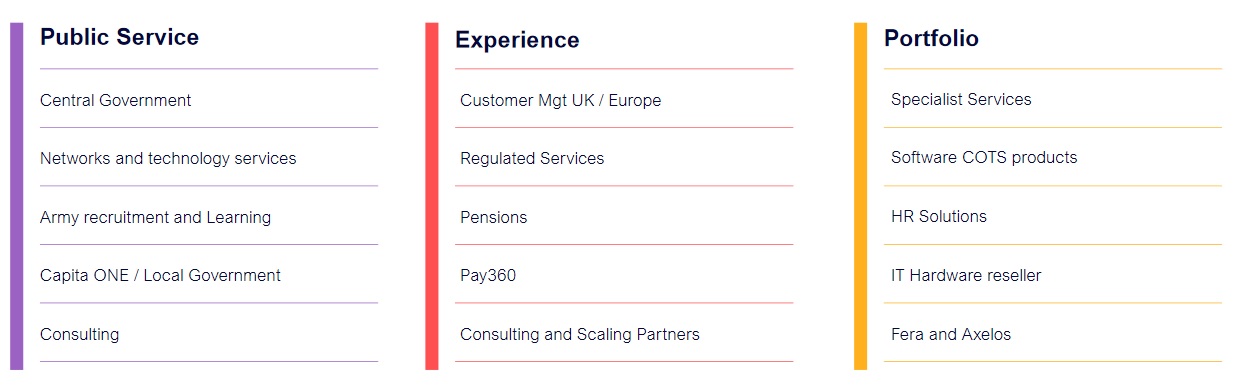

A sweeping Capita restructuring will see the outsourcer halve its six divisions to three -- dubbed "Capita Public Service" and "Capita Experience" (crudely, public and private sector-focussed), with a third comprising an "enlarged portfolio of valuable but non-core businesses" which it plans to dispose of to pay down debt, it revealed today. (The latter includes its IT hardware reselling and commercial off-the-shelf software products.)

The restructuring, detailed in an annual report, came as Capita eyes a growing chunk of what it sees as a juicy government IT processes and services market. Capita continues to generate some £1 billion+ annually in UK government IT contracts and secured ~£100 million of Covid-related business in 2020, including providing 1,200 contact-centre workers to Test and Trace, and sending 11.2 million letters to the vulnerable on behalf of the NHS.

The company will double-down on its public sector focus. The UK Government market is currently worth around £69 billion, it noted in the report: "The fastest-growing parts of that, at around mid-single digit CAGR growth, are business process and technology-enabled services... The outlook for 2021 is promising, with a strong unweighted pipeline of £9.7 billion... including a big increase in Government Service", executives noted in the earnings brief.

The company has been rapidly pushing to sell assets and trim costs, as well as improve revenues: it faces "significant" short-term loan note maturities, with £440m due over the next two years. The company hopes to renew and extend credit facilities before then, but also to pay off debt through aggressive ongoing asset disposals.

Three key sales are currently under way, CEO Jonathan Lewis revealed: "These comprise "our ‘blue light ’ emergency services software, our specialist insurance businesses in partnership with Artificial Labs, and our Axelos joint venture with the UK Government, with combined expected proceeds of at least £200m. We anticipate proceeds to come through in the second half of the year. Further non-core disposals are expected to realise around £200 million," he added., including from more off-the-shelf software assets

The company meanwhile noted that it had closed 49 offices in 2020 for savings of £11m in the year and plans to reduce office space by another 15% in 2021: "Operationally, we have demonstrated to clients that remote working can be secure and productive, while maintaining our service KPIs. This has given fresh impetus to rationalising our property footprint. We have permanently closed 11% of our floor space in 2020, including our head office in London. We are now moving to a more flexible workspace model, allowing collaboration when needed but also recognising that our people want to spend more time working at home than before the pandemic.

Total contract value (TCV) won in the year was £3.1b, £233m more than in 2019. As CEO Jonathan Lewis noted however, the company's markets are changing in nature -- "away from traditional business process outsourcing (BPO) to higher value business process services (BPS) and business process as a service (BPaaS)... we are now investing in BPaaS capabilities, which is a standardised, process-specific solution deliverable to many clients. Consulting and transformation revenue comprised just over 15% of total Group revenue won in 2020. We expect to improve both margins and cash generation by increasing this type of revenue, as well as doing more BPS and BPaaS work."