The Bank of England (BOE) is seeking an interim Chief Information Officer (CIO) under a 9-12 month fixed term contract to oversee its £80 million annual IT budget and head up a team of 650+ people.

The hire comes as outgoing CIO Robert Elsey -- a respected technologist who joined the central bank in 2015 from Vodafone as Head of Technology -- moves on to a fresh opportunity after six years with the bank.

The Bank of England CIO leads the technology directorate, which helps build and run systems that range from tracking the gold in the central bank's vaults, to settling transactions worth £750+ billion daily.

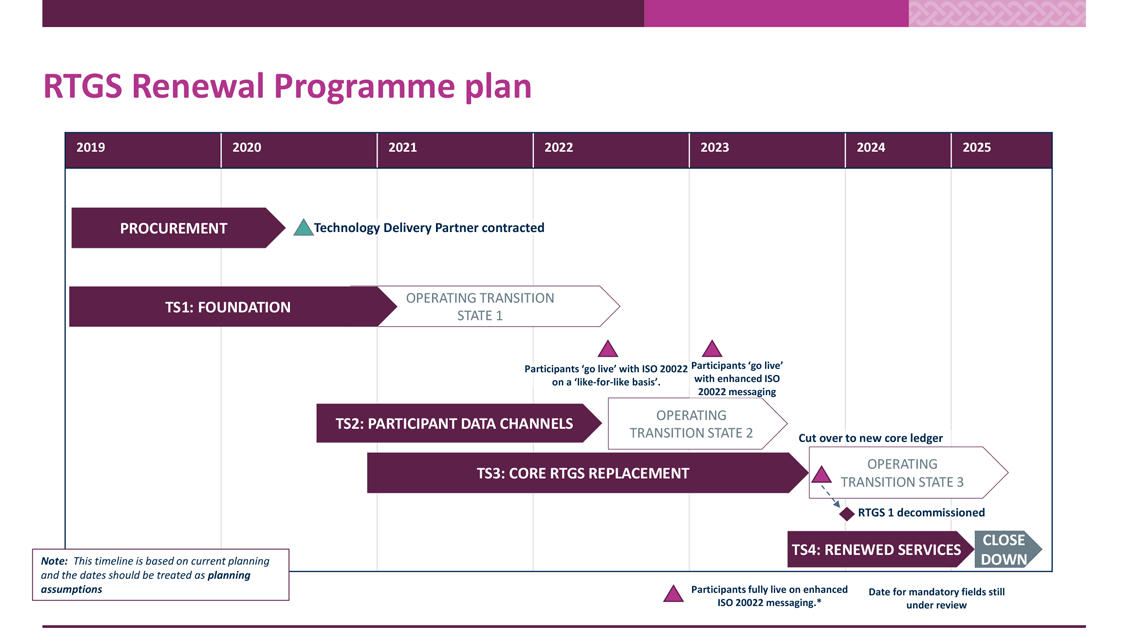

The interim CIO will join the central bank at a critical juncture, as it begins work on a "once in a generation" project to modernise the BOE's RTGS (Real-Time Gross Settlement) system, with the help of SI Accenture.

The central bank continues to provide both engineering and development in-house and the CIO will oversee a substantial team spread across seven divisions, incl. security and product development.

New Bank of England CIO: The Job Spec

The incoming Bank of England CIO, as per an ad posted July 2 (closing) July 15) will be responsible for:

- Architecture, Analysis and Consultancy

- Digital Platforms

- Product Development

- Digital Services

- Cyber Security

- Enterprise Assurance and Planning

- Projects and Programmes

See also: Exclusive Interview, Pamela Chase Dyson, CIO, Federal Reserve Bank of New York, on her career, digital transformation at the Fed

Among the incoming CIO's responsibilities will be ensuring that the Bank has the "right technical architecture" to support its future needs; reducing technology TCO; ensuring that cybersecurity defences are "commensurate with the changing threat landscape; overseeing the Cyber Division and managing the CISO"*; "effective management and operation of our data centres"; and service delivery, management, incl. "running major incidents and outages." More strategically, they will be responsible for leading the bank's "future Technology Roadmap including the planning and management of system obsolescence".

Tackling the RTGS

The planned hire casts a fresh light on the much-awaited work to fundamentally overhaul the RTGS -- Critical National Infrastructure that functions as the backbone of UK payments and through which financial institutions hold their sterling bank accounts, exchange and settle funds.

Plans to rebuild the RTGS's architecture have been under active discussion since at least 2017. The BOE appointed Accenture in July 2020 in a contract worth up to £150 million to help build and deliver the planned new system, with the aim of boosting resilience, facilitating innovation, and overcoming a reliance on legacy technology that is heavily dependent on batch-processing, with limited real-time data monitoring.

The renewed RTGS service will continue to use SWIFT as the provider of messaging services, but will be designed to be capable of sending and receiving payment messages from multiple sources, the BOE notes in its updates on the project, with plans underway to move to a "Message Network-Agnostic RTGS in the future."

Follow The Stack on LinkedIn

The rebuilt RTGS will also include "automated real-time tools for accessing RTGS transactional and liquidity data" as market participants push the bank to deliver more APIs. "There will also be some write access APIs, subject to the ability to secure it [sic]" the BOE notes.

Pressure has been mounting on the Bank of England to modernise its systems, which have frustrated many fintechs with their limited windows to open accounts, and restricted operating hours. As Victoria Cleland, the BOE's Executive Director, Banking, Payments, and Innovation put it in an October 2020 speech: "Operating hours are often cited as a key friction. We are developing near 24/7 technological capability which will have the flexibility to be upgraded to full 24/7 operating hours in line with industry demand.

She added: "This will help to tackle the mismatch of operating hours and increase the overlap of operating schedules to make payments quicker and cheaper... Of course, to fully realise the benefits of extended operating hours other jurisdictions will need to play their respective part, but the Bank can and will lead by example."

(As consultant Bob Lyddon noted to The Stack's founder Ed Targett some years back, for the BoE, opening a settlement account "is an IT change that needs to go through a full testing cycle. This policy was introduced after the CHAPS outage in 2014 to ensure that BoE’s systems did not fall over again, these systems being of 'systemic importance' to the UK’s financial and economic system. One IT change can be done per week. As there are IT freezes over the summer and over Christmas/New Year, and as there are 13 meetings of the Monetary Policy Committee that might result in a Base Rate change (also an IT change), this leaves only a small number of slots available for new accounts. This indicates a comically antiquated IT infrastructure at the BoE.")

(You can revisit his views on that here...)

The Bank of England's page on its RTGS upgrade, last updated March 2021, is here.

You can apply for the Bank of England CIO role here.

*Editor's footnote: this not always a favoured line of reporting, and seen by many as raising conflicts of interest for the CIO, who is left "marking their own homework". It's curious to see it at the BOE.