AWS will invest $15.24 billion in Japan by 2027 to expand its infrastructure in the country – where appetite for cloud services is slowly gaining steam. AWS already has data centres in Tokyo and Osaka. It did not specify if it was building new regions or expanding capacity and interconnects.

Traditionally conservative businesses have been slow in Japan to adopt the cloud. In 2021 it accounted for just 4% of IT spend in the country. But recent deals like like a major stock market brokerage moving to Oracle Cloud suggest appetites are changing – and political support is growing.

(Fierce AWS rival Oracle has also landed Japan's largest telco, NTT Docomo, as an Oracle Cloud Infrastructure customer.)

The Japanese government has been actively soliciting investment from Silicon Valley. At a press conference on Friday, Japan's digital minister Takuya Hirai said "the development of digital infrastructure in Japan is key to strengthening the country's industrial competitiveness..."

Currently, AWS offers generative AI services to Japanese corporate customers including Asahi Group, Marubeni and Nomura Holdings, according to a statement made to Reuters. Amazon has invested $10 billion in the country's cloud facilities to-date. The Japanese cloud sector has been growing rapidly. According to IDC Japan, the country's public cloud market will grow by 18.8% per year until 2026, and the market size in 2026 will reach 3.76 trillion yen, about 2.4 times the size in 2021.

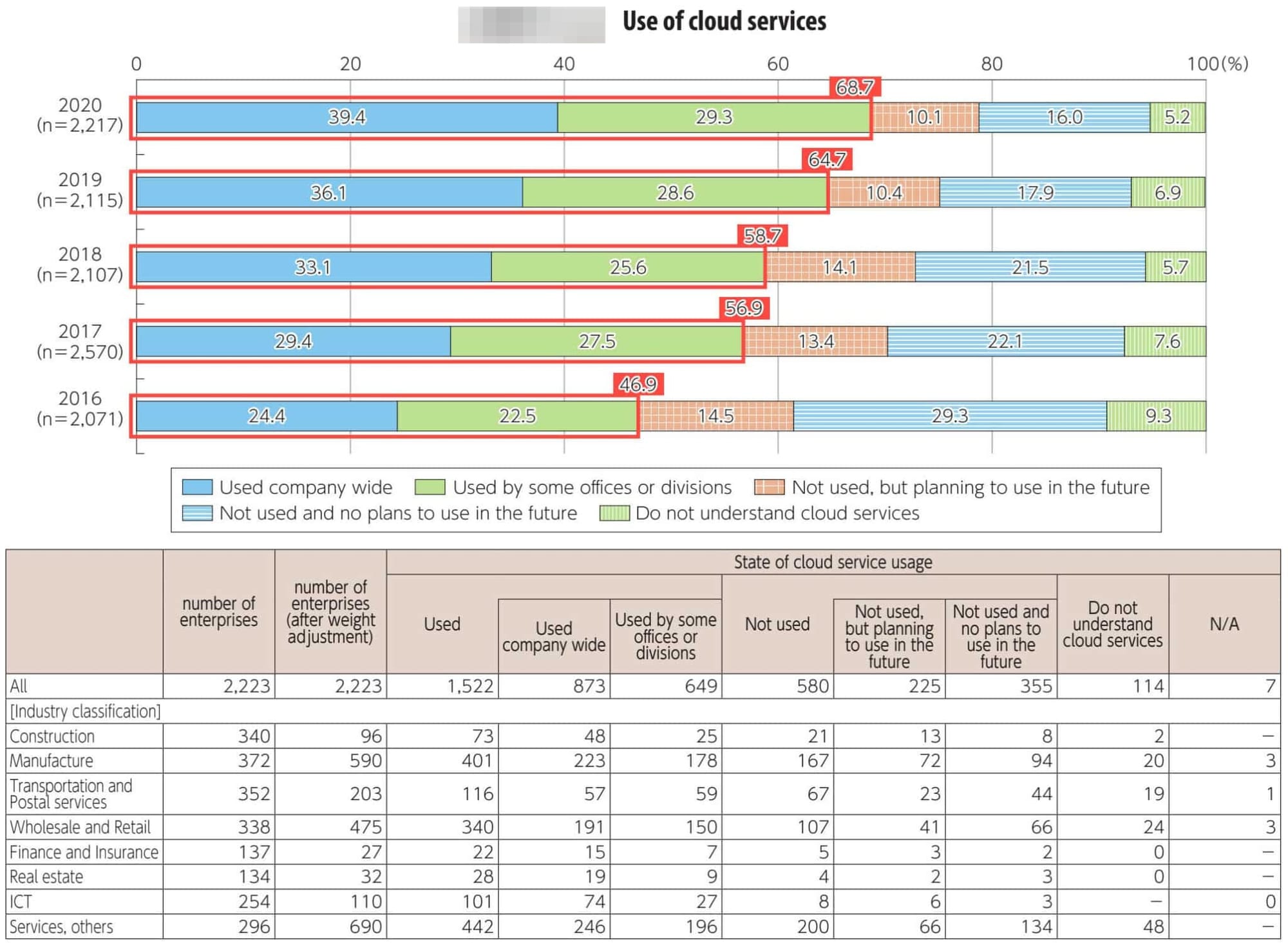

Data from Japan's Ministry for Internal Affairs and Communications in 2021 shows an uptake in cloud computing adoption by companies.

According to the ministry, 68.7% of enterprises were expected to use cloud services partially or extensively in 2020, up 4.0% from 2019, when it stood at 64.7%. But "cloud services" is an expansive term and can often just cover cloud-based email or a small handful of SaaS applications.

As Oracle Japan's CFO S. Krishna Kuma told analysts on a September 2023 earnings call: "Enterprise customers in Japan especially now understood that there is a lot of value in moving their workloads to the cloud... we are seeing a tendency to lock in for several years into the future and then also expand on that. So, you have a workload today that you think that you’re going to use for the next five years, so you lock it, you lock your price, you lock a contract for the next five years, and then you move on to the next workload."

Attractive for Oracle and attractive for AWS too.