BT is currently spending £600 million a year on legacy IT systems, its chief digital and innovation officer has admitted, and is looking to slash that in half as part of the BT digital transformation programme.

To this end, BT on May 4 announced a new five-year partnership with AWS to move the telco’s internal applications to the hyperscaler’s cloud. The deal comes weeks after a BT deal with Google Cloud, focused more on data analytics and AI – all part of an aggressive BT digital transformation programme that aims to help the firm cut £2 billion from its costs by end-2024, including by retiring legacy apps and their associated infrastructure.

The challenges of BT’s transformation programme are on a different scale to most – as Harmeen Mehta, chief digital and innovation officer (CDIO) at BT Digital, readily admitted at a recent briefing to investors.

BT legacy IT challenge: cost to revenue ratio 40% worse than peers

She said: “£600 million of my spend actually goes in maintaining [legacy systems]. And because all of our products are also going live on [them], legacy increases the time to market, increases the complexity even further – and I've got a reverse flywheel going there,” added Mehta, who joined BT from India’s Bharti Airtel, India's second-largest mobile operator, last year.

That £600 million represents half of BT Digital’s budget, and the weight of those legacy systems – representing 80% of BT’s 2,400 applications – means BT’s IT cost to revenue ratio is 40% worse than other telco peers, according to Mehta.

She also used the “reverse flywheel” metaphor to describe the effect this complexity has on the company: “If we have so many apps, and for even our simple processes we are going through that level of complexity, every change costs more, takes more time – and that keeps adding into our cost base.”

This aspect of BT’s digital transformation plan is clear: it is taking a machete to its applications, aiming to reduce them from 2,400 to less than 500, and cutting the 80% legacy apps figure to less than 30% by 2027. This plan will also see BT cut its telco stacks from 58 to 14, and halve its legacy IT cost to £300 million by 2025.

Living on the cloud

Mehta told the investor briefing BT was starting its transformation project late in the day, but that this had an upside: “This gives us an opportunity that by the time we're done with this, we are actually going to be one of the very few, if not only, telcos that's going to be living almost fully on the cloud.”

BT aims to have as many applications be “cloud-first” as possible, with Mehta describing this as the “essence” of this part of the transformation strategy: “That's what will propel us to move faster, and help us transform a lot faster as well.”

The cloud-first element of BT's digital transformation plan doesn’t just apply to applications, but BT’s data as well. Mehta said the company had put its data and AI programme “on steroids”, and had gone from aiming to move 3% of its data to the cloud, to now planning to move 60% to GCP by 2023.

Follow The Stack on LinkedIn

“The power of that is unprecedented. The business case as we were putting it together... it's underpinning more than £500 million of value in the business,” said Mehta.

“It's also going to simplify our landscape. We've got 21 different data platforms in the company today... We're going to decommission all of them for the sake of that one data platform.”

Mehta was also extremely bullish on the wider impact using GCP to analyse and make use of BT’s data would bring for the group as a whole: “The beauty of this is not about us moving the data to the cloud.

“The beauty of this is about the kind of deal we've done with Google, about the kind of intelligence they are going to help bring into the businesses, and what we are going to do with all that AI modelling and the power it's going to generate for our businesses – that is going to become the differentiator for us over a period of time.”

The contradiction

But while BT is planning to strip back its legacy systems and move its internal operations to hyperscalers such as GCP and AWS as far as possible, the telco is also aiming to reduce its reliance on subcontractors.

According to Mark Murphy, director of HR for BT Digital, 80% of the firm’s IT talent are subcontractors at the moment – the BT digital transformation programme will see that cut to less than 50% by 2027.

Murphy told the investor briefing the telco wanted to “strengthen BT's digital muscle” and would be launching a recruitment campaign to “insource” talent: “We're going to significantly increase the in-house capability for BT, whilst at the same time scaling back on the dependency we've had on subcontractors over recent years.”

Alongside this, he also highlighted BT’s £30 million deal with Distributed, a freelancer platform focused primarily on IT, where clients can hire from a wide group of independent contractors, while Distributed handles the admin. As part of BT’s investment in Distributed, Murphy will take a seat on the company’s board.

See also: BT signs £30m deal with Distributed, takes equity in tech workforce startup

Talking about Distributed, Murphy said: “It's increasingly important that we're both creative and innovative in how we're tapping into the talent pools that exist both in the UK and in India, and looking at creative ways to access those talent pools.

“The investment that we’ve made in Distributed enables them to really scale up that talent pool rapidly, opening up an opportunity for a much broader range of talent that can work on activity for BT and be in the BT sphere. That flexible talent pool is going to be increasingly important to us alongside our ambitions for our in-house talent.”

How BT will balance its internal resources versus a highly-variable pool of freelancers remains to be seen, especially given its on-going dispute with the Communication Workers Union over pay. But its commitment to Distributed, along with the telco’s shift to cloud platforms, does seem to raise a contradiction with the telco’s stated commitment to boost in-house capabilities.

Responding to an analyst question on the risks of eroding core skills by using hyperscalers, Mehta dismissed the idea: “Everybody's working with hyperscalers, yes – but it's like saying if every telco has a BSS/OSS, then why is one telco more successful than another? Every company in the world is using Java, but how is one more technically advanced than another?

“The job of the hyperscalers is making that capability available, because that's their business model to all of us. The real essence lies in how you use it and what you do with it. That's where, if you have the right talent and the people who think about it the right way, that's where you create your differentiation.”

From telco to techco

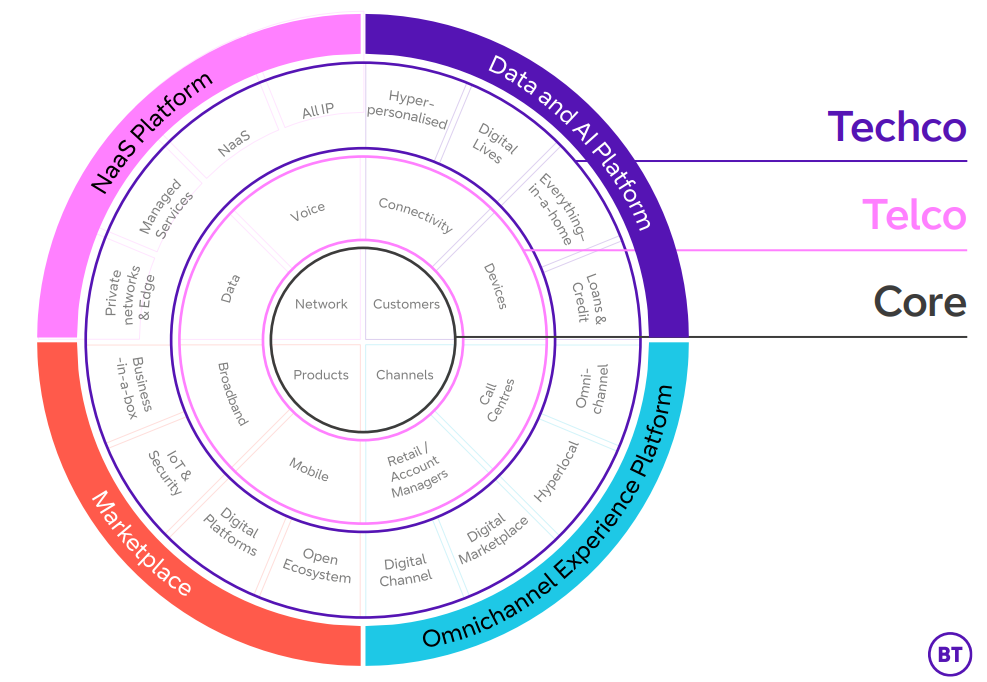

Beyond cutting costs and pruning away legacy tech, Mehta said the vision for the BT digital transformation programme was to move from being a telco to a “techco”. She made much play of turning BT into a platform business, referencing the potential of Network-as-a-Service, marketplaces, and the omnichannel experience platform, along with data and AI.

While details on what this might mean in practical terms were thin, Mehta did point to several concrete examples of how data analytics has benefitted BT. She said the telco had identified a £34 million revenue opportunity by analysing where its fibre-to-the-premises (FTTP) rollout could be extended small distances to almost double the number of homes reached.

BT will also save £88 million in fibre build planning over the next five years, thanks to better analysis of enterprise customer requirements. And BT’s global business unit will see a £37 million increase in EBITDA over five years thanks to “propensity modelling”.

Mehta said the use of improved AI chatbots would lead to a 40% reduction in mean time to resolution, and a 30% reduction in ticket volumes.

Kevin Lee, chief digital officer for consumer at BT, highlighted the firm’s mobile division EE’s use of the “AIMEE” digital assistant. AIMEE currently understands 60% of customer queries, and has a Net Promoter Score of 60 – which some companies relying on human interaction would be pleased with.

BT is also making greater use of AI when developing software, said Mehta: “The way we are building the new application sets, and the new product and platform portfolios, is using a lot of AI-led operations to really allow for technology to be the solution when things are not going well, and for problems to auto-heal, to self-heal, to auto-recover, and not have unnecessarily an army of people in technology as well doing a lot of that work.”

And the telco will also dip its toes into creating and investing in start-ups, with healthcare technology and drones an initial focus of its “Digital Incubation” project. Mehta said this part of the BT digital transformation strategy aims to generate £200 million in prospects for the telco techco by 2027.

The bottom line

In answer to a question on how Mehta and her team’s performance are assessed, the CDIO said she was “obsessed” with metrics, and that measuring BT Digital’s performance comes down to three key areas.

“We are either measuring it on whether we're creating more value for our business, we're creating a better experience for the customers, or we're helping to optimise the cost model – all our metrics by and large fall into these three buckets,” she said.

And for all the talk of platforms and marketplaces, right now the first priority remains delivering on the one big promise in the BT digital transformation plan: cutting £2 billion of annualised costs out of the business by 2024. Mehta highlighted that BT had already achieved £1 billion in savings 18 months early.

“From the remainder, more than 50% of those [savings] are actually underpinned by BT Digital. And that's not only for us within, but it's actually by transforming various things for the businesses as well, and the opportunities that we create for the businesses to bring about those cost savings,” she added.

It was also clear BT Digital has its work cut out “wading” through the “spaghetti” of BT’s many and varied legacy operations, as Mehta put it. When asked how she saw BT Digital’s £1.2 billion budget changing over time, she said the challenge wasn’t a lack of budget, but being able to move it around.

“I have more than enough money to spend. It's just a lot of it is locked down in various places, and it's a short-term thing, how do I unlock some of that to make the shifts that we need to do? So it is a very challenging task, but we are actually approaching it quite aggressively – and that does mean us taking different stances on many things, ruthlessly prioritising as well,” she said.

It's clear Mehta has had an uphill struggle to get things moving for BT's digital transformation project – and not just because of organisational struggles: “I'll be honest, if I look at last year, I spent six months trying to first get into the country in the pandemic, trying to understand the landscape.

“It's the last six months that I really feel I am doing something finally. I really feel we need one more year to really get a lot of this momentum.”