BlackRock, one of the world’s largest asset managers, says its ongoing strategic investments in technology – including a major cloud migration of its portfolio management software Aladdin to Microsoft’s Azure cloud – was behind a 12% rise in expenses over the past quarter, even as a market downturn slashed the value of its assets under management by $1.7 trillion since December 31. The firm says it will continue IT investment.

CEO Larry Fink told analysts on an earnings call: “While we can't control near-term market volatility, we are always prepared for it. We have strong conviction in our strategy, our clients' increasing needs for whole portfolio and technology solutions, the growth of global capital markets and the strength of our proven operating model”.

See: The Big Interview with Bloomberg CTO Shawn Edwards

BlackRock CFO Gary Shedlin added however that “we are mindful of the current environment, and we are proactively managing the pace of what I would call certain of our discretionary investments.”

“We are delaying certain senior hires into next year” he noted “[and] we're continuing to evaluate the pace of our core G&A [global and administrative spend, which includes IT investment]. And while there is no material change to the plans we communicated in January, we would clearly expect the year-over-year increase to come in closer to the bottom end of that previously communicated 15% to 20% range in terms of core G&A.”

G&A for the quarter was $530 million. Total expenses were $2.3 billion. Higher travel and entertainment expenses, as well as increased marketing also drove the 12% quarterly increase, earnings showed.

Asset managers, banks vowing to sustain IT spending

BlackRock joined JPMorgan over the past week in reporting earnings below market expectations amid what it described as “rising recession fears, surging inflation, interest rate hikes and geopolitical tensions.”

JPMorgan had also faced aggressive questions about its spending on a call July 15, with analyst Mike Mayo from Wells Fargo Securities asking JPMorgan’s CEO Jamie Dimon to “reconcile your words with your actions? After Investor Day, Jamie, you said a hurricane is on the horizon. By today, you're holding firm with your $77 billion expense guidance for 2022. I mean, it's like you're acting like there's sunny skies ahead” Mayo said.

“You're out buying kayak, surfboards, wave runners just before the storm…”

Dimon was swift to respond: “ We've always run the company [by] consistently investing, doing this stuff through storms. We don't like pull in and pull out and go up and go down and go into markets, out of markets through storms” -- and pressed for examples of IT spending wins said “ we spent $100 million building certain risk and fraud systems so that when we process payments on the consumer side, losses are down $100 million to $200 million. Volume is way up... I don't think [we] want to stop doing that because there's a recession.”

BlackRock Aladdin Azure migration on-track

BlackRock’s decision to migrate Aladdin off its own data centres and onto Azure was first announced in April 2020. By April 2022 the firm had moved about two-thirds of Aladdin client instances to Azure, saying the migration “ heralds exciting new opportunities for the financial services world. Traditionally, the industry ecosystem was very fragmented, and communication between different stakeholders—such as custodians, asset managers, investment banks, and trading organizations—was often inefficient. Now that is changing…”

The firm had planned to have all existing Aladdin customer instances running from Azure by June 2022. It did not immediately respond to a question about whether it had met that deadline.

An April 2022 Microsoft customer case study noted that [BlackRock] "took its time with premigration planning and preparation to ensure that everyone and everything was organized and prepared. Over the course of six months, the technology teams built a pipeline so they could migrate clients from on-premises to the cloud very securely, at scale, and in an automated fashion. Their work has resulted in migrations that get completed according to plan, on time, and without significant errors" -- with Joseph Chalom, Head of Strategic Ecosystem Partnerships for BlackRock adding that “We can spin up a new client environment in weeks, rather than quarters, because of the elasticity and global reach of Azure... That helps us bring innovative new solutions to market faster and to sell Aladdin technology in regions where we didn’t have local datacenter capabilities. And it’s opened up client segments that weren’t available to us before we moved to Azure.”

See also: SS&C CTO Anthony Caiafa on building a new private cloud

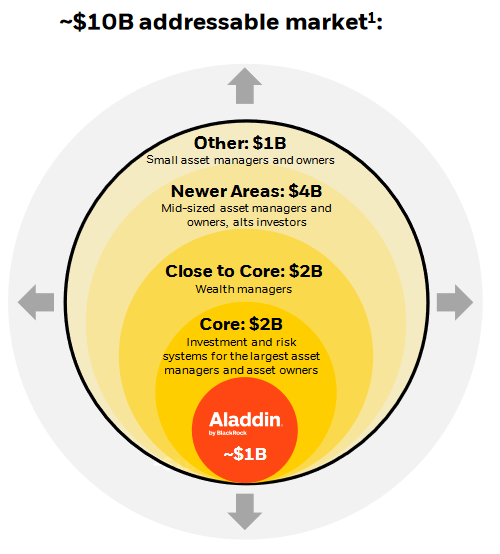

BlackRock’s Aladdin, which the company uses itself as well as making available to clients, lets users see portfolio positions and exposures, performance and attribution, portfolio risk, scenario analysis, compliance and oversight data and more with the aim of helping institutions rethink portfolio management and delivering an accurate feed for timely reporting of positions across most asset classes and instrument types. The idea is to provide transparency that can drive decisions across different metrics, including duration, convexity, value-at-risk, credit risk measures and credible stress tests; customers include central banks, which can adopt a combination of metrics in Aladdin to suit each use case: “For example, one institution has recently implemented VAR – which offers an alternative measurement to credit spreads – to determine expected credit loss by estimating probabilities of default, recovery rates” et al, BlackRock said in a recent case study.

“We can [now] spin up a new client environment in weeks, rather than quarters" said Chalom. “That helps us bring innovative new solutions to market faster and to sell Aladdin technology in regions where we didn’t have local datacenter capabilities. And it’s opened up client segments that weren’t available to us before we moved to Azure.”

Despite the worst first half declines in decades, BlackRock's assets are up over $2.5 trillion since early 2019.