Whether you think of it as the future for businesses or a term that is now a cliché, companies have been and continue to implement digital transformation projects. The impact of the COVID-19 pandemic convinced potential stragglers to invest more in technology -- IDC has predicted that spending on digital transformation technology and services will grow to $3.4 trillion worldwide by 2026. However, for many finance teams, digital transformation is something that happened elsewhere, writes Nick Jewell, Technology Evangelist, Incorta.

While customer-facing products and services were redesigned and invigorated, internal systems run in the same way they always did. Ventana Research found that 9 out of 10 executives want finance as a strategic partner, but only a third of companies will have delivered this by 2026. The challenge now is how finance teams can keep up with the pace of the business.

To deliver on this, CFOs have to look at how their teams operate and what processes they have around data. This involves knowing the right questions to ask in the first place -- for many CFOs and their teams, they are not aware that there are better ways to achieve results, as they have always found that technology projects did not live up to expectations or deliver on their promises.

For IT teams, this is an opportunity to improve how they work with finance around data projects.

What has to change around finance

According to the 2023 CFO Agenda Report by Hackett Group, 75 percent of companies have a major finance initiative addressing digital transformation. However, the finance executives involved were not confident in their ability to meet business objectives. This lack of confidence included not having the right retention approach around skills and talent (60 percent), low confidence in how to turn data into actionable insights (57 percent), and an inability to make finance teams more agile (50 percent).

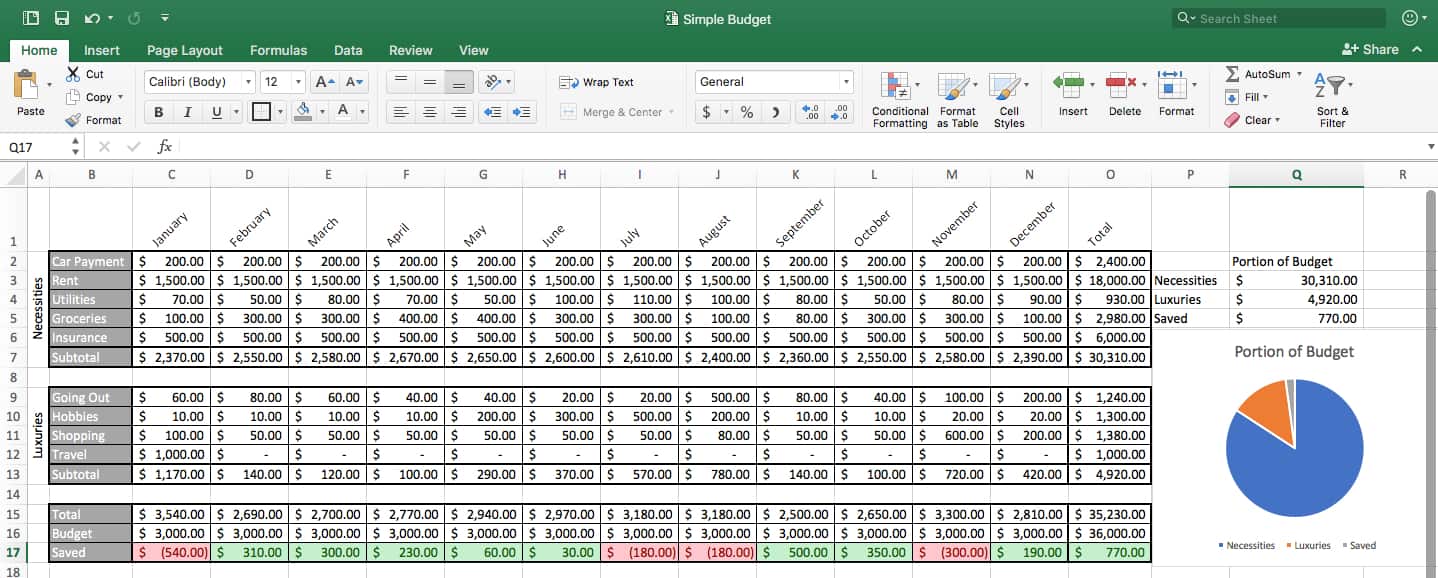

All of these problems are linked. For many finance professionals, their day involves sourcing data then pushing it through an arcane series of transformations powered by spreadsheets and manual manipulation. Each of these processes will rely on people getting all their steps right. As with all manual work, mistakes can slip in and cascade through the rest of the process. The result? At best, inaccurate data. At worst, inaccurate data, delivered slowly, that leads to bad decisions by the management team that affect overall company performance.

See also: AWS’s CEO missed an open goal on cost fears. It didn’t go unnoticed

These manual processes are designed to serve requirements around financial close and reporting, usually per month or per quarter. Digital transformation includes technologies that deliver real-time product recommendations for customers, or decisions on goods in their supply chain, and companies want to see the financial impact of these decisions. Yet they currently rely on reports for the month before in order to get an idea of any changes in demand.

In order to fit with these projects, CFOs and their teams will have to adopt a continuous finance model. Just as developers build using continuous integration/continuous deployment pipelines, so finance teams will need to get that continuous pipeline of data through from the company’s supply chain, operations and ERP systems to find out what is happening and then derive the right information around how these changes affect working capital and profit and loss.

This is a transformation exercise, with just as much potential for impact as digital transformation on business operations. The office of finance has to look at how teams work with data, find the potential problems that exist, and then re-architect processes to make them work more efficiently. For the IT team, this will mean more technology projects and more support on how to make things work. Across IT and finance, this involves looking at skills, attitudes towards data, and how to build acceptance for new ways of working.

Implementing new processes around data

One of the biggest issues is simply getting the data that they need in the first place. Rather than the well-ordered and structured data that developers and IT professionals are used to in databases, finance teams take multiple sets of data from across the business and massage it to make it suitable for analysis. With ERP data, this data is not simple but connected to multiple other applications and sources, so getting an accurate snapshot of where things are right now is harder.

Finance teams are used to this situation, and they are not aware that it can - indeed, should - be changed. For the teams working across financial planning and analytics (FP&A), crunching data in spreadsheets is natural for them as these tools act as a lowest common denominator. And because everybody works in spreadsheet files, the processes around those files become ossified and unable to change. The risk of making any changes outweighs the perceived value that could be delivered, and the deadlines around delivering financial close make it harder too.

However, the change in speed around digital operations will quickly lead to problems for finance teams. With this in mind, Gartner has predicted that 40 percent of all finance roles will be significantly affected by technology by 2025, and 80 percent of new headcount in finance will be for new roles rather than traditional FP&A ones. These roles will focus on how to use data more effectively.

For CFOs, this internal pressure to provide more detail in real time will go alongside more pressure on management teams around financial compliance. The Securities and Exchange Commission announced enhanced powers to claw back executive compensation in the event of financial misstatements, under Release No. 33-11126, in order to improve the quality of financial reporting. With CEOs and other executives now materially on the hook for the accuracy of their company financial reports, there will be more demand on the CFO for accurate data over and beyond what they currently supply.

Making the change

In order to make these changes, CFOs will have to look at their goals and how their teams operate. The aim here is to get beyond obligations around reporting, and look ahead at what they could achieve with faster processes and less manual work. Partly, this should set out what the initiative will deliver over time, but also create buy-in and inspire the team around what they could achieve in the future.

From a technology perspective, finance teams should look at how they can work with data more efficiently from multiple sources, rather than relying on their own manual transformations to get what they need. To get this, teams have to trust that the process giving them their data is accurate, as well as being as fresh as possible.

Rapid prototyping and involving the FP&A team in designing the process should convince them that this will work for them. This includes showing teams where data came from and where they can drill into the results. Being able to go into specific sub-ledgers that prove where those results are found is even better for establishing trust in that data.

Following on from this, CFOs can then look at how they can improve the use of data to answer more questions on financial status and ultimately business performance. When it takes seconds or minutes to run a query - rather than taking days to gather, filter, transform and process data manually - the kinds of questions that the team can ask will be different. There will also be more of them, as the increased efficiency and availability of a service makes it easier to consume and use, following the Jevons Paradox.

Putting this increase in productivity to good use can help the finance team spot opportunities to capture more value for the business, as well as optimising operations and business decisions. It also aligns with that Gartner prediction on new roles in the office of finance.

The future for data in the office of finance

For IT teams, this ability to answer “what if” questions using data has been a staple workload for data scientists for many years. For finance teams, the problem of getting data in the right format, in real time, or through legacy data pipelines has meant that they could only concentrate on specific areas and top-line KPIs like financial close and monthly reporting. In essence, they could only answer “what.”

Being able to deal with these data problems at speed to provide those necessary elements faster and more accurately will help the business. Freeing up time across the office of finance to investigate that data in a trustworthy and agile way will provide more opportunities for the future. With finance professionals looking at how to deliver financial transformation alongside the digital transformation taking place across the rest of the business, the opportunity is there to improve financial data delivery, optimisation for operations, and trust in data.