“The man who made Nike uncool” Bloomberg called him – and 10 days later CEO John Donahoe was toast, to the delight of shareholders.

News of his impending departure (Donahoe will be replaced on October 14) saw critics of his leadership come screeching out of the woodwork.

Amongst their complaints (other than poor share performance) was a rupture with retail partners and narrow focus on digital channels.

Donahoe joined Nike in 2020 when bricks-and-mortar stores were shutting as the pandemic started – and retailers without digital channels and direct-to-consumer muscle were realising their predicament.

Donahoe and Nike was arguably a natural fit at the time. His background at eBay and Silicon Valley experience saw him prioritise what are widely regarded in most businesses these days as two linchpins of success.

- Owned channels that directly reach your customer.

- Rich first-party data gleaned from those channels.

Donahoe had admirable success here.

Nike’s digital share of business nearly tripled to 26% in fiscal 2023 from 10% in fiscal 2019. Nike.com alone now has more than 300 million users and processes $20 billion in sales yearly – whilst four applications (SNKRS, the NIKE Mobile App, NTC and NRC) have hit over 500 million users.

That push aligned with a strategy first announced in 2017 (before his appointment) to focus on direct-to-consumer (DTC) sales. And pursuing that approach, Nike slashed the number of retail partners it worked with,

Nike appoints Amazon Fashion boss as new CTO

A year into Donahoe’s tenure, Nike had “exited about 50%” of its retail partners, Nike finance chief Matthew Friend said in late 2021 – before realising in 2023 that the approach was hurting it in several ways.

Even though Nike “is more than capable of driving its business [via DTC]… it probably found that pulling back from retail channels has lost it some customers and given more prominence to rivals,”as Neil Saunders, managing director of GlobalData Retail, told Modern Retail back in 2023,

Tom Nikic, SVP of equity research at Wedbush Securities told the same publication at the time that “there are still millions of customers who shop at Macy’s and DSW and Foot Locker… there are a lot of customers out there who want a multi-brand experience, who want to be able to compare a Nike shoe and an Adidas shoe head-to-head... I think they may have underestimated the stickiness of that multi-brand demand.”

Nike pledges better data use, as digital sales slump

Donahoe appears to have recognised the crisis. Speaking on Nike’s last earnings call (June 27, 2024) he said: “We've spent a lot of time leaning in with our wholesale partners. We've had several wholesale partner summits. We've had RSG [running speciality] groups, neighborhood, partners, and authenticators to campus. We're exposing our three-year product innovation pipeline to them, and feedback has been very strong.”

By the last quarter, Donahoe had driven Nike's net income up 12% year-on-year to $5.7 billion for fiscal 2024 – and an impressive 45% for Q4.

But flatlining revenues, a downbeat outlook, and a sense that Nike had lost its way amid pressure from more sports-focused upstarts appear to have done for Donahoe. The sense from critics being that a powerful digital strategy without a core mission and audience-centricity shining through was hollow. Add to that relationships with bricks-and-mortar partners that were still only recovering and investor patience was gone.

"We could rack up serious costs in our AWS bill"

Behind the scenes, the technology estate that powers Nike’s digital efforts arguably does not get enough attention from investors, bar the occasional query on a much-delayed effort to modernise and join up its ERP systems.

Nike does not break out technology spending and shares little detail on its infrastructure and ongoing modernisation efforts in earnings calls, despite the criticality of this to its DTC approach and broader digital channels.

What is clear is that Nike is a major AWS user.

(The company also recently hired an Amazon veteran as its new CTO.)

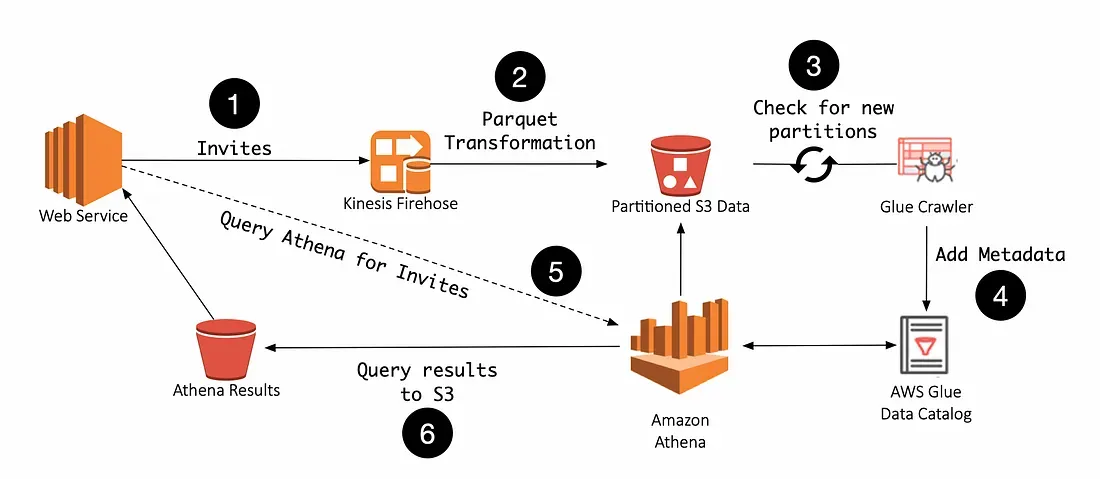

Its engineering team has previously spoken about how it migrated its large clusters of Cassandra and Couchbase to “fully-managed [AWS] DynamoDB tables to reap the benefits of cloud native architecture” – as well as how Nike built an event stream system to analyse data from nudges to application users, via an extensive suite of AWS managed services.

The latter can get expensive, one Nike engineer admitted back in 2019.

“Queries to Athena are charged by the amount of data scanned, and if we scan the entire event stream frequently, we could rack up serious costs in our AWS bill. For our use case, however, we’ve determined these limitations are acceptable” he wrote – in what appears to have been the last engineering blog from Nike’s team; it has not been updated since.

Whether that architecture has evolved significantly since or not (we couldn't say) Nike admitted in one of the few mentions of technology on its fiscal Q4 earnings call to be “optimizing technology spend; and restructuring our organization to streamline layers and support functions.”

In May 2024 meanwhile Nike appointed its first Chief Data and AI Officer (CDAO), Alan John, as The Stack first reported, and continues hiring widely for a range of technology roles despite some recent downsizing – it recently laid off "32 vice presidents, 112 senior directors and 174 directors."

Among the roles currently open at Nike (Oregon) are one for a "Senior Director of Technical Recovery Management to oversee the global strategy and execution of our technology disaster recovery program" (one of several interesting cybersecurity-focused roles open at Nike.)

Also sought are several software engineers (India) to join a "mission critical team focused on building a high-quality, low-latency, fault-tolerant supply chain platform that drive Nike’s Digital transformation and growth strategies" and numerous open roles suggesting an ongoing overhaul of finance and demand planning/supply chain software.

Change is clearly afoot – and not just at the CEO level.

Whatever the market thinks of Donahoe however; and whatever the real state of the underlying IT architecture, with that application user growth and data collection, he has laid some powerful foundations for his successor.

Work at Nike and want to talk about its digital strategy, on or off-the-record?

Feel free to get in touch.

Sign up for The Stack

Interviews, Insight, Intelligence for Digital Leaders

No spam. Unsubscribe anytime.