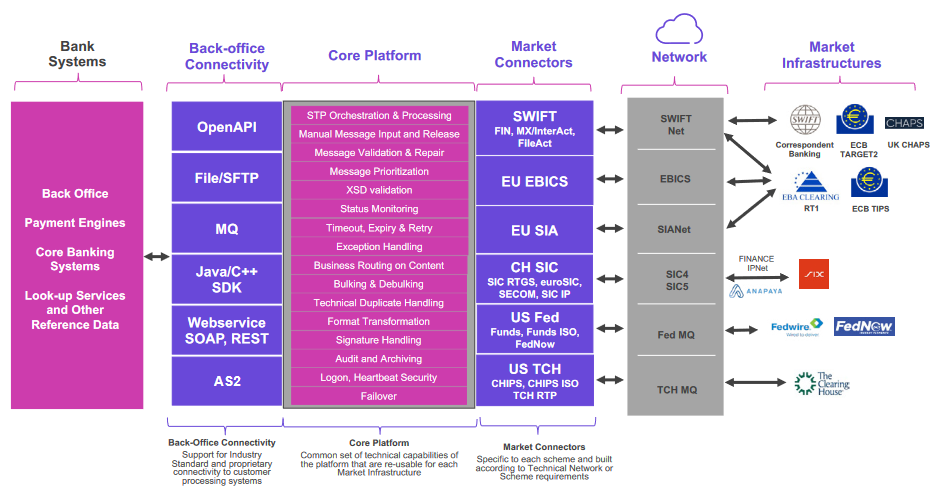

Finastra's Fusion Total Messaging platform for example (a financial messaging platform that provides a gateway and workflow engine for market infrastructure, instant payment and payment service provider (PSP) connectivity) is using machine learning that lets financial institutions read SWIFT and other payment messages (e.g., SIC, euroSIC) to identify anomalous fraudulent payment messages in real-time.

AI-related efforts ongoing at Finastra are widespread. They include areas such as financial product recommendation, mortgage process document summaries, detecting outliers in business metrics and benchmarking consumers.

As Licht has pointed out however, innovating using AI often requires thinking outside of traditional structures: As he earlier put it, "my experience is that if you are trying to innovate inside a traditional business unit, in most cases it will fail. The only way to really have success with emerging technology is to create your own platform and solutions..."