Accountants have slammed the UK’s tax, payments, and customs authority, HMRC for its “extraordinary” digital failings – and “many gaps in basic online services” including a lack of secure email or document exchange.

Their comments came as the Parliament’s Public Accounts Committee (PAC) said HMRC had “implemented its digital services poorly and with inadequate testing” – airing the criticisms in a new February 28 report.

HMRC said it is working to improve digital experiences. Deputy Chief Executive Angela MacDonald flagged plans for 2024 to “let customers see and pay their liabilities within their own third-party provided software.”

Accountants: HMRC systems unfit for purpose

The Institute of Chartered Accountants in England and Wales (ICAEW) told the committee: “It is extraordinary that HMRC has not developed and rolled out [secure email or document exchange] at the national level.”

The professional membership organisation added that “agents do not have access to online services to prompt changes to tax codes, to appeal penalties, or to request the withdrawal of a self-assessment tax return.”

HMRC has insisted that it has adequate digital capabilities – people are just not using them. It told MPs in a letter dated January 11, 2024 that “HMRC needs an even higher proportion of customers to self-serve online.

“In order to deliver maximum efficiency from the investment of taxpayers funds into HMRC, it is necessary that where quality digital services exist, customers and tax agents must use them” – the tax office added.

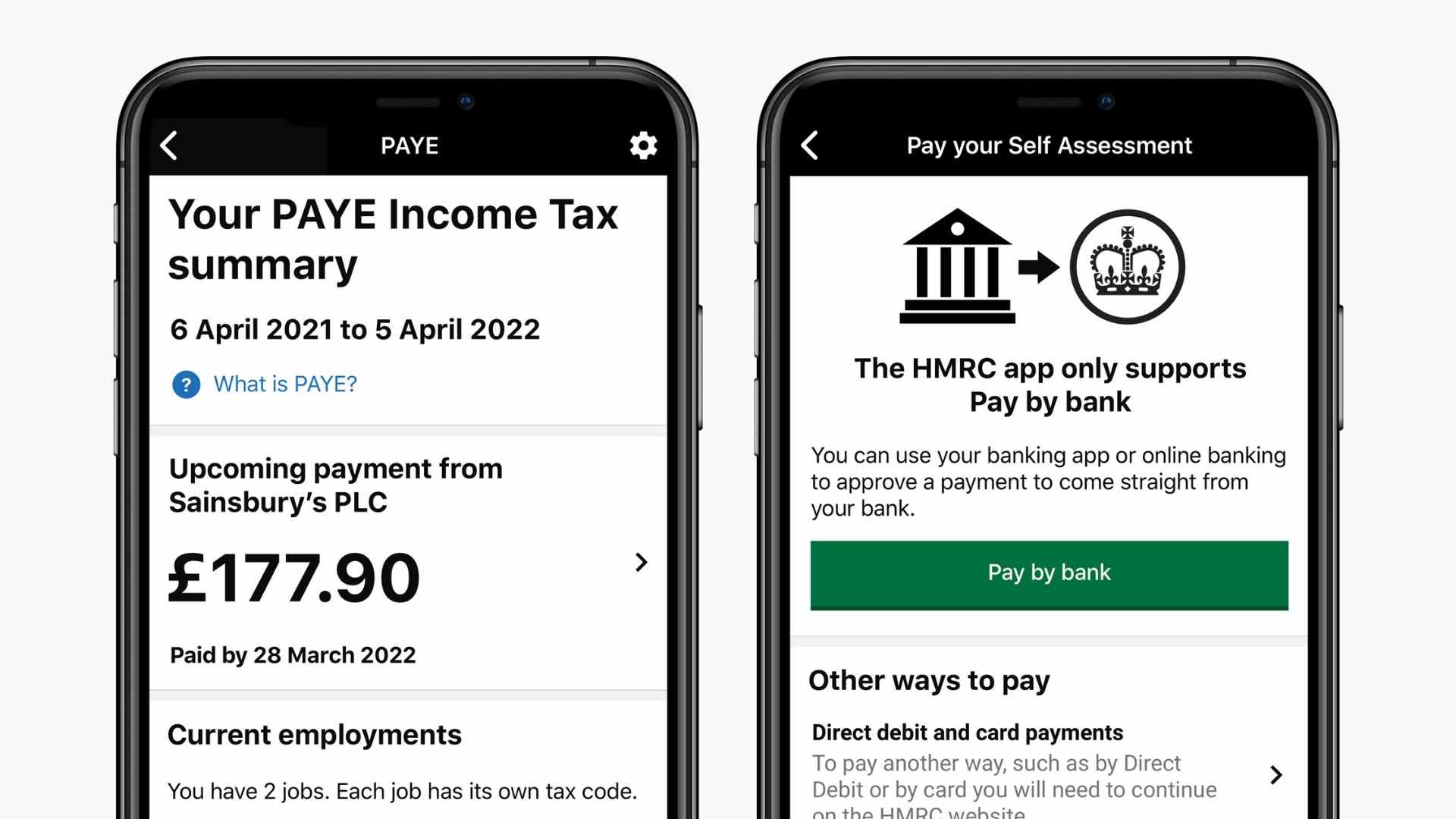

Defending its digital progress, it pointed to a 70% increase in use of the HMRC application in 2023. This, it said, lets users pay self-assessment tax bills via open banking, download their National Insurance Number and tax history, manage income tax, child benefit and update personal details.

MPs were not swayed: “HMRC has been promising plans to develop and improve the HMRC app and online accounts, but this work will take many years to deliver,” noted the report. “It is not yet fully funded [and] may be derailed by other changes to the tax system and technological change.”

The sluggish digitisation process has been blamed in part on legacy IT systems and the Herculean task of migrating taxpayers records onto new platforms. While digitisation is no easy feat, the ICAEW said HMRC has been a repeat-offender: “The experience of poorly implemented digital services… has been repeated. This undermines trust in HMRC’s ability to deliver improved service via digital channels,” it said in written evidence.

See also: HMRC tees up £4.5 billion "DALAS" framework

Tax disputes lawyer Morag Ofili told The Stack: “Digital transformation in any organisation will fail if the user experience is not taken into account.

“HMRC say that their services are good quality but they seem to be ignoring the experience of taxpayers and tax professionals. Digitisation is only a solution if it works for the users… Other European countries (such as Estonia) has succeeded in framing digitalisation as a process which makes the taxpayer's life easier. The key takeaway for me is that HMRC are failing the taxpayer population and there is a lack of trust on both sides.

“Most people want to get their tax right but are prevented from doing so because of a complicated system and a negative experience with HMRC. They need to start by building trust in their system (digital or otherwise).”

Another accountant, preferring not to be named, told The Stack: “Whilst we are waiting for calls to be answered (which can take up to one hour sometimes), we have to constantly endure a recorded message to go online to resolve our issue. If the issue could be resolved online, we would not be wasting our time trying to speak to them now would we?!”

They added: “An accountant can register a client in Germany and receive their UTR [unique tax reference] number within 10 mins, and in the UK, the whole process takes anything between four to eight weeks. As for VAT registration, some have taken [us] as long as six months…”

“Making Tax Digital”

Most recently, the government’s plan to introduce the Making Tax Digital for Individual Tax Self-Assessment (MTD for ITSA) was derailed. Initially scheduled for 2024, the programme was pushed back until April 2026.

According to evidence provided to the PAC by the Association of Accounting Technicians, “digitisation should be progressed without any further delays, co-designed more with software developers and accompanied with targeted support for those who are digitally excluded.”

HMRC’s Deputy Chief Executive, Angela MacDonald, told PAC: “We have plans to deliver several new digital services over the next 12 months that will make interacting with HMRC easier and more efficient. This includes a more consistent, personalised experience online and in the HMRC app, built around customers’ needs… customers will be supported by an integrated digital assistant which can escalate to a webchat advisor where it’s required. Customers will receive a mix of SMS and push notifications to remind them to complete a task and then gain assurance the task has been successfully completed, without having to call HMRC.”

She added: “We are introducing changes to provide an even better digital experience for PAYE and Self Assessment customers, so that they can self-serve and they are less likely to need to call us” and suggested that “in the coming year, we will also enable customers to see and pay their liabilities within their own third party provided software.”

What has your experience of HMRC's digital services been like? Let us know.