Datadog and Palantir posted identical growth numbers of 27% for their respective fiscal second quarters this week – as customer CIOs and their teams continue to buy and expand their use of diverse data platforms.

Palantir’s revenues hit $678 million. Datadog’s were $645 million. Palantir anticipates 2024 earnings of up to $2.74 billion; Datadog, $2.63 billion.

The similar earnings reports sent the two (otherwise very different) firms’ shares climbing in an otherwise tough week on Wall Street – and demonstrated the sustained appetite among IT buyers for tools that help them drive meaningful value from and secure their growing datasets.

Generative AI was a tailwind for both

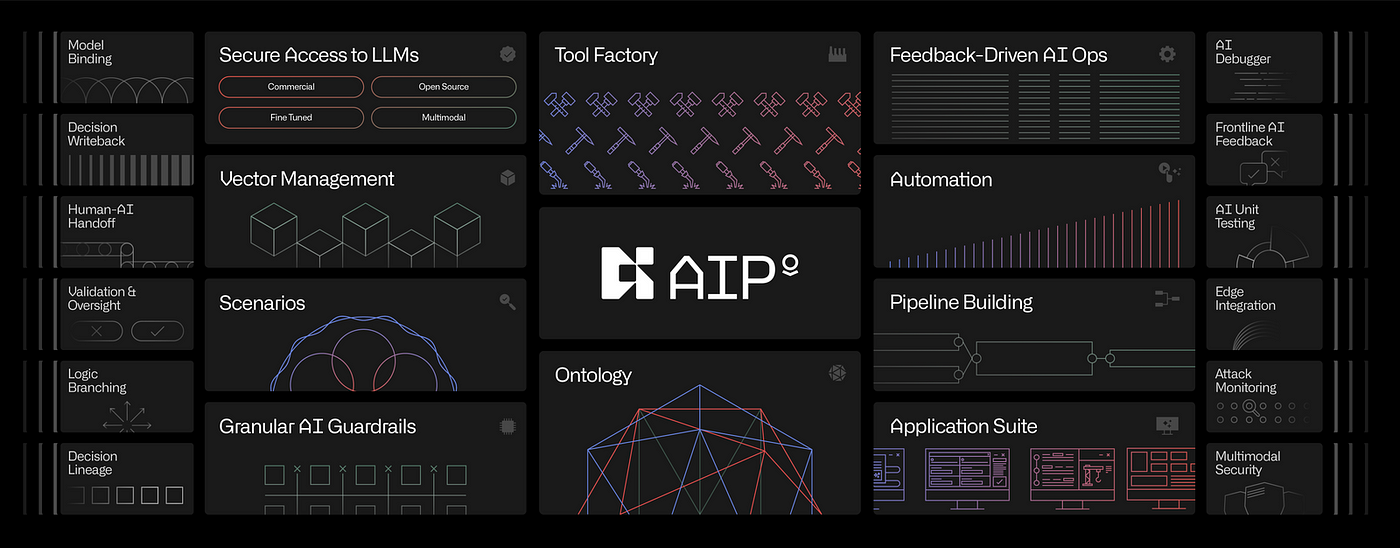

Palantir CTO Shyam Sankar said on a Q2 call: “The journey to production, as the market is now discovering, is fraught and requires a foundational set of technologies that we have uniquely invested in, creating a product pipeline that's needed to harvest economic value from AI…”

See also: LLMs’ “Bullsh*t” problem, DARPA, and testing for nonsense

He added: “The bottleneck and the transition from prototype to production is a very hard set of technical problems. We didn't build those technologies eating berries in San Francisco. We had to be on the factory floor, in the foxhole, eating pain with our customers, seeing the secret truths of what does and doesn't work and metabolizing it into product.”

On August 8 Palantir announced a deepened partnership with Microsoft that will see Palantir deliver its AIP and other software on Microsoft Azure for IL5 [a federal security category] environments.

On its Q2 call Palantir executives announced plans for a new "WARP Speed" platform to function almost as an ERP+ for manufacturers, including those in the defense world. (The Stack has some further details below.)

Datadog, a monitoring and security platform provider (which now has 28,700 customers) has also continued to build out its AI product suite.

In recent weeks it has released new propositions like time-series forecasting model “Toto” and an “LLM Observability” offering – now GA and designed to help users monitor, troubleshoot, and secure AI apps.

It also highlighted growth in real user monitoring or RUM; a way of tracking user journeys and data across web and mobile applications

“We saw the strongest growth with our enterprise customers…Growth in usage has accelerated over the past several quarters” said Datadog CEO Olivier Pomel: “About 2,500 customers use one or more of our AI integrations to get visibility into their increasing use of AI” he added.

Net income? Palantir is well ahead

Palantir edged Datadog ($43 million) in terms of net income.

CEO Alex Karp said: “We generated $134 million in net income in Q2 2024—the largest quarterly profit in our company’s twenty-year history.”

He added, in a letter to shareholders that "the large language models that have transfixed the world will only be capable of transforming the work of a multinational business or a defense agency’s operations if their power is unleashed within the context of an enterprise software system that has an opinionated view of the world—its idiosyncratic objects, logic, and physics...Models with trillions of parameters may be able to flawlessly mimic Goethe, but without more, add little value to the enterprise…”

Diversified offerings for customers

Datadog's earnings call showed a company rapidly expanding its proposition – and eyeing future M&A opportunities to do so.

Among its recent releases was Kubernetes Autoscaling, to help customers optimise for cost and performance by automatically rightsizing Kubernetes resources – and a fully managed OpenTelemetry service.

As Datadog's CEO put it: "We have this platform strategy where we're building a consolidator and we're bringing together many different use cases into one shared platform, we had very broad interest and a very ambitious road map in many different directions..."

To Palantir meanwhile, a new "Warp Speed" offering was emerging.

First unveiled on its Q2 call as "the modern American manufacturing operating system" the idea drew quizzical questions from analysts.

So what is Palantir Warp Speed? They asked. An ERP?

Palantir CTO Sankar, speaking in a Q&A session, said: "Warp Speed... we conceived of it as an operating system for the modern American manufacturer. It touches not just ERP but also MES, PLM, PLCs, so it's interacting with the factory floor. I think the kind of congenital defect from most of [such] software [stems from the fact that it was] designed historically in the '70s for the CFO. Why would you do that? If you were starting over today, you would build software that was designed for the head of production that was focused principally on production.

"What is the right way to think about grafting the software around the manufacturer in a way that gives them alpha, not just creates a huge amount of services for the system integrators? We live in a world today where it's $1 of license for $9 of implementation that never seems to quite work... there's an entire opportunity to reinvent this now, and I think the bolus of energy around national defense and reindustrialization is catalyzing this opportunity," Palantir's CTO added on the call.

More detail? The closest listeners were getting at this point was that "there's this very powerful role of taking AIP, building the applications on top of it using the OSDK [Ontology SDK], and delivering the integrated suite of applications that are also malleable to the business.

We look forward to sharing more details when we have them.

Got something you'd like to share with The Stack? Get in touch at any point.