Ericsson has agreed to buy New Jersey-based Vonage for $6.2 billion in an intriguing acquisition.

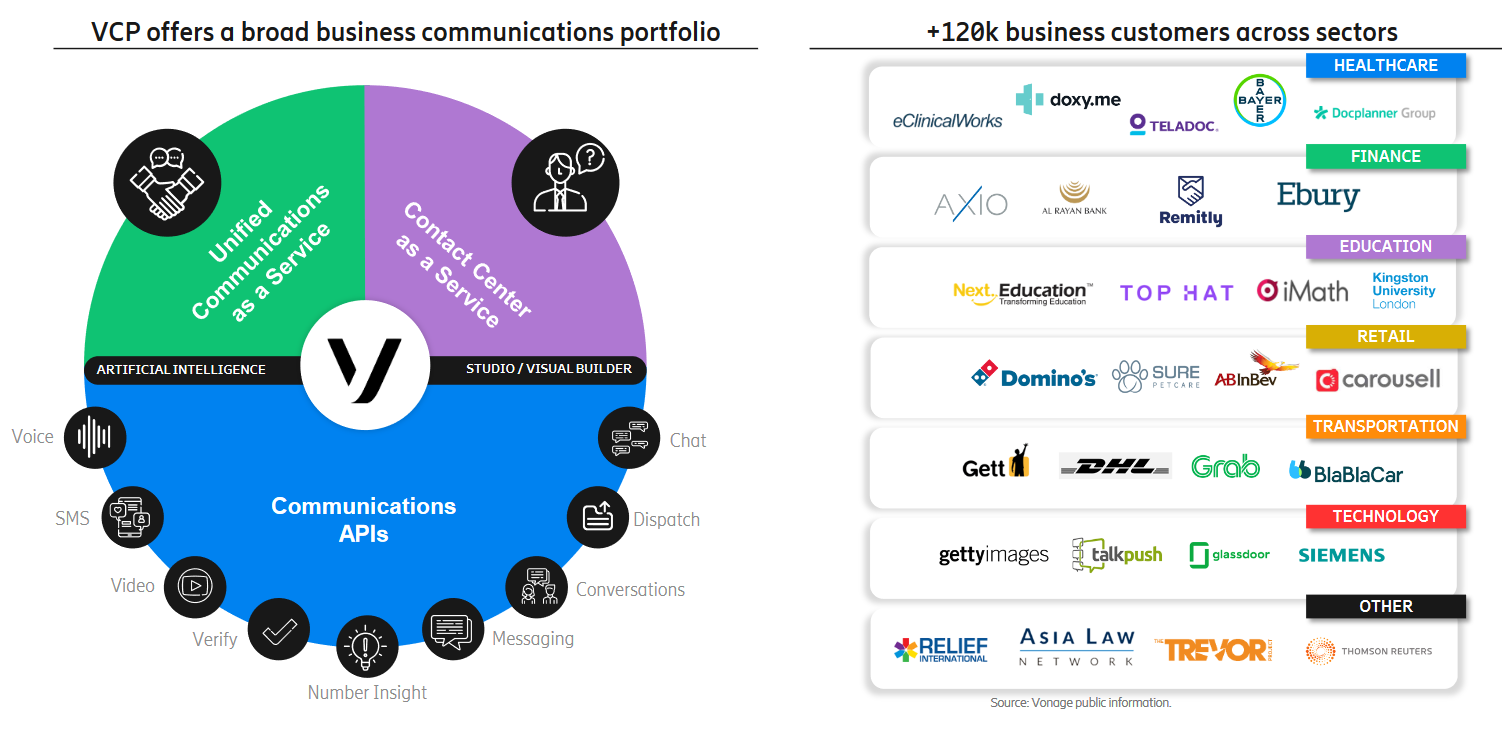

Vonage has 2,200 staff and since early 2020 has been led by Rory Read – a former CEO and President of AMD and President and COO of Lenovo (more recently an EVP at Dell Boomi and CEO of Virtustream). It provides unified communications, contact centres, and communications APIs all under one roof in what it describes as the “world’s most flexible cloud communications platform" and has a claimed million-strong developer community.

Vonage has two key business segments: an established if slightly declining consumer/residential VoIP offering with a tenured customer base of some 800,000; a rapidly growing B2B, API-based platform that offers a range of options for customers. The company also boasts direct sourcing agreements with ~200 cloud service providers.

The acquisition looks like a canny one for Ericsson as a result, taking it beyond its customary comfort zone of telecommunications hardware like 5G network equipment and deeper into customer-facing cloud-based platforms and software that will give it what it hopes to be a central role in “enabling the next wave of premium and new communication experiences (e.g., high quality video, XR)” as Ericsson said in an investor presentation.

As Ericsson CEO Börje Ekholm said, tellingly, of the all-cash deal, it will "add cross-selling opportunities, R&D and scale... together, we elevate the 5G ecosystem by establishing a global network platform."

Software has been eating the legacy telecommunications world for lunch, with the industry’s traditional world of legacy specialist circuit boards – running tasks with equally bespoke software that require complex back-office systems and applications built on reams of sometimes undocumented code – rapidly being replaced by a world of software-based, virtualised systems running on commodity servers/cloud. (As the world shifts, telecos have been among the largest technology spenders this year, as IBM CEO Arvind Krishna noted on an earnings call this summer. Research & Markets expects industry capex is likely to come in around $300 billion for 2021...)

Sweden-headquartered Ericsson described the acquisition has helping it “put the power of the network at the fingertips of developers – linking communication and network APIs (e.g. 5G network slicing)”, adding in its deck that “operators are the foundation for high- performance networks and new capabilities.”

See also: First 5G network slicing success: why you should care

(The deal comes as Deutsche Telekom, Ericsson, and Samsung in June successfully completed the world’s first 5G end-to-end (E2E) network slicing trial, splitting the 5G network hitting a Samsung S21 tethered to a VR headset into a fully isolated default mobile broadband slice and a cloud VR gaming-optimized slice: an important success as 5G adoption continues to pick up, with subscriptions increasing at a rate of about a million per day.)

The deal, in short, buys Ericsson an influential platform that puts it – and its hardware and associated software platforms -- significantly closer to end-customers, in a rapidly changing world that has seen scores of new virtual network software companies enter the space in recent years (think Affirmed Networks, Altiostar and Parallel Wireless – which offer a software-based mobile core solution – Etiya, which provides a virtualised mobile solution (running on AWS), and Metaswitch, which offers a wide range of mobile and fixed network software-based network technologies. (Microsoft in 2020 bought both Metaswitch and Affirmed Networks within less than 10 weeks, with Microsoft’s corporate VP for Azure networking Yousef Khalidi saying the deals would help it “support hybrid and multi-cloud models to create a more diverse telecom ecosystem and spur faster innovation”.)

Vonage will be run as a separate segment reporting directly to the CEO. The deal is expected to close in H1, 2022.