Back in February 2021 the Financial Conduct Authority (FCA) hired five high-powered women to lead a sweeping overhaul of its digital strategy, as the markets watchdog struggled to keep pace with the avalanche of data being generated by the 58,000+ financial firms it regulates -- every day the FCA pulls in 30 million transaction reports and 200 million order messages on market activity for 10,000 listed products and their derivatives.

BlackRock veteran Stephanie Cohen was appointed as COO with a mandate to improve operations and business performance, systems, infrastructure, and finances; former eBay senior finance and analytics director Jessica Rusu was made the FCA's first Chief Data, Information and Intelligence Officer (CDIIO); Sarah Pritchard was appointed Executive Director for Markets; Emily Shepperd hired as Executive Director, Authorisations; and Clare Cole appointed as Director of Market Oversight, to oversee the conduct of participants across the primary and secondary markets through the watchdog's listing, prospectus and market abuse regimes.

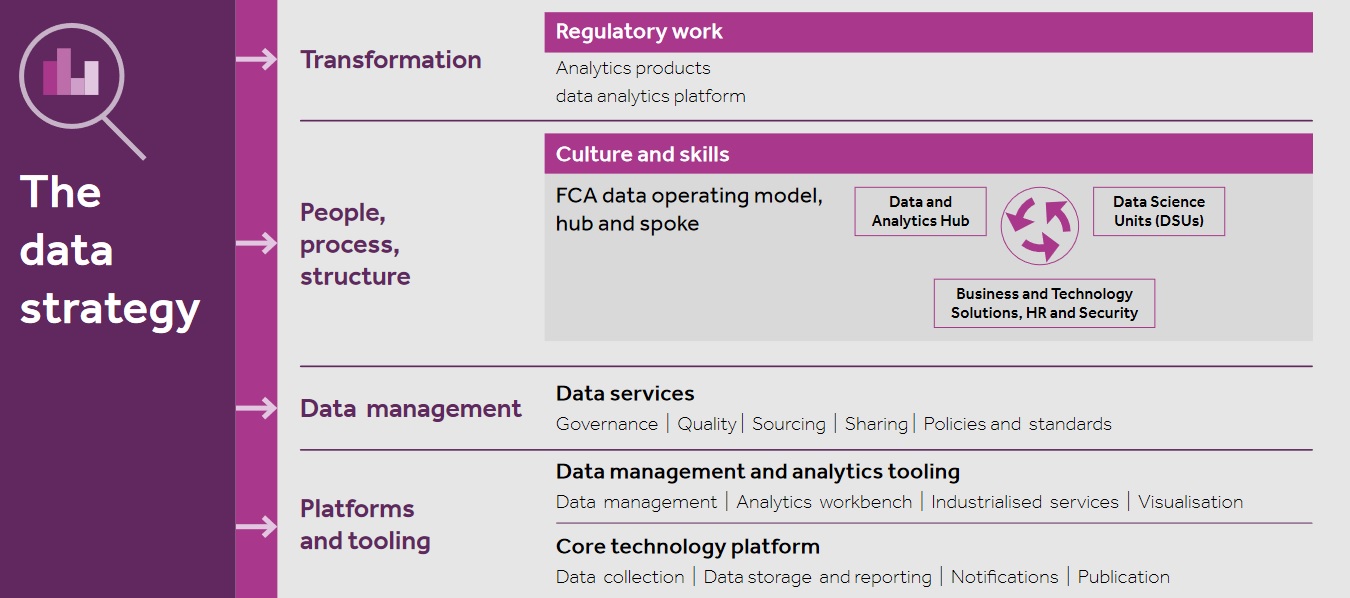

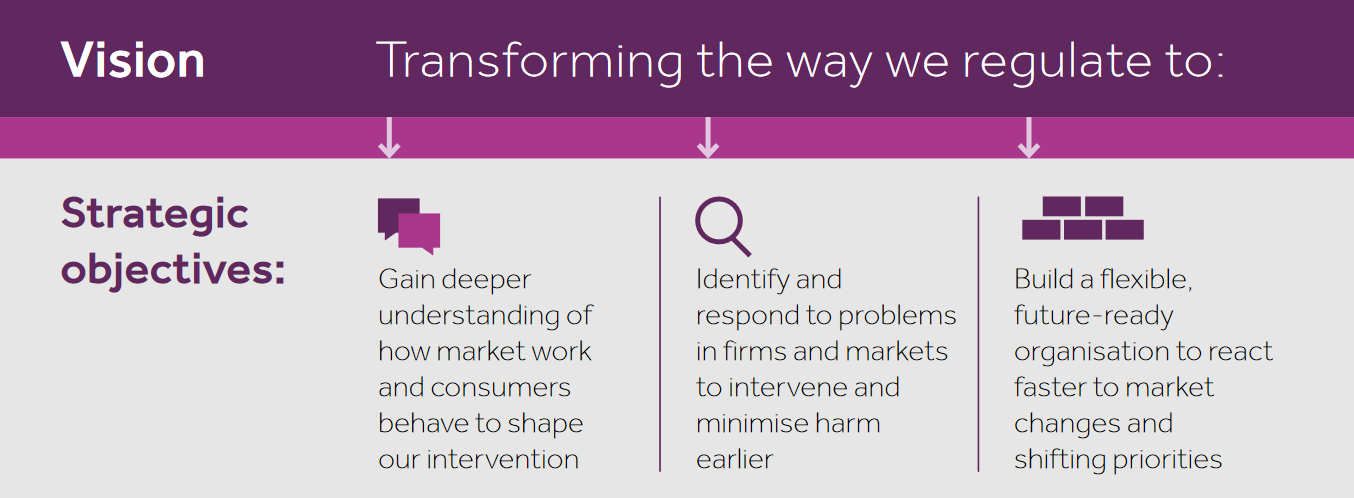

The leadership shakeup came as the FCA continues to work its way through a digital transformation that include an ambitious data strategy. The aim of the latter: improve the FCA's ability to simulate policy outcomes using automation and analysis; use advanced data analysis to identify where it needs to intervene; upgrade its ability to actively scan the activity of firms it regulates -- as well as analyse market infrastructure -- and ultimately publish rich FCA datasets that allow firms to simulate and test new products and business models.

FCA data strategy: watchdog to tap market

There's a chunky workload ahead for the FCA team. As FCA CEO Nikhil Rathi noted in a November 2020 speech, "we are also working closely with peer regulators around the world, many of whom are embarking on their own digital transformations. It’s fair to say that for all of us, there is a significant journey ahead."

(Federal Reserve Bank of New York is among those working to digitalise and improve their market surveillance tools: CIO Pamela Dyson told The Stack in late 2020 that the Fed has "a lot of custom-built legacy applications that we really want to modernise and move to more modern platforms." Read the interview here.)

Follow The Stack on LinkedIn

Among the near-term projects is procuring an upgraded "market surveillance software" system in August 2021, with the aim of bringing in tools that give the FCA more sophisticated insight into the "near real-time world of issues affecting listed companies", as it modernises its existing cloud-based infrastructure.

That's according to a May 5 public information notice, which highlights the FCA's challenges analysing 30 million transaction reports and 200 million order messages daily covering market activity on 10,000+ listed products and their asssociated derivatives.

Earlier public information point to pain points, highlighting that the independent regulator needs help with "data modelling; data mapping; data catalogue; data quality; reverse-engineering a logical data model from Salesforce".

Announcing a supplier day on May 26, the FCA said it would "like to extend current capabilities beyond secondary market activity into the near real-time world of issues affecting listed companies. The new solution will also enable the FCA to further exploit these rich markets datasets by enabling teams to utilise data engineering/data science techniques to drive improvements and generate greater insight."

The announcement comes as the FCA has faced blistering criticism for failing to get ahead of the collapse of London Capital & Finance (LC&F). More than 11,600 people had invested £237 million when LC&F collapsed in January 2019. Its “mini-bonds” had promised returns to investors of up to 8% a year.

In December 2020 an inquiry led by former high court judge Dame Elizabeth Gloster found that the FCA failed to properly supervise and regulate LC&F. Bank of England governor Andrew Bailey, who was FCA chief executive at the time, in February 2021 told MPs that the regulator’s call centre had received over 600 calls about LC&F, including 15 from one individual voicing detailed fraud concerns. As he put it, however: “The red flags were buried in the 200,000 calls … There was no proper system for extracting that information.”

You can read more about the FCA's updated data strategy here. Interested parties can register for the May 26 supplier day here. The FCA expects to publish a contract notice August 2.