Bank of America 2020 profits plunged by over a third year-on-year, the bank revealed as it posted its full-year earnings, falling from $27.4 billion to $17.9 billion -- although Q4 saw a sharp uptick again with a 12% increase in profits on-quarter, driven by lower provision expenses.

Chairman and CEO Brian Moynihan blamed the stark decline in an earnings statement today on "dramatic effects of the health crisis on the economy and our company's operations", though noting that Q4 saw "increased consumer spending, stabilizing loan demand by our commercial customers, and strong markets and investing activity" across the banks.

In a call with analysts he sounded upbeat about the future, saying: "There’s one priority; and that’s to get everyone vaccinated so the healthcare crisis is behind us [and] the economy can regain its strength. Our research team has just this past week has upgraded 2021 forecasts. And their view is, the U.S. GDP growth will be around 5% and global forecast for growth are 5.4%.

CFO Paul Donofrio added: "Despite one of the worst economic environments in modern memory, we ended the year stronger than before the health crisis and well positioned to support our clients.

"We grew deposits by $361 billion, improved our capital ratios and increased liquidity to record levels, exceeding loans.

Donofrio added: "Because of the responsible way we have operated the company over many years, we were able to support the economy by raising $772 billion in capital on behalf of clients, invest in our franchise and still be in a position to return $4.8 billion in capital to our shareholders in the first quarter of 2021."

Bank of America 2020 profits down, but digital progress looks substantial

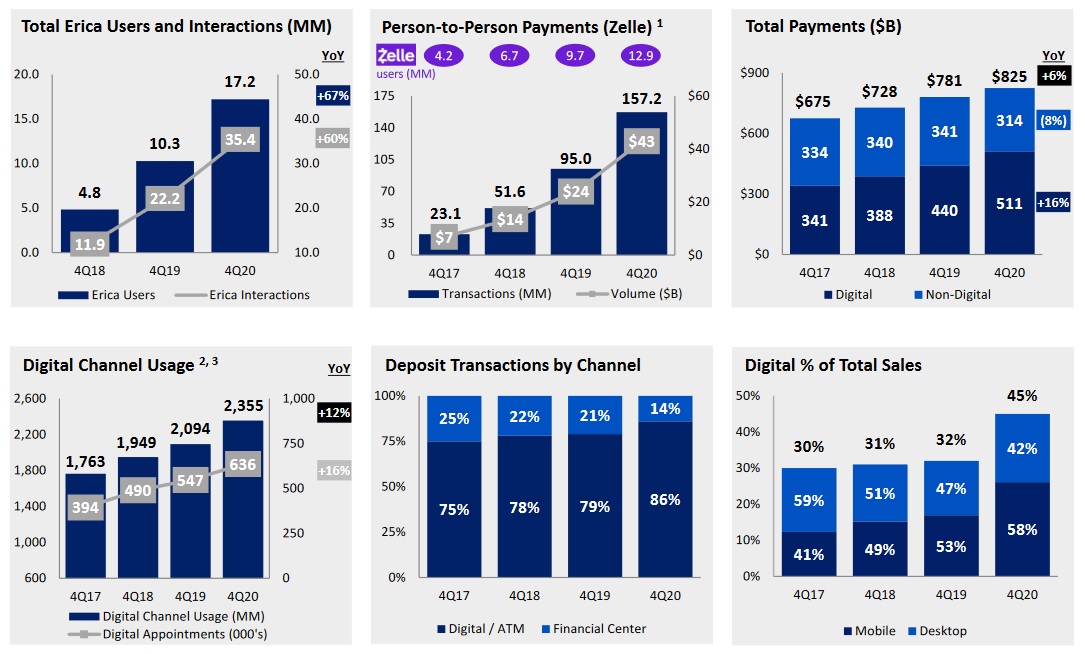

On the digital front the bank made significant steps forward, with digital accounting for 42% of consumer sales this year, while the bank's homegrown chatbot "Erica" now handles 58% of all interactions: or 1.4 million hours of client interactions for 17 million users.

(That's up from 10 million users in December 2019. BOA earlier claimed there were over 400,000 unique ways users could ask the chatbot financial questions. Development on the bot started in 2016).

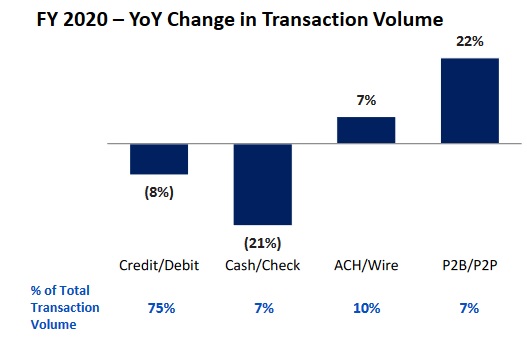

Use of cash also fell dramatically.

As CEO Moynihan noted: "Physical payments of cash and checks have moved to more digital forms, which creates operational efficiencies for us and has been a strategic initiative for many years, and one that was moved forward by the crisis. Full-year 2020 cash and check transaction volume fell to lowest on record, down 21%, as Covid accelerated the migration to digital card-based payments."

Some 69% of Consumer and Wealth Management households are also digitally active, generating nine billion logins in 2020, the bank noted."