Fresh from adding Wells Fargo CIO Tracy Kerrins to its board and onboarding 27 new members, banking architecture and interoperability non-profit, BIAN, has rolled out new tools and APIs to its 100+ members.

The Banking Industry Architecture Network (BIAN), an independent standards organisation, advocates a common architectural framework for banking interoperability – and provides APIs and tools for its members.

Its latest is “API Align” which it said lets developers and architects “find the most appropriate API for their specific project, map internal APIs against BIAN’s APIs, score alignment and certification and receive AI driven recommendations on how to best align APIs to BIAN standards.”

"BIAN is also working with several major platform providers, including Microsoft, to potentially embed these tools into their platforms. This will enable banks who are using these platforms to create, develop and integrate BIAN compliant API's and code objects more efficiently" - BIAN

BIAN cited one member from a global bank who said API Align was “critical in improving integration and standardisation as we progress our digital transformation projects. The tool will contribute to significant time savings and efficiencies as we’re now able to reduce the development of open standards-based on BIAN’s APIs from fifteen hours to just one hour.”

BIAN also introduced its Business Scenario Designer (BSD) tool.

That was built as a process modelling framework to help members “choose the relevant BIAN Service Domain and develop workflows based on BIAN rules to ensure valid connections to BIAN’s standards [with] templated processes to encourage further time savings…” it added on November 25.

Former HSBC CIO and BIAN chairman Steve Van Wyk said: “We will start to see much greater development, adoption and usage of standards-based integration with these tools, lowering the costs of integration and enabling more banks to embark on digital transformation projects…”

BIAN's service domains

As The Stack noted in an interview with BIAN's founder and executive Hans Tesselaar back in 2021, BIAN was set up out of recognition that IT investment in financial services was too often just adding more complexity into environments already struggling with interoperability issues.

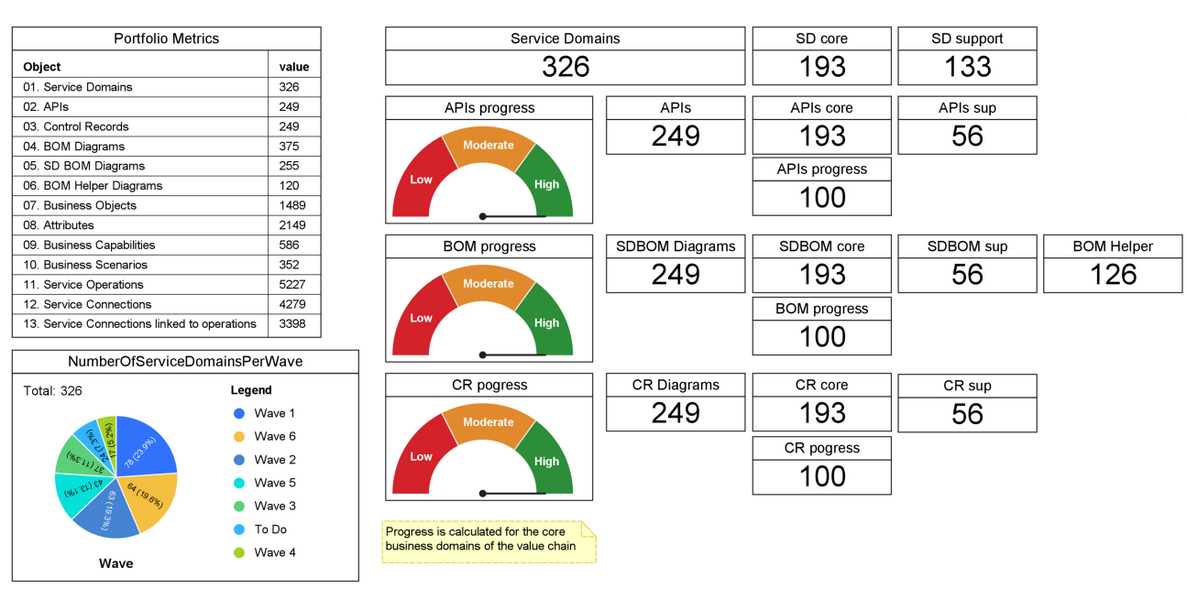

It proposes a map of service domains: building blocks of discrete business capabilities in a bank. (Its latest iteration of this standardised framework is version 12, which includes thousands of business scenarios and service definitions.) It emphasizes a composable architecture whereby individual components can be moved around like lego pieces.

As one whitepaper explains, "BIAN Service Domain defines the application of a specific pattern of operational control to instances of a specific type of production asset and it does so for the complete life-cycle (from start to end, and as often as needed). This design property intentionally results in business capacities that are discrete and highly encapsulated. The Service Domains are also defined at one specific level of detail such that all Service Domains are ‘peers’ (i.e. one Service Domain is not a combination of smaller

Service Domains). The level of granularity is pitched so that the functionality provided

by each Service Domains is ‘elemental’ – meaning a bank either needs one or doesn’t

but does not need only part of a Service Domain. This property is necessary for the

standard to be canonical..."

The new tools are at https://portal.bian.org.