JPMorgan tapped UK fintech Thought Machine to deliver core banking technology amid an overhaul of its US retail banking environment, it revealed on September 21. And it's turned to another British fintech, 10x, to power the cloud-native core banking engine of its UK retail bank, which launched (well, you can join the waiting list; it's unclear how long for...) this month under its Chase brand, the two confirmed September 30.

It's a big win for 10x, which has also been working with Australia's WestPac. (WestPac recently launched a Banking-as-a-Service platform built on 10x's "SuperCore" technology stack and deployed on AWS.)

Chase chose 10x "based on its modern scalable platform built on micro-services and accessible via APIs"; 10x also helped develop Chase’s ledger infrastructure, the two said in a press release this week.

The announcement comes three months after 10x -- founded by former Barclays CEO Antony Jenkins in 2016 -- landed $187 million in Series C funding from funds led by BlackRock and CPP Investment.

See also: LIBOR laggards win a “synthetic” reprieve from the FCA. Wait — AI didn’t fix it?

In its first retail-led international expansion in a 222-year history, JPMorgan will start providing just current accounts, as it tests the waters of what is an already highly competitive UK retail banking environment -- bidding to lure customers in with a planned 5% interest rate on spending round-ups and 1% cashback on daily spending.

Whether UK consumers will adopt the new account remains a big unknown, with indigenous digital-first banks like Monzo and Starling and fellow US investment heavyweight Goldman Sachs already heavily in the fray, but it's clear from lifting the hood that UK fintechs have won big on the B2B side of the equation.

Sanjiv Somani, COO at International Consumer, JPMorgan Chase’s retail consumer banking arm outside of the US, said: “As one of our foundational partners, 10x has been instrumental in building the technology platform.

"We chose 10x because we needed a modern scalable core banking platform built on micro-services and accessible via APIs, in order to drive rapid product development and to provide our customers with a world class experience. This collaboration ensures we have the right technology in place to meet changing customer needs now and into the future", he added this week.

See also: JPMorgan's Global CIO Lori Beer joins The Stack to talk tech talent, security, and staying cool

Most industry observers will recognise the depth of technical debt that so many banks have accrued over the years. TSB's COO gave The Stack a cheerful insight into a few hops at that comparitively modern bank's back-end in a recent interview, noting that "if you call ‘0800 TSB’ today, before we ask for your mother’s maiden name, the call lands with a managed service to us from BT; the identification of you as a customer is then done in the Fiserv cloud; then the transaction actually works its way through to Microsoft Dynamics implemented in the Azure Stack; then it goes to the banking platform, which runs in an IBM plant to render the screen before the agent says, ‘Hey, what’s your mother’s maiden? “That’s the architecture we run. It means I’m not worried about infrastructure engineers or DBAs, or Unix administrators. It gives me tremendous flexibility. Tomorrow, if I want to cut off the mortgage platform and introduce a new one, I have to do local surgery, not intergalactic surgery.

"This works on a good day. On a bad day, when I’m not able to say “what’s your mother’s maiden name?” — because the problem could be with BT, Fiserv, IBM — you could be left saying ‘hell, what happened?’"

(Others have it far worse: “Continuous extensions with new features and stand-alone solutions, as well as interfaces to other applications in legacy IT, have often created a jumble of dependencies over the years, with no transparent structure or logic,” as Stephan Kliche, a client technical architect at knowis AG, a German specialised software vendor for the banking industry has put it. “This increases the complexity and leads to an intricate system landscape that resembles a plate of spaghetti. An uncomplicated migration to new versions or other providers is hardly possible.”)

10x describes its Supercore engine as a "microservices and API centric architecture [that] liberates banks from product and channel silos."

The 10x SuperCore system is predominantly written in Java and uses CockroachDB distributed SQL database, according to a late 2020 write-up by Martin Whybrow of NextGen Core Banking Solutions. It supports ISO20022 payment message flows and comes with Kafka feeds baked in to its architecture for real-time transaction visibility.

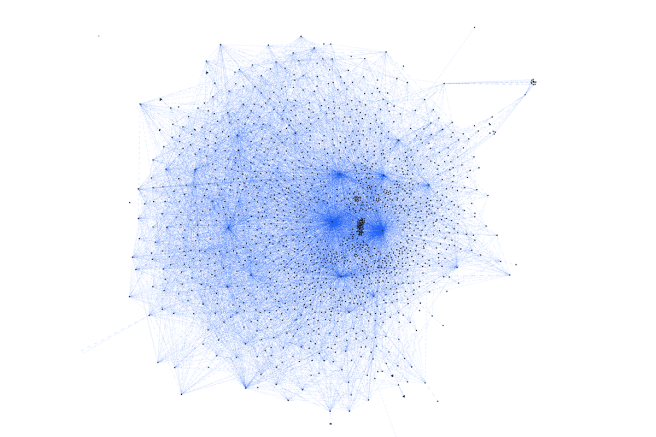

For a sense of what a microservices-based core banking engine can look like, Monzo (1,800+ microservices)'s brilliantly detailed blog this month on ensuring microservices performance paints an interesting picture. (To give a sense of what they are wrangling, each service in the image above is represented by a dot, and every line is an enforced network rule.)