In 2020, over 500 investors managing $106+ trillion in assets requested that thousands of companies in their investment portfolios disclose their environmental data. They were joined by 147+ large purchasers overseeing more than $4 trillion in procurement spending. This reporting pressure was just one of many signs that investment community is getting serious about Environmental, Social and Governance (ESG) reporting, which has gone far beyond simply being the green buzzword du jour: investors increasingly seriously want to assess, mitigate, and avoid climate risk; if that happens to reduce reputational risk along the way, all the better.

Yet for all the surge in market interest, in investor-led climate activism, and in the flurry of new emissions data-focussed startups, the term ESG still covers a multitude of sins. Indeed, famously and startlingly – as the Massachusetts Institute of Technology found in 2019 – ESG scores from the main five ESG data providers are uncorrelated for any given company. As a result, when it comes to the “E” in ESG, it can often like everyone is talking about something quite profoundly different.* And for those seeking to do more than quantify the total pollution caused by an existing portfolio – even if they could get accurate, standardised data – how would this help investors actively avoid a frequently nebulous-seeming “climate risk” at meaningful scale?

“These interactions often defy analysis”

A 2020 climate risk report for the US Commodity Futures Trading Commission captures the challenge tidily.

“For data to be decision useful, it is necessary to know which climate-related variables materially impact the performance of markets, countries, sectors, asset classes, companies, projects, and securities, and how these variables interact. While these interactions often defy analysis, the ambition to better understand them remains.”

Can the open source community help? This team thinks so...

One of the people with that ambition is Truman Semans, a former Treasury economist, who has been working at the nexus of sustainability and investment for several decades. He told The Stack: “I've been working to integrate the environment into decision making for a long time; using data-driven approaches that started with really crude modelling back in the 1990s that got progressively advanced; including working with large corporations and using Excel-based tools to peer forward into the future and look at how changes in policy and technology and consumer preferences created opportunities for clients of mine like General Electric, large utilities, etc. We took that to literally the end of Excel could do – with models that took a large team of analysts weeks to run.”

In 2020 after several years of behind-the-scenes rabble-rousing, Truman helped deliver the launch of a new Linux Foundation project called the LF Climate Finance Foundation (LFCF).

This brought together founding members Allianz, Amazon, Microsoft and S&P Global, along with a planning team from the World Wide Fund for Nature (WWF), Ceres and the Sustainability Accounting Standards Board (SASB).

Its task: to try and “accelerate predictive analytic tools and investment products that manage climate-related risk and finance climate solutions across every geography, sector and asset class”. (With minimal spreadsheets involved. As Truman notes: “Major breakthroughs in in programming languages and data science and the reduction in costs of cloud storage and computing are an important part of the birth story...”)

Why the Linux Foundation? As the non-profit open source hub’s executive director Jim Zemlin put it at the launch: “The cost and complexity of analytics for climate-related investments require highly organized collaboration and resource sharing across hundreds of users and contributors… The LF Climate Finance Foundation will enable neutral governance, shared development costs and technical leadership from many of the world’s leading financial institutions, multilateral organizations, academia, governments and NGOs.”

OS-Climate

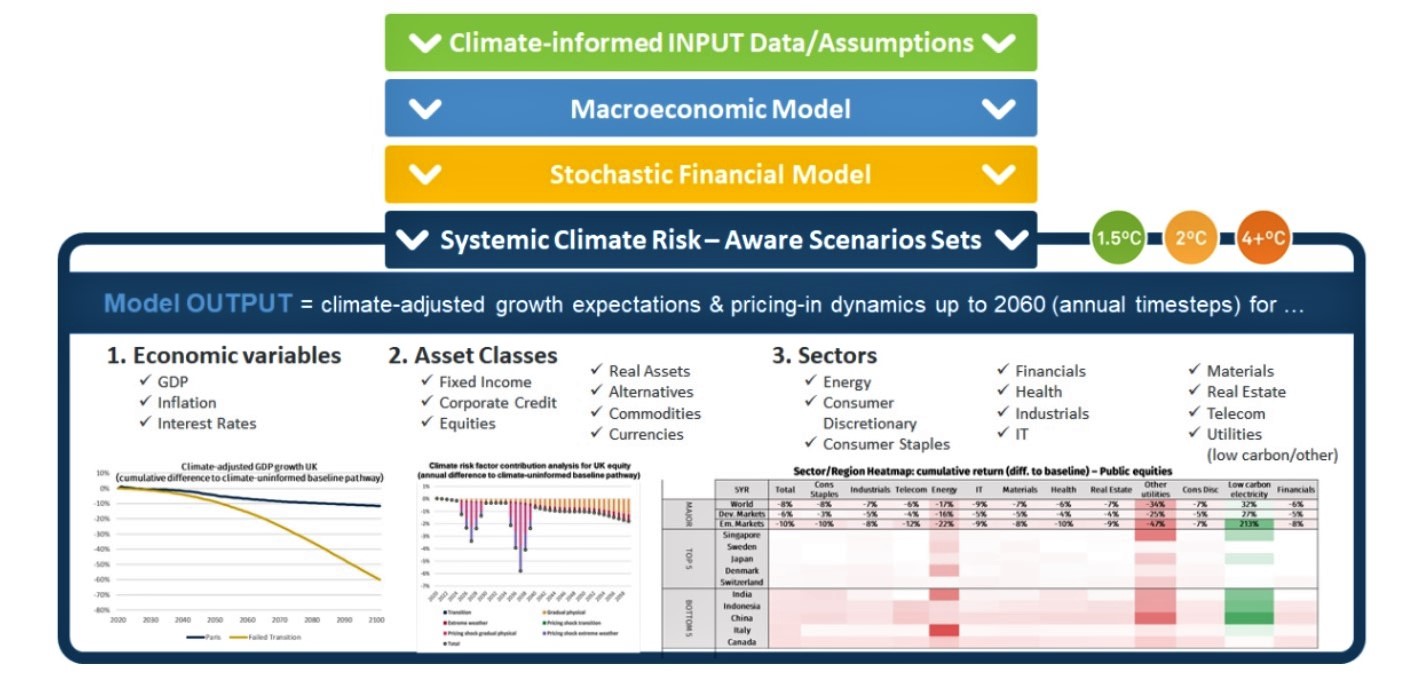

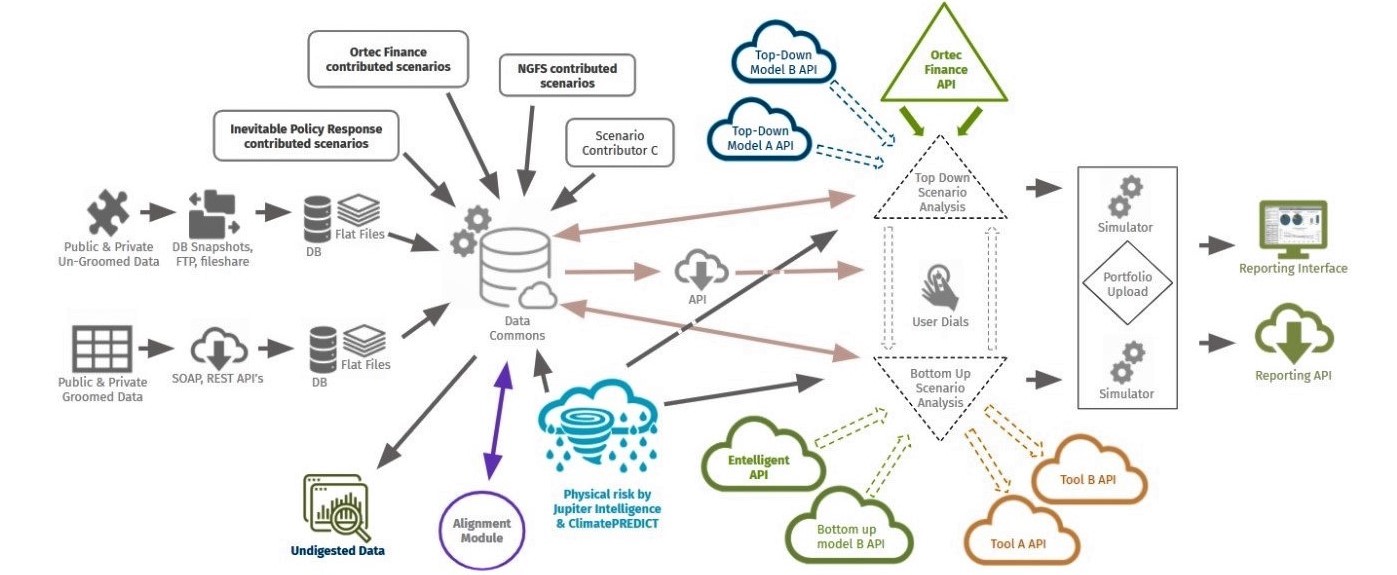

At the heart of the LCFC’s work is OS-Climate: an ambitious Open Source software platform that the project hopes will support the management of climate risk and accelerate investment in climate mitigation, resilience, and adaptation by providing – as Truman puts it – “The equivalent of public infrastructure for climate-integrated investing; aggregating the best available data and modeling worldwide for AI-enhanced predictive analysis of how climate-related factors (technology, resources, climate and weather, policy, consumer preferences, and macro variables) will impact performance of economies, industries, companies, and assets across future scenarios.” (Did we mention that it’s ambitious?)

It sounds like a bold and important vision. What does it mean in practice? Crudely: 1) an open source community with a global data commons (donated by members Allianz, State Street, Jupiter Asset Management S&P Global and others): 2) open source models that can support "top-down" and "bottom-up" analysis that informs climate-related risk and opportunity for investors across multiple climate scenarios and transition pathways: 3) Through this, help inform climate-risk aware asset/sector/regional re-allocation; align portfolios with temperature and emissions targets, and more broadly support climate-aligned stress testing, risk management, as well as the design and execution of benchmarks, strategies and products by the broader community.

"The scope of this thing is enormous..."

Michael Tiemann started the world's first Open Source company, Cygnus Solutions, in 1989, going to become the first open source company to receive VC funding (1997), before a buyout by Red Hat in 2000 – where he became CTO. (He's now vice president of open source affairs). Like Truman -- they live in the same corner of North Carolina -- he has a keen interest in how open source can be used to deliver social and environmental goods. He's now heading up the open source community side of OS-Climate, where teams from a wide range of organisations are testing models. He told The Stack: “As you can imagine, the scope of this thing is enormous.

"But I've definitely seen through the lens of what seems impossible when you're on one side of the timeline and what then becomes so obvious on the other side of the timeline: I remember when Linus Torvalds released a few thousand lines of code and said, ‘hey, I'm starting a kernel, it's nothing; it's not going to be anything big. But if you want to join here, here I am’.

“It seemed absolutely impossible to imagine an operating system being able to compete on the PC platform. Lo and behold, it takes over Wall Street and ushers in an era of cloud computing and all that stuff…”

“Many different things are arrayed against being able to perform climate aligned investing. But on the other hand, it is a problem that we have to solve, just like we have to solve global warming, fossil fuel addiction and all manner of other challenges. If you're a wonk, it's very exciting.

"We have access to a large amount of computing power. Amazon has sponsored some some substantial cloud computing resources for us, and we haven't begun to scratch the surface of what that can deliver. We have a diverse set of folks working together. We've got Microsoft people working with Amazon people. We've got folks in the insurance and banking spaces, got market data providers providing advice."

And the focus is narrowing with the team "relentless driving focus down to specific use cases and specific questions", Truman tells The Stack: "One discrete problem within the broader set of challenges is portfolio alignment tools; understanding the the implications of of a company's targets and and its emissions and forwardlooking information relative to Paris goals... the way that we have achieved focus is by the sort of the time honored approach in open source development of working with particular contributors who themselves are are driven by commercial product rigor, essentially; in very customer value creation-driven way."

Data (from simple availability, down to reliability, cleanliness, and all the other issues that bedevil many major data-led projects at the start) remains an issue. As Michael Tiemann puts it: "In the normal open source world, if you take something like the Human Genome Project – an absolutely awesome project – there is a team of people who are working on the sequencing engine, all based in an open source language called PERL. There's a bunch of biologists who are busy actually generating the generating the DNA codes, using analysis. And these two projects went hand in glove together and actually out ran the proprietary attempt to fully sequence the human genome. And so it is a very exciting footrace that involved a lot of coordination across these two disciplines.

These reporting standards don't necessarily mandate the kind of data organisation that makes it super easy to then plug it into an analytical tool.

"Asset owners tend to be super, super proprietary about some things, but they also know that in order to in order to get to the next step of what they are doing, they they they need to be a little open with us.

"And we have to prove that not only can we do the technical work, but we can also provide things in a way that protects what they are doing. The Allianz guys have been absolutely phenomenal in that way: we've been asking for slices of this data and that data and they've been helping extensively... [yet] portfolio data is probably not the the crucial thing, although it is important.

The former Red Hat CTO notes: "One of the things that is a great challenge is getting the corporate data. There are a number of standards and the corporations are kind of doing their best, more or less in working their way toward reporting that [ESG metrics]. But these reporting standards don't necessarily mandate the kind of data organisation that makes it super easy to then plug it into an analytical tool.

"So if somebody if somebody discloses in their sustainability report, chapter and verse of all these different policy requirements and regulatory requirements, and they publish an essay in PDF... it might meet the ESG requirements, but it makes life very difficult for the person who tries to figure out, 'OK, so how do I turn that into a number relative to this particular metric that we're trying to compare across every different company?'

He adds: "Corporations on the on the one hand have tried to be responsive to these reporting requirements, but they also want to know when everyone's going to settle on a standard that is as simple as 'we did this much revenue, we did this much cost; here's our net GAAP profits. Because not only are some of these reporting metrics not standardised, but they are not even that simple. So getting corporations to keep the faith, improve the quality and standardisation of their reporting – and in an open source-friendly way – is the biggest challenge."

"But each month we've got a longer and longer roster of people who are who are signed up to chip away at the work in front of us. And the rubber is getting closer to really hitting the road."

*n.b. This may soon change: leading sustainability and integrated reporting organisations CDP, CDSB, GRI, IIRC and SASB are working together to develop a climate-focussed financial disclosure standard in a project facilitated by the Impact Management Project, World Economic Forum and Deloitte. They published a prototype in December. Those interested in learning more can tune in to a webinar with their CEOs on Jan 12) at 15:00 GMT.